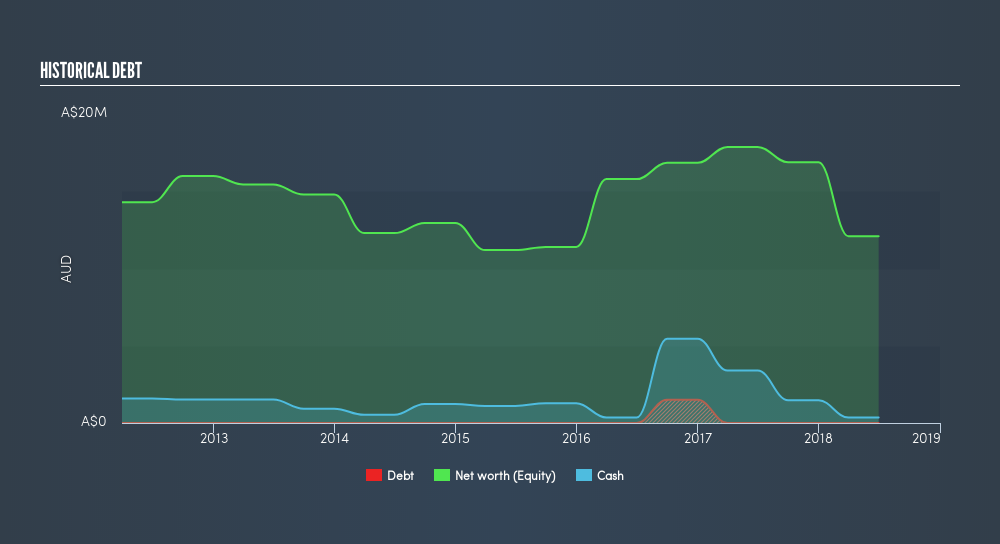

The direct benefit for GBM Resources Limited (ASX:GBZ), which sports a zero-debt capital structure, to include debt in its capital structure is the reduced cost of capital. However, the trade-off is GBZ will have to adhere to stricter debt covenants and have less financial flexibility. While GBZ has no debt on its balance sheet, it doesn’t necessarily mean it exhibits financial strength. I will go over a basic overview of the stock's financial health, which I believe provides a ballpark estimate of their financial health status.

View our latest analysis for GBM Resources

Is GBZ growing fast enough to value financial flexibility over lower cost of capital?

Debt funding can be cheaper than issuing new equity due to lower interest cost on debt. Though, the trade-offs are that lenders require stricter capital management requirements, in addition to having a higher claim on company assets relative to shareholders. GBZ’s absence of debt on its balance sheet may be due to lack of access to cheaper capital, or it may simply believe low cost is not worth sacrificing financial flexibility. However, choosing flexibility over capital returns is logical only if it’s a high-growth company. GBZ’s revenue growth over the past year was an impressively high triple-digit rate, so it is acceptable that the company is opting for a zero-debt capital structure currently as it may need to raise debt to fuel expansion in the future.

Can GBZ meet its short-term obligations with the cash in hand?

Given zero long-term debt on its balance sheet, GBM Resources has no solvency issues, which is used to describe the company’s ability to meet its long-term obligations. However, another measure of financial health is its short-term obligations, which is known as liquidity. These include payments to suppliers, employees and other stakeholders. With current liabilities at AU$431k, it appears that the company may not have an easy time meeting these commitments with a current assets level of AU$398k, leading to a current ratio of 0.93x.

Next Steps:

GBZ is a fast-growing firm, which supports having have zero-debt and financial freedom to continue to ramp up growth. However, its lack of liquidity lowers our confidence around meeting short-term obligations. Some level of low-cost debt funding could help meet these needs. Going forward, its financial position may be different. This is only a rough assessment of financial health, and I'm sure GBZ has company-specific issues impacting its capital structure decisions. I suggest you continue to research GBM Resources to get a better picture of the stock by looking at:

- Historical Performance: What has GBZ's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:GBZ

GBM Resources

Engages in the exploration and development of mineral properties in Australia.

Adequate balance sheet low.

Market Insights

Community Narratives