- Australia

- /

- Metals and Mining

- /

- ASX:AVL

Australian Vanadium Leads The Charge Among 3 ASX Penny Stocks

Reviewed by Simply Wall St

The Australian market recently faced a slight downturn, with the ASX200 closing down 0.34% amid concerns over potential trade tensions sparked by President Trump's tariff threats. Despite these broader market uncertainties, penny stocks continue to attract attention for their potential to uncover hidden value in smaller or newer companies. Though the term 'penny stock' may seem outdated, it still signifies opportunities where strong financials and growth prospects can lead to significant returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$66.88M | ★★★★★★ |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.895 | A$89.63M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.485 | A$306.97M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.88 | A$106.21M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.085 | A$66.32M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.03 | A$332.15M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$3.03 | A$248.73M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.17 | A$339.21M | ★★★★☆☆ |

| Vita Life Sciences (ASX:VLS) | A$1.90 | A$105.71M | ★★★★★★ |

Click here to see the full list of 1,031 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Australian Vanadium (ASX:AVL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Australian Vanadium Limited, with a market cap of A$116.57 million, is involved in mineral exploration activities in Australia through its subsidiary.

Operations: There are no revenue segments reported for this company.

Market Cap: A$116.57M

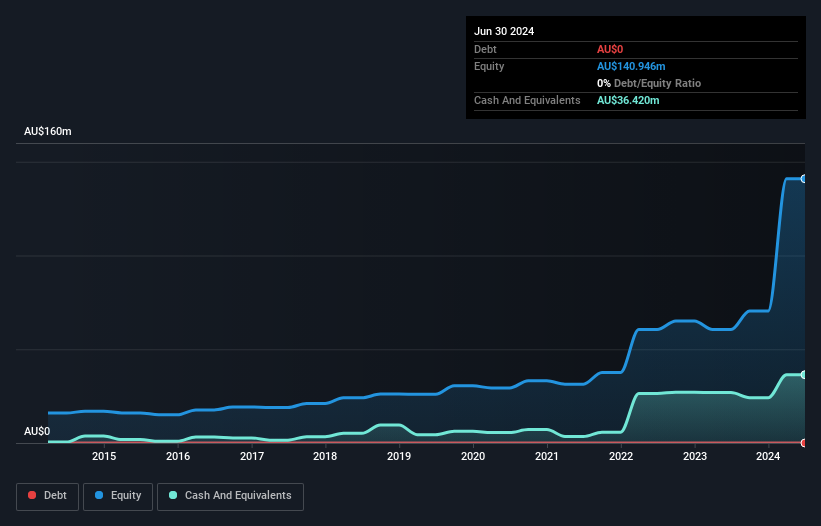

Australian Vanadium Limited, with a market cap of A$116.57 million, is a pre-revenue company involved in mineral exploration. It has stable short-term assets (A$37.7M) exceeding both its short-term (A$27.1M) and long-term liabilities (A$2.3M), ensuring a solid financial position despite being unprofitable and having increased losses over the past five years at 28.3% annually. The company benefits from an experienced management team but faces challenges with high volatility and limited cash runway if free cash flow continues to decline rapidly. Recent board changes include the resignation of Non-Executive Director Ms. Anna Sudlow due to external commitments.

- Click to explore a detailed breakdown of our findings in Australian Vanadium's financial health report.

- Gain insights into Australian Vanadium's future direction by reviewing our growth report.

Great Divide Mining (ASX:GDM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Great Divide Mining Ltd is involved in the exploration and development of mineral resource properties in Australia, with a market capitalization of A$18.90 million.

Operations: The company generates revenue from its Mineral Exploration and Resource Development segment, amounting to A$0.13 million.

Market Cap: A$18.9M

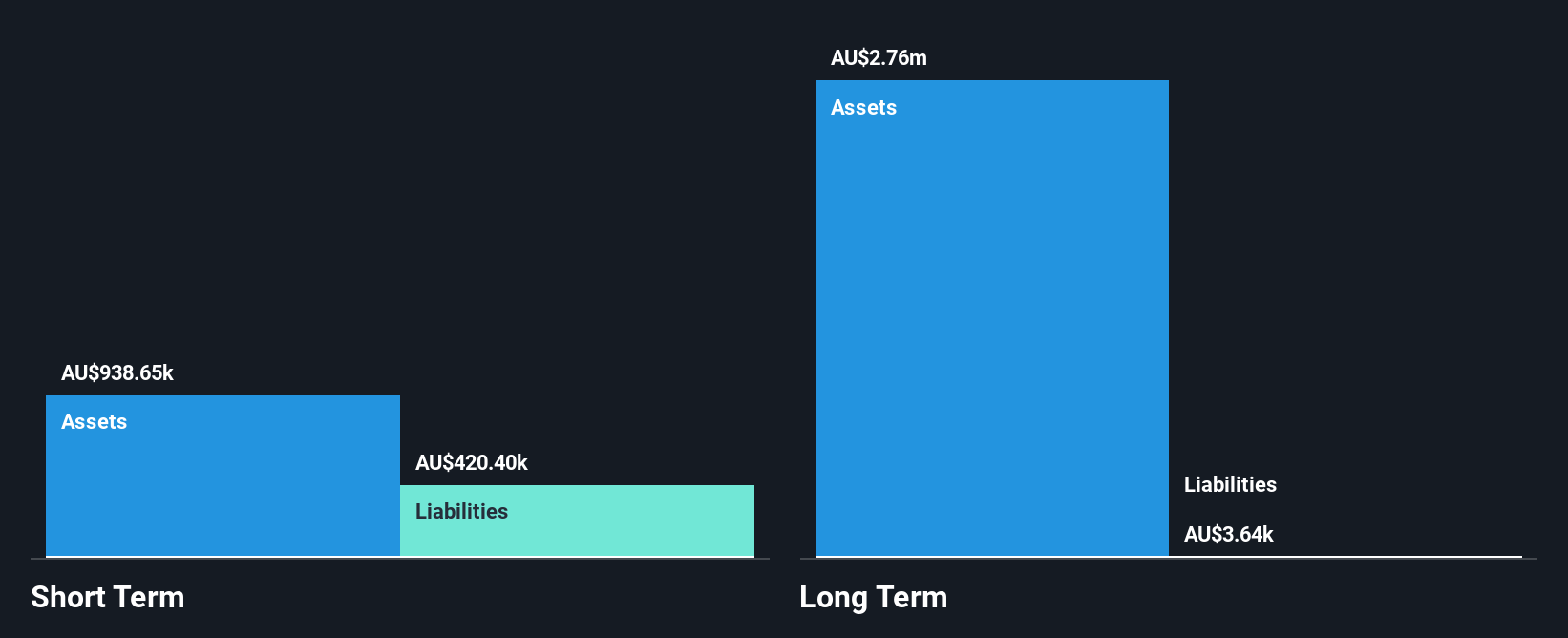

Great Divide Mining Ltd, with a market cap of A$18.90 million, is a pre-revenue entity focused on mineral exploration and development. Despite being debt-free and having short-term assets (A$1.6M) that cover both short-term (A$265.2K) and long-term liabilities (A$3.6K), it faces challenges such as less than one year of cash runway if current free cash flow trends persist, high share price volatility, and an inexperienced board with an average tenure of two years. The company recently held a special shareholders meeting to discuss potential changes under ASX Listing Rule 11.1.2 amidst ongoing unprofitability issues.

- Get an in-depth perspective on Great Divide Mining's performance by reading our balance sheet health report here.

- Learn about Great Divide Mining's historical performance here.

Optiscan Imaging (ASX:OIL)

Simply Wall St Financial Health Rating: ★★★★★★

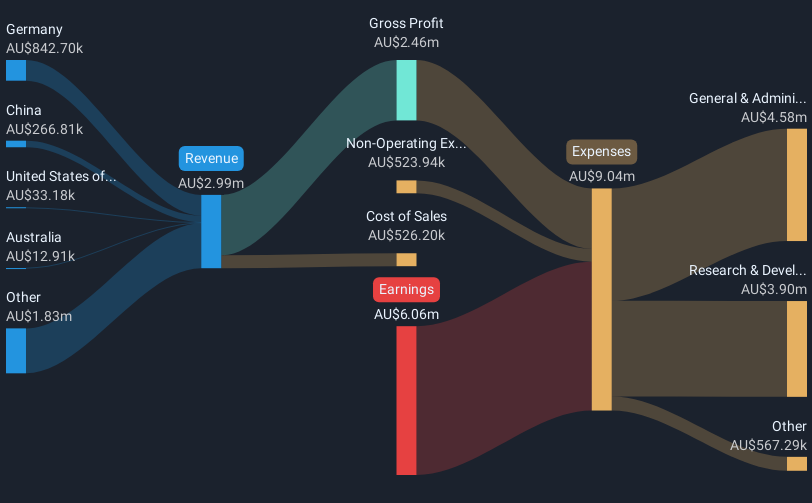

Overview: Optiscan Imaging Limited develops, manufactures, and commercializes endomicroscopic digital imaging technology for medical and pre-clinical applications across Australia, Germany, China, and the United States with a market cap of A$137.83 million.

Operations: The company generates revenue from its Confocal Microscopes segment, amounting to A$2.99 million.

Market Cap: A$137.83M

Optiscan Imaging Limited, with a market cap of A$137.83 million, operates in the medical imaging sector but faces challenges as it remains unprofitable with earnings declining by 25.8% annually over the past five years. The company has limited revenue from its Confocal Microscopes segment (A$2.99 million) and a negative return on equity (-43.7%). Despite this, Optiscan has more cash than debt and short-term assets (A$15.1M) that exceed both short-term (A$1.8M) and long-term liabilities (A$7.9K). Recently, Ms. Elissa Hansen was appointed as Company Secretary to enhance corporate governance practices.

- Take a closer look at Optiscan Imaging's potential here in our financial health report.

- Review our historical performance report to gain insights into Optiscan Imaging's track record.

Taking Advantage

- Dive into all 1,031 of the ASX Penny Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AVL

Australian Vanadium

Together with its subsidiary, engages in the mineral exploration activities in Australia.

Excellent balance sheet moderate.

Market Insights

Community Narratives