- Australia

- /

- Metals and Mining

- /

- ASX:FMG

Fortescue (ASX:FMG) Valuation in Focus After Boosted Debt Tender and Capital Management Moves

Reviewed by Simply Wall St

Fortescue (ASX:FMG) just increased its cash tender offer for outstanding debt securities to $750 million, up from $600 million. The company also raised the cap on its 2031 Notes. This proactive move directly impacts how the company manages its capital and debt.

See our latest analysis for Fortescue.

Fortescue’s decision to lift its debt tender offer comes as the share price has gathered momentum in recent months, climbing 7.2% over the past month and delivering a robust 14.7% total shareholder return over the last year. The company’s proactive refinancings and steady capital management have supported sentiment, even as broader sector dynamics remain in flux while investors keep an eye on longer-term growth potential.

If you’re looking to spot more opportunities with strong momentum and standout returns, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares already rallying and analysts’ price targets now sitting below the current price, the key question is whether Fortescue’s recent gains leave it undervalued or if the market is already factoring in future growth.

Most Popular Narrative: 10.8% Overvalued

Compared to Fortescue’s last close price, the most widely followed narrative sees the company trading above its fair value, raising concerns over recent optimism. This sets the stage for a closer look at what is driving this perspective.

Investors may be overestimating the ability of Fortescue's decarbonization and green metals initiatives to deliver rapid margin or earnings expansion, despite heavy near-term capital outlays and uncertain time-to-profitability. As CapEx remains elevated through at least 2030, returns on investment may be delayed, pressuring both net margins and free cash flows.

Think the story is all about long-term green metals? Think again. The calculation behind this fair value quietly hinges on sharper margin compression and shrinking profit assumptions. Want to see which bold forecasts are shaping the narrative and how they may surprise you? Dive deeper to discover the full outlook.

Result: Fair Value of $18.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Fortescue's cost leadership and green technology investments could protect margins and unlock new growth, particularly if iron ore demand remains resilient.

Find out about the key risks to this Fortescue narrative.

Another View: What Does the Market Multiple Say?

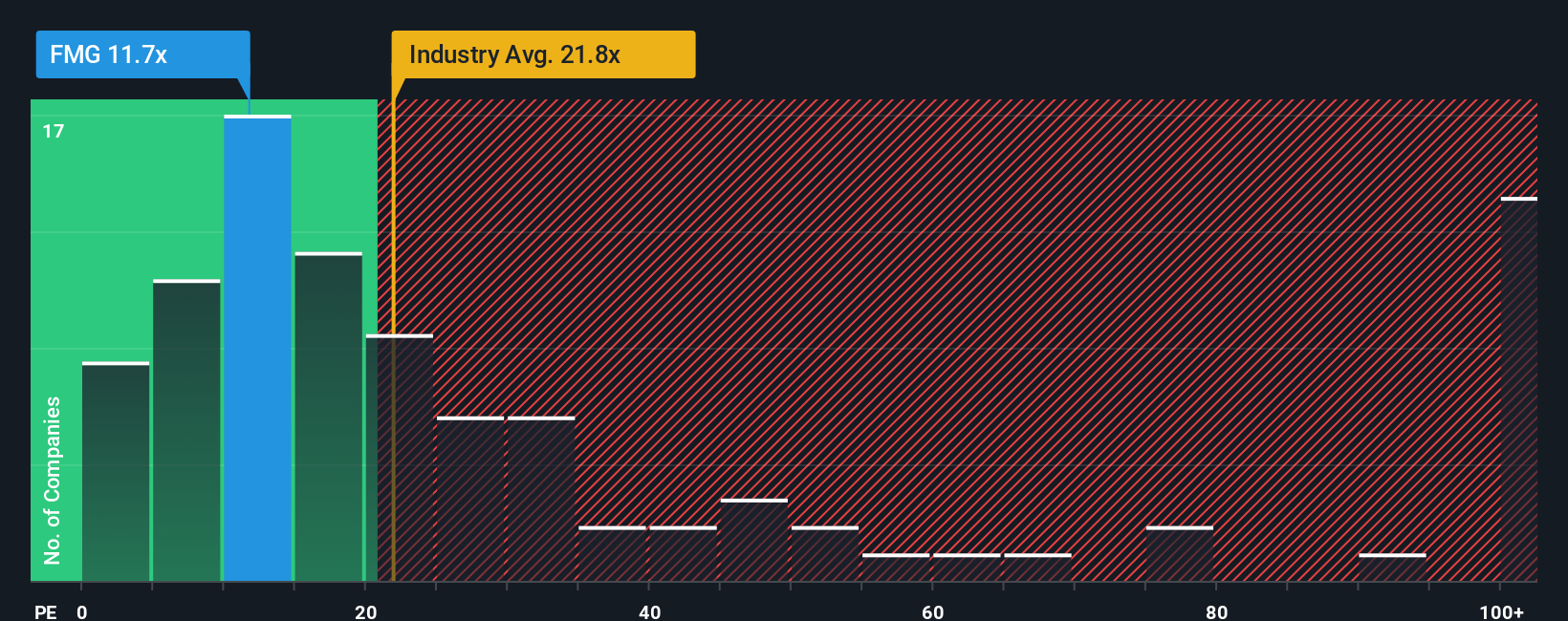

While the fair value analysis points to Fortescue being overvalued, the market’s chosen measure, its price-to-earnings ratio, tells a different story. At 12.2x, this is markedly lower than the industry average of 21.4x and even its peer group at 62.1x. The fair ratio sits near 16.5x, so Fortescue trades at a noticeable discount compared to both the market norm and what fundamentals suggest it could command. Does this open the door to value investors, or does it signal ongoing skepticism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortescue Narrative

If you think a different story could emerge or want to dig into the numbers yourself, building your own perspective only takes a few minutes. Go ahead and Do it your way.

A great starting point for your Fortescue research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to get ahead of the market and zero in on stocks that match your investing goals. The Simply Wall Street Screener is your ticket to fresh opportunities.

- Capitalize on rapid tech breakthroughs by jumping into these 27 AI penny stocks to spot the companies powering tomorrow’s smartest innovations.

- Accelerate your returns and lock in higher yields by scanning for income potential among these 17 dividend stocks with yields > 3%.

- Seize value opportunities others overlook by searching through these 878 undervalued stocks based on cash flows, driven by standout cash flows and under-the-radar potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FMG

Fortescue

Engages in the exploration, development, production, processing, and sale of iron ore in Australia, China, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives