- Australia

- /

- Metals and Mining

- /

- ASX:GNG

A Rising Share Price Has Us Looking Closely At GR Engineering Services Limited's (ASX:GNG) P/E Ratio

GR Engineering Services (ASX:GNG) shareholders are no doubt pleased to see that the share price has had a great month, posting a 31% gain, recovering from prior weakness. But shareholders may not all be feeling jubilant, since the share price is still down 27% in the last year.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). So some would prefer to hold off buying when there is a lot of optimism towards a stock. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E implies that investors have high expectations of what a company can achieve compared to a company with a low P/E ratio.

See our latest analysis for GR Engineering Services

How Does GR Engineering Services's P/E Ratio Compare To Its Peers?

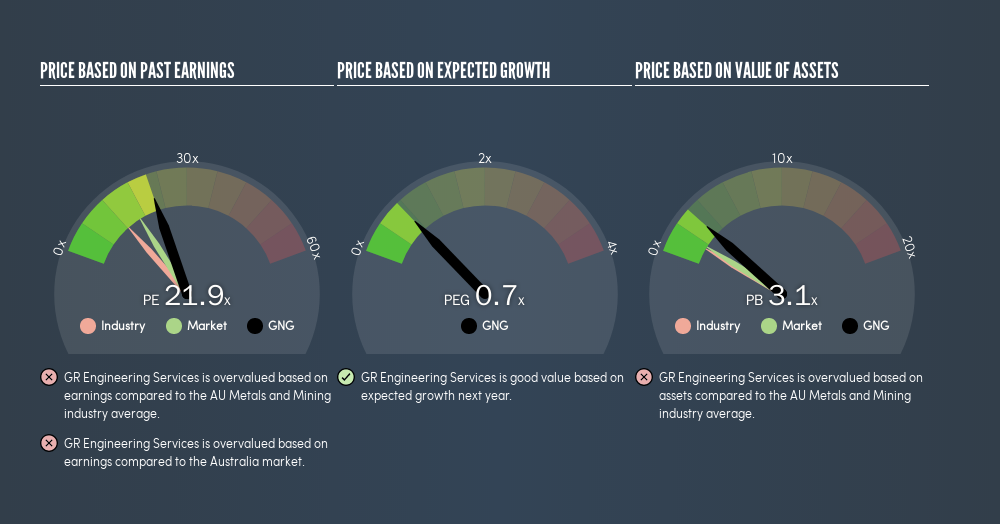

GR Engineering Services's P/E of 21.89 indicates some degree of optimism towards the stock. As you can see below, GR Engineering Services has a higher P/E than the average company (12.3) in the metals and mining industry.

Its relatively high P/E ratio indicates that GR Engineering Services shareholders think it will perform better than other companies in its industry classification.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. A higher P/E should indicate the stock is expensive relative to others -- and that may encourage shareholders to sell.

GR Engineering Services shrunk earnings per share by 45% over the last year. And EPS is down 13% a year, over the last 5 years. This might lead to muted expectations.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

So What Does GR Engineering Services's Balance Sheet Tell Us?

With net cash of AU$27m, GR Engineering Services has a very strong balance sheet, which may be important for its business. Having said that, at 18% of its market capitalization the cash hoard would contribute towards a higher P/E ratio.

The Verdict On GR Engineering Services's P/E Ratio

GR Engineering Services trades on a P/E ratio of 21.9, which is above its market average of 16.3. The recent drop in earnings per share might keep value investors away, but the relatively strong balance sheet will allow the company time to invest in growth. Clearly, the high P/E indicates shareholders think it will! What is very clear is that the market has become significantly more optimistic about GR Engineering Services over the last month, with the P/E ratio rising from 16.7 back then to 21.9 today. If you like to buy stocks that have recently impressed the market, then this one might be a candidate; but if you prefer to invest when there is 'blood in the streets', then you may feel the opportunity has passed.

When the market is wrong about a stock, it gives savvy investors an opportunity. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' So this free report on the analyst consensus forecasts could help you make a master move on this stock.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:GNG

GR Engineering Services

Provides engineering, process control, automation, and construction services to the mining and mineral processing industries in Australia and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026