- Australia

- /

- Commercial Services

- /

- ASX:AMA

3 Promising ASX Penny Stocks With At Least A$100M Market Cap

Reviewed by Simply Wall St

The Australian market is experiencing a cautious recovery, with ASX futures showing slight gains after a challenging November, while investors await local GDP data for further direction. Despite the broader market's fluctuations, penny stocks—often smaller or newer companies—continue to capture attention as potential growth opportunities. These stocks may be considered niche investments today, but when supported by strong financial health and fundamentals, they can offer intriguing prospects for those looking beyond traditional investment avenues.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.425 | A$121.8M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.70 | A$80.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.835 | A$51.99M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.85 | A$438.02M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.68 | A$271.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$36.87M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.81 | A$3.21B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.25 | A$1.38B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.58 | A$238.86M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.37 | A$131.64M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 409 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Ai-Media Technologies (ASX:AIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ai-Media Technologies Limited offers captioning, transcription, and translation services across multiple regions including Australia, New Zealand, Singapore, Malaysia, North America, and the United Kingdom with a market cap of A$177.49 million.

Operations: The company generates A$64.86 million in revenue from its Internet Software & Services segment.

Market Cap: A$177.49M

Ai-Media Technologies Limited, with a market cap of A$177.49 million and revenue of A$64.86 million, is navigating challenges typical for smaller stocks. The company remains unprofitable but has shown improvement by reducing losses over the past five years at a rate of 43.1% annually and maintains a positive free cash flow with a sufficient runway exceeding three years. Despite having more cash than debt and covering liabilities comfortably, insider selling in recent months may raise concerns among investors. Additionally, the board's inexperience could be an area to monitor following recent auditor changes announced in September 2025.

- Click here to discover the nuances of Ai-Media Technologies with our detailed analytical financial health report.

- Examine Ai-Media Technologies' earnings growth report to understand how analysts expect it to perform.

AMA Group (ASX:AMA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AMA Group Limited operates a collision repair business in Australia and New Zealand with a market capitalization of A$421.15 million.

Operations: The company's revenue is primarily derived from its Capital Smart segment at A$490.33 million, Ama Collision at A$360.04 million, ACM Parts at A$99.70 million, Wales at A$77.88 million, and Specialist Businesses contributing A$56.29 million.

Market Cap: A$421.15M

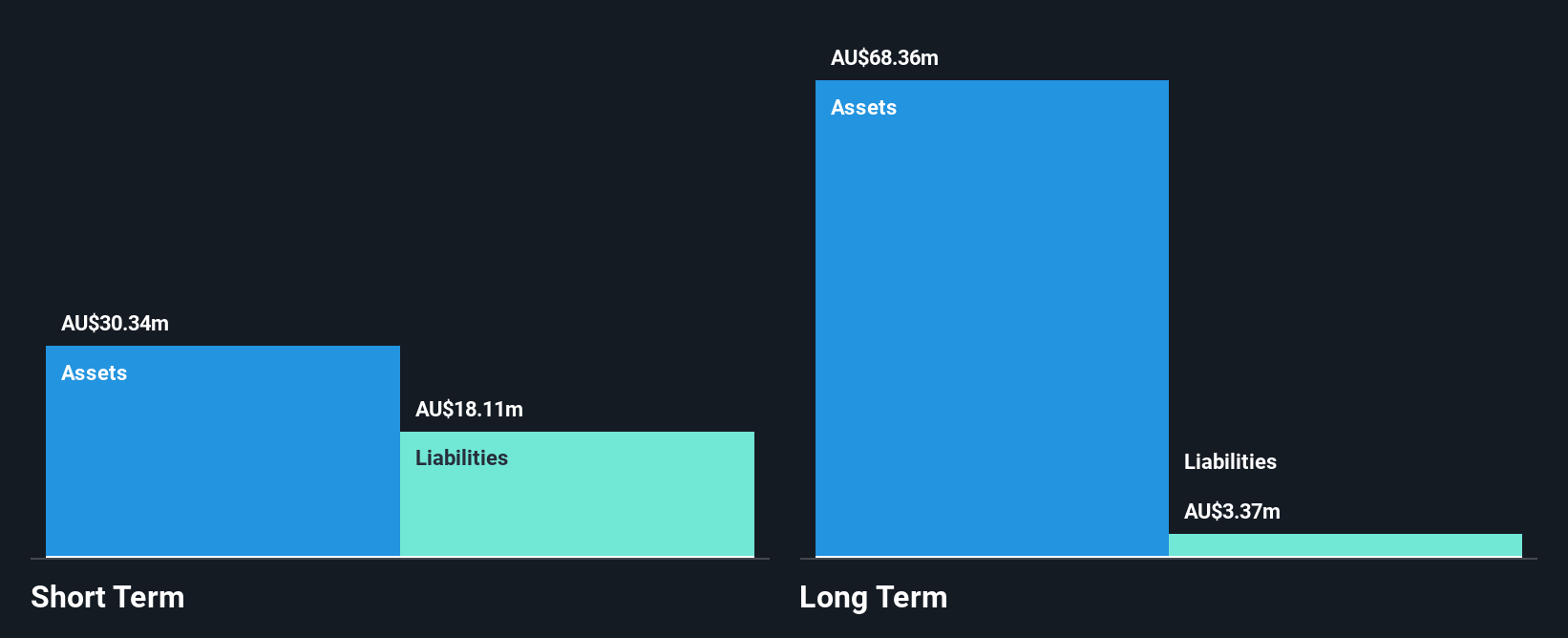

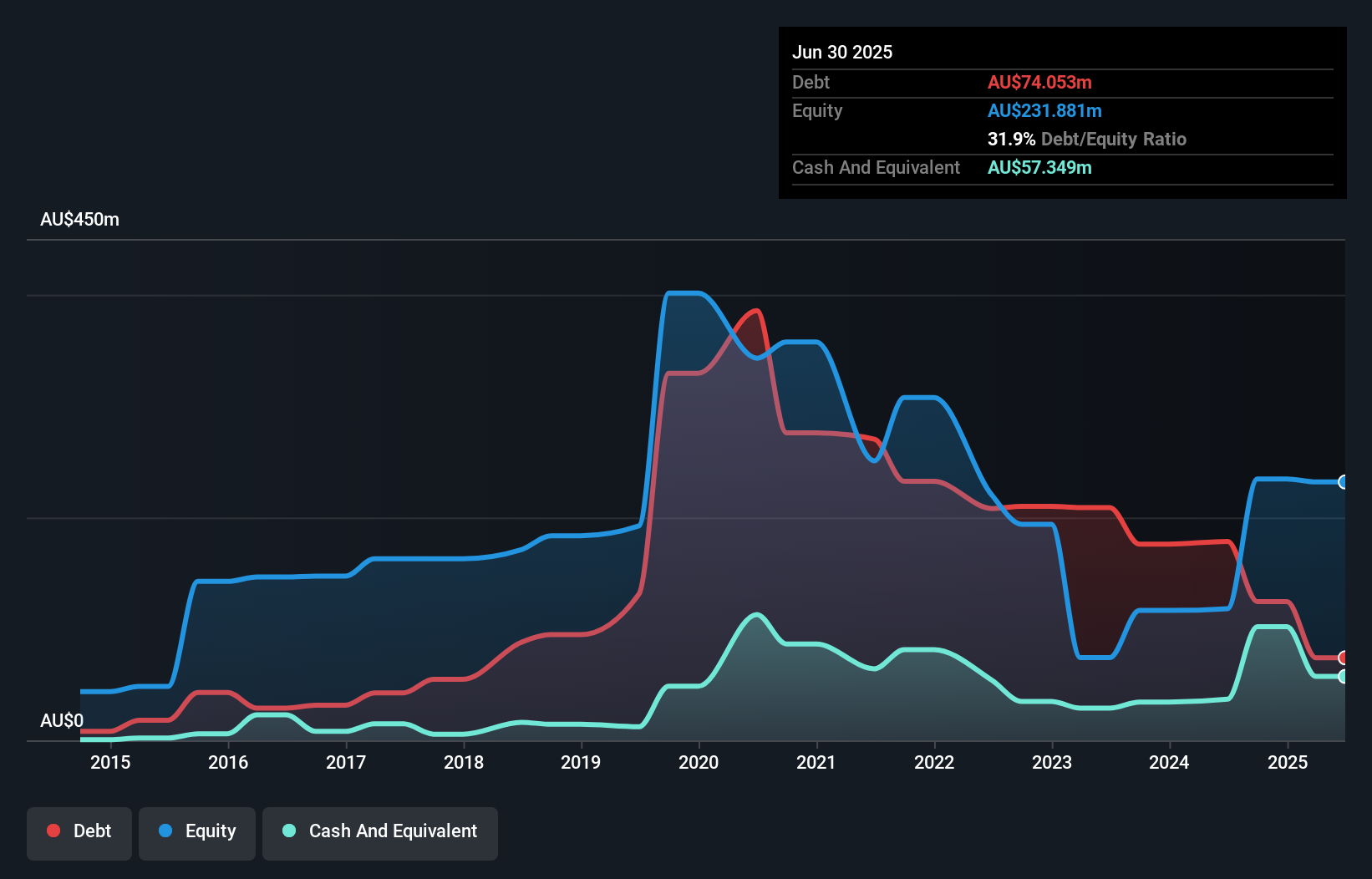

AMA Group Limited, with a market cap of A$421.15 million, operates in the collision repair industry and has shown resilience despite being unprofitable. The company has reduced its debt-to-equity ratio significantly over five years and maintains a satisfactory net debt position at 7.2%. While short-term assets do not cover liabilities, AMA's cash runway exceeds three years with positive free cash flow. Earnings are forecast to grow substantially, yet management and board inexperience could pose challenges. Recent corporate actions include a stock split on November 5, 2025, which may impact investor sentiment positively or negatively depending on market perception.

- Click to explore a detailed breakdown of our findings in AMA Group's financial health report.

- Learn about AMA Group's future growth trajectory here.

GR Engineering Services (ASX:GNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GR Engineering Services Limited offers engineering, process control, automation, and construction services to the mining and mineral processing sectors both in Australia and internationally, with a market cap of A$701.46 million.

Operations: The company's revenue is derived from two main segments: Oil and Gas, contributing A$95.93 million, and Mineral Processing, which accounts for A$383.09 million.

Market Cap: A$701.46M

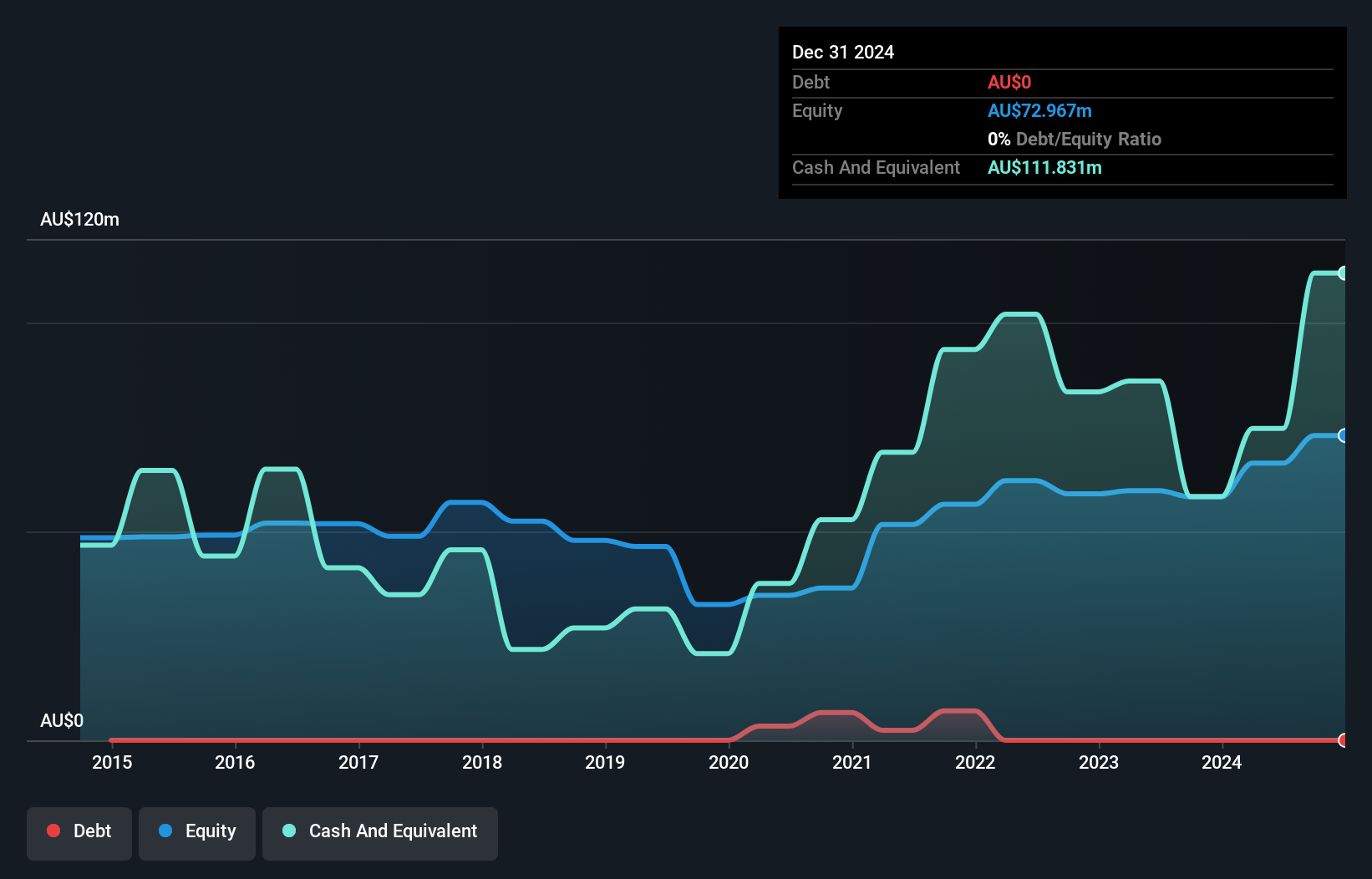

GR Engineering Services Limited, with a market cap of A$701.46 million, is debt-free and has strong asset coverage for both short-term (A$137.8M) and long-term liabilities (A$8.2M). Despite a high return on equity at 49.7%, the company's dividend yield of 5.76% is not well supported by earnings or free cash flows, indicating potential sustainability issues. Revenue growth is forecasted at 7.8% annually, but recent insider selling could signal concerns about future prospects. The management team and board are experienced, which may help navigate these challenges as they prepare to report Q1 2026 results on November 21, 2025.

- Unlock comprehensive insights into our analysis of GR Engineering Services stock in this financial health report.

- Review our growth performance report to gain insights into GR Engineering Services' future.

Next Steps

- Investigate our full lineup of 409 ASX Penny Stocks right here.

- Contemplating Other Strategies? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AMA

AMA Group

Engages in the development and operation of collision repair business in Australia and New Zealand.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026