As Australian shares are poised to align with Wall Street's softer decline, sparked by traders cashing in on record equity highs, investors are keenly observing the market dynamics. While the term 'penny stock' might seem outdated, it still signifies opportunities for discovering value in smaller or newer companies. These stocks can offer a blend of affordability and growth potential when supported by strong financials, making them appealing for those looking to uncover hidden gems in the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.49 | A$117.46M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.34M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.73 | A$420.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.795 | A$474.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Tasmea (ASX:TEA) | A$3.74 | A$881.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$352.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.645 | A$806.18M | ✅ 5 ⚠️ 3 View Analysis > |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$225.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.28 | A$155.64M | ✅ 4 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.75 | A$140.95M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 472 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Bailador Technology Investments (ASX:BTI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bailador Technology Investments Limited is a venture capital firm focusing on series A, mid and late venture, growth, and expansion capital investments in companies beyond the start-up phase, with a market cap of A$163.43 million.

Operations: The company generates revenue from its internet-related businesses, amounting to A$33 million.

Market Cap: A$163.43M

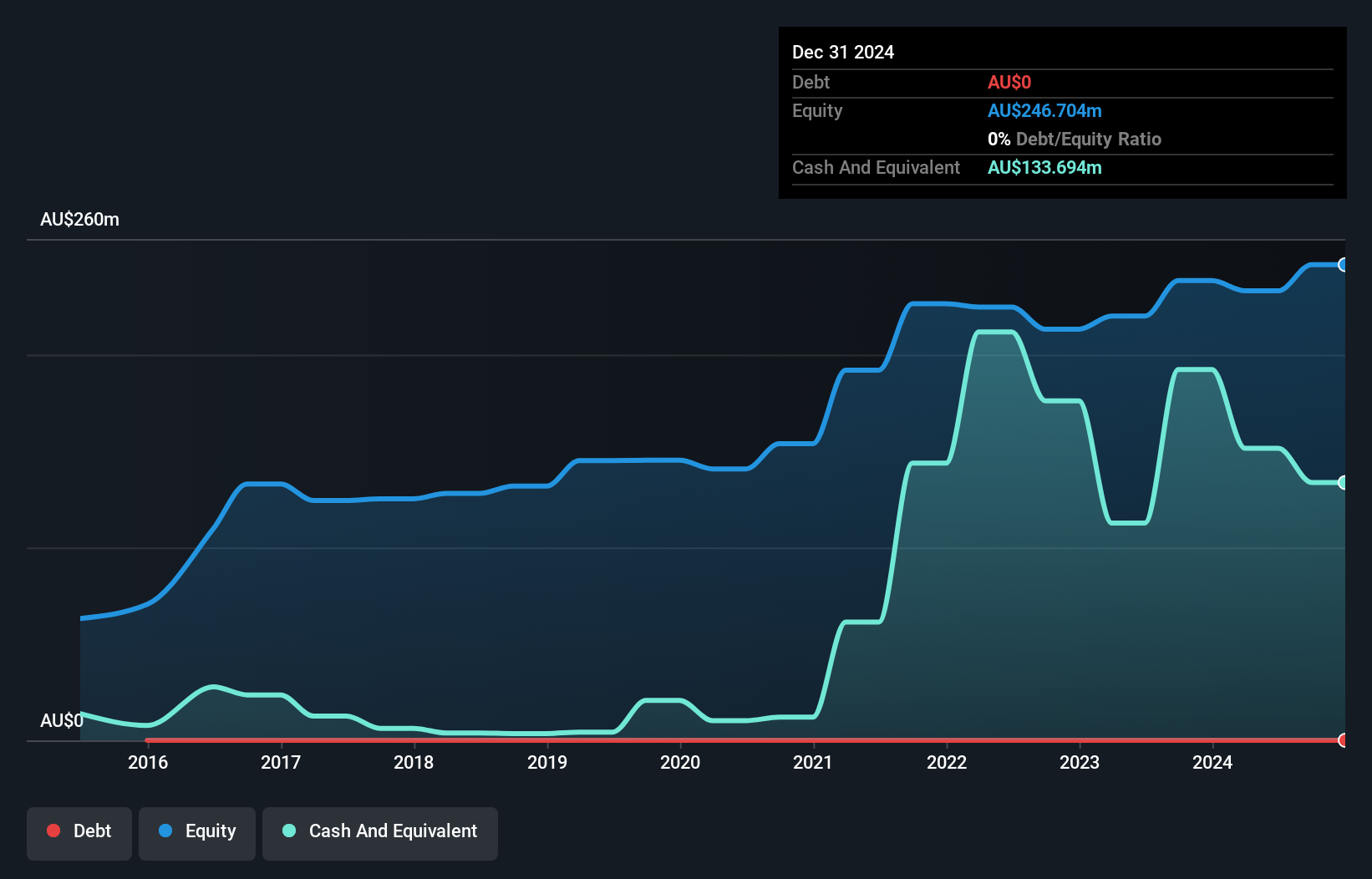

Bailador Technology Investments, with a market cap of A$163.43 million, is trading at 23.6% below its estimated fair value and remains debt-free, enhancing financial stability. Despite negative earnings growth last year, the company has shown an average annual earnings growth of 8.6% over the past five years. Its short-term assets significantly exceed both short-term and long-term liabilities, indicating strong liquidity. However, net profit margins have slightly declined to 49%. The seasoned board and management team add credibility but the dividend yield of 6.27% is not well covered by free cash flows, which could pose sustainability concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Bailador Technology Investments.

- Gain insights into Bailador Technology Investments' historical outcomes by reviewing our past performance report.

GBM Resources (ASX:GBZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GBM Resources Limited is an Australian company focused on the exploration and development of mineral properties, with a market capitalization of A$16.39 million.

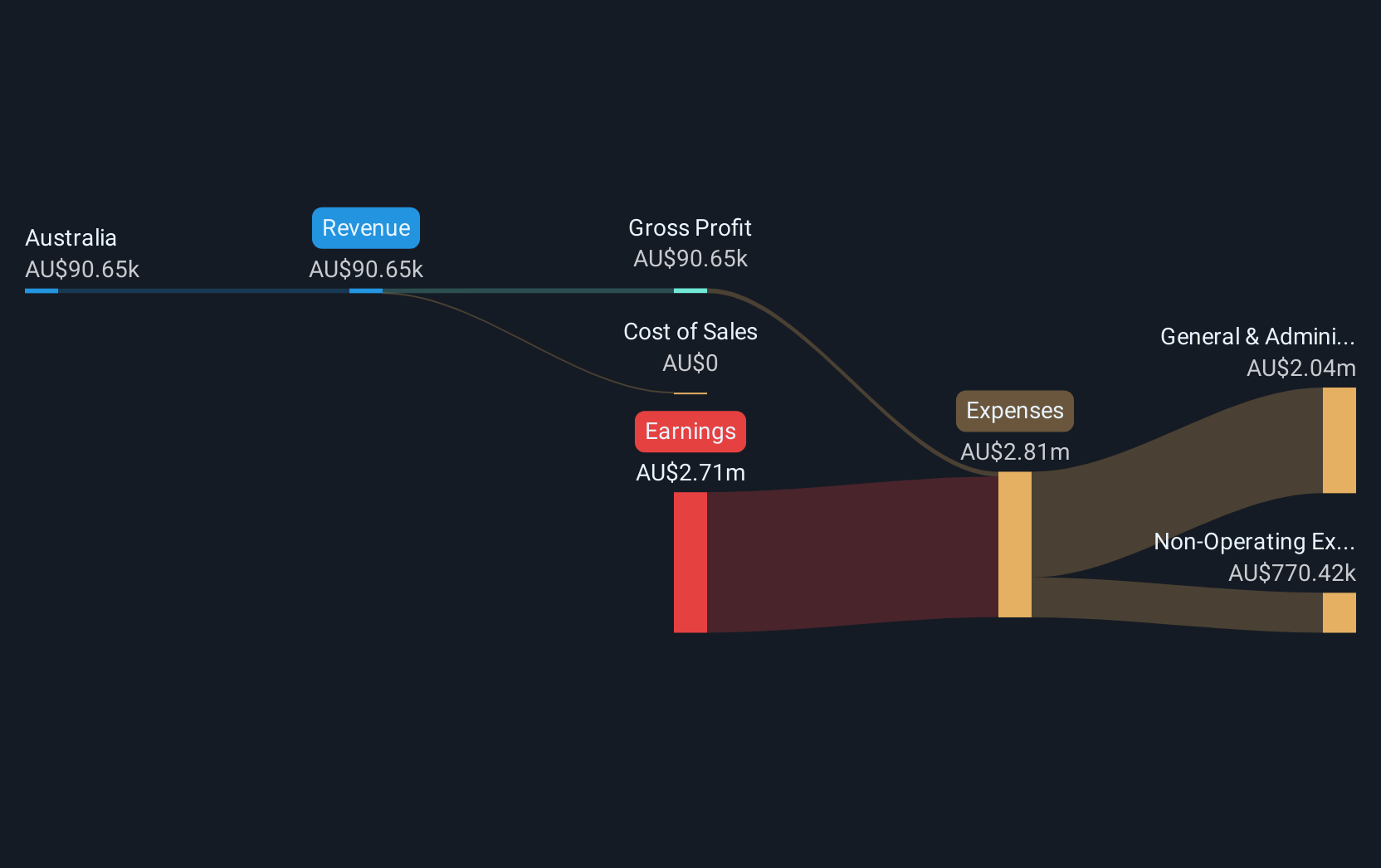

Operations: The company generates revenue from its operations in Australia, amounting to A$0.09 million.

Market Cap: A$16.39M

GBM Resources, with a market cap of A$16.39 million, is pre-revenue, generating A$0.09 million from its operations. Despite being unprofitable, it has reduced losses by 7.9% annually over five years and recently raised A$13 million through equity offerings to extend its cash runway beyond the previous 4-5 months estimate. The board and management are experienced with average tenures of over five years each. Short-term assets of A$11.2 million exceed long-term liabilities but fall short against short-term liabilities (A$14 million). Share price volatility remains high, while debt to equity has increased to 15.8%.

- Dive into the specifics of GBM Resources here with our thorough balance sheet health report.

- Examine GBM Resources' past performance report to understand how it has performed in prior years.

Silex Systems (ASX:SLX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silex Systems Limited is a technology commercialization company focused on the research, development, and licensing of SILEX laser enrichment technology in Australia, the United States, and the United Kingdom, with a market cap of A$1.03 billion.

Operations: The company's revenue is primarily derived from its Silex Systems segment, contributing A$7.61 million, and the Translucent segment, which adds A$2.40 million.

Market Cap: A$1.03B

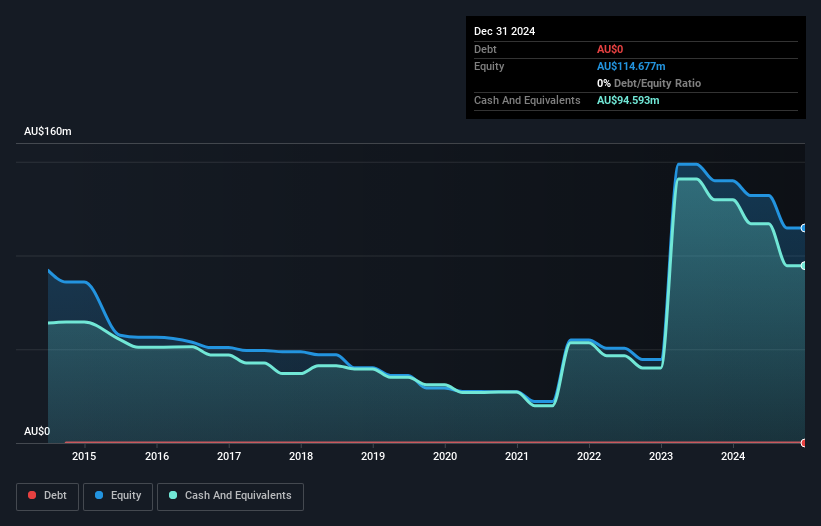

Silex Systems, with a market cap of A$1.03 billion, is unprofitable but maintains a strong financial position with no debt and sufficient cash runway for over three years due to positive free cash flow. The company’s short-term assets of A$106.5 million comfortably cover both short-term liabilities (A$7.3 million) and long-term liabilities (A$0.87 million). Despite its seasoned board and management team, Silex has seen increased losses over the past five years at 31.7% annually, while its share price remains highly volatile compared to most Australian stocks. It is not expected to achieve profitability in the near term.

- Get an in-depth perspective on Silex Systems' performance by reading our balance sheet health report here.

- Understand Silex Systems' earnings outlook by examining our growth report.

Key Takeaways

- Click this link to deep-dive into the 472 companies within our ASX Penny Stocks screener.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SLX

Silex Systems

A technology commercialization company, engages in the research and development, commercialization, and license of SILEX laser enrichment technology in Australia, the United States, and the United Kingdom.

Flawless balance sheet very low.

Market Insights

Community Narratives