- Australia

- /

- Metals and Mining

- /

- ASX:PRN

3 Top ASX Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the ASX200 experiences a modest uptick, with sectors like IT and Staples leading gains, investors are closely monitoring market dynamics to identify opportunities in dividend stocks. In this context, selecting robust dividend-paying stocks can be a strategic move to enhance portfolio stability and income, especially amidst the current economic landscape.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Fortescue (ASX:FMG) | 9.98% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 7.55% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.37% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.05% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.35% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 5.76% | ★★★★★☆ |

| National Storage REIT (ASX:NSR) | 4.93% | ★★★★★☆ |

| New Hope (ASX:NHC) | 7.99% | ★★★★☆☆ |

| Ricegrowers (ASX:SGLLV) | 5.09% | ★★★★☆☆ |

| Australian United Investment (ASX:AUI) | 3.55% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top ASX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

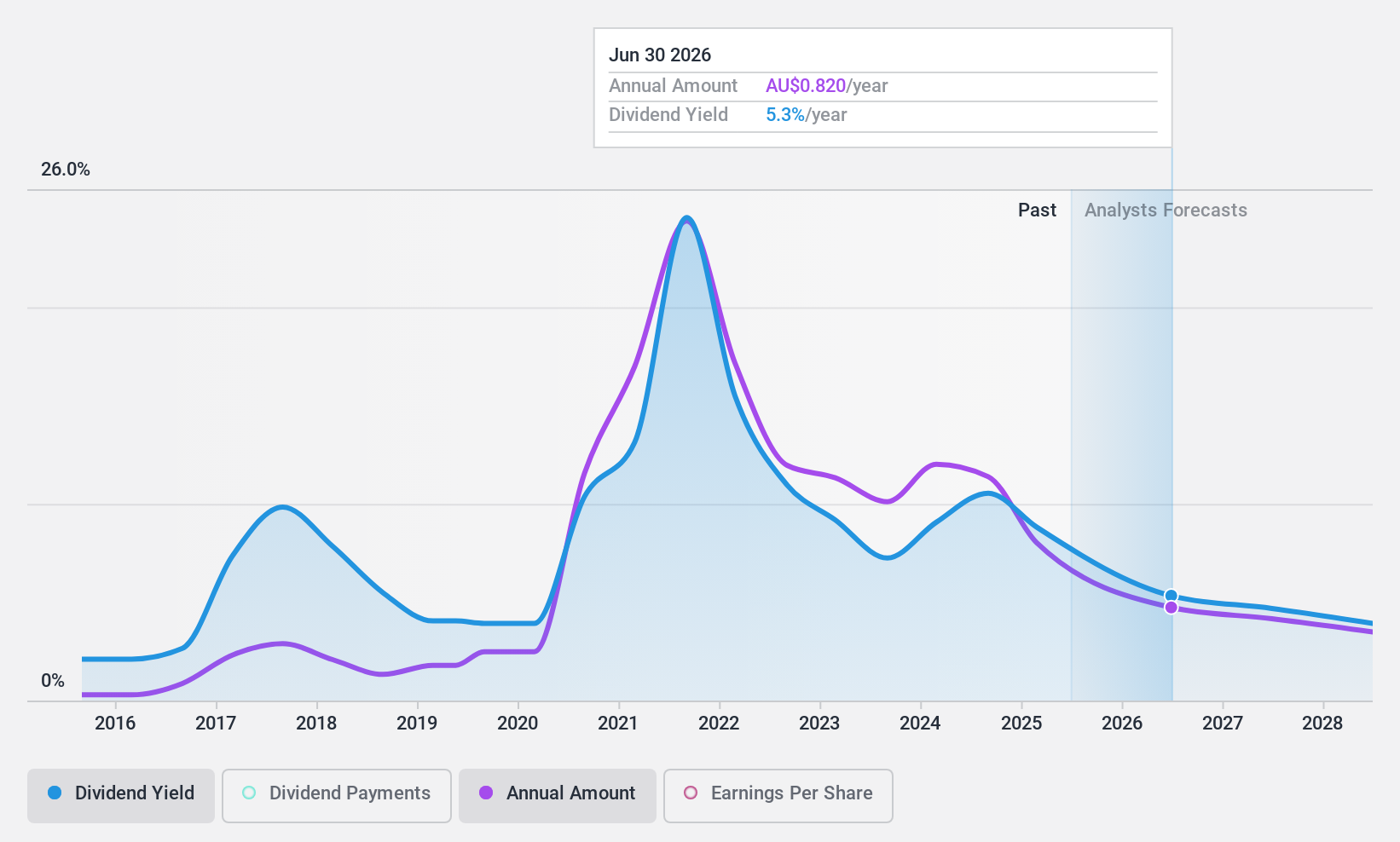

Fortescue (ASX:FMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fortescue Ltd is involved in the exploration, development, production, processing, and sale of iron ore across Australia, China, and internationally with a market cap of A$59.55 billion.

Operations: Fortescue Ltd generates revenue primarily from its Metals segment, which accounts for $18.13 billion, complemented by its Energy segment contributing $91 million.

Dividend Yield: 10%

Fortescue's dividend yield ranks in the top 25% of Australian payers, supported by a payout ratio covered by both earnings and cash flows. Despite this, its dividend history is marked by volatility and unreliability over the past decade. While trading below estimated fair value and offering good relative value compared to peers, future earnings are forecast to decline significantly. Recent company events include a change of registered office address in Perth.

- Delve into the full analysis dividend report here for a deeper understanding of Fortescue.

- Insights from our recent valuation report point to the potential undervaluation of Fortescue shares in the market.

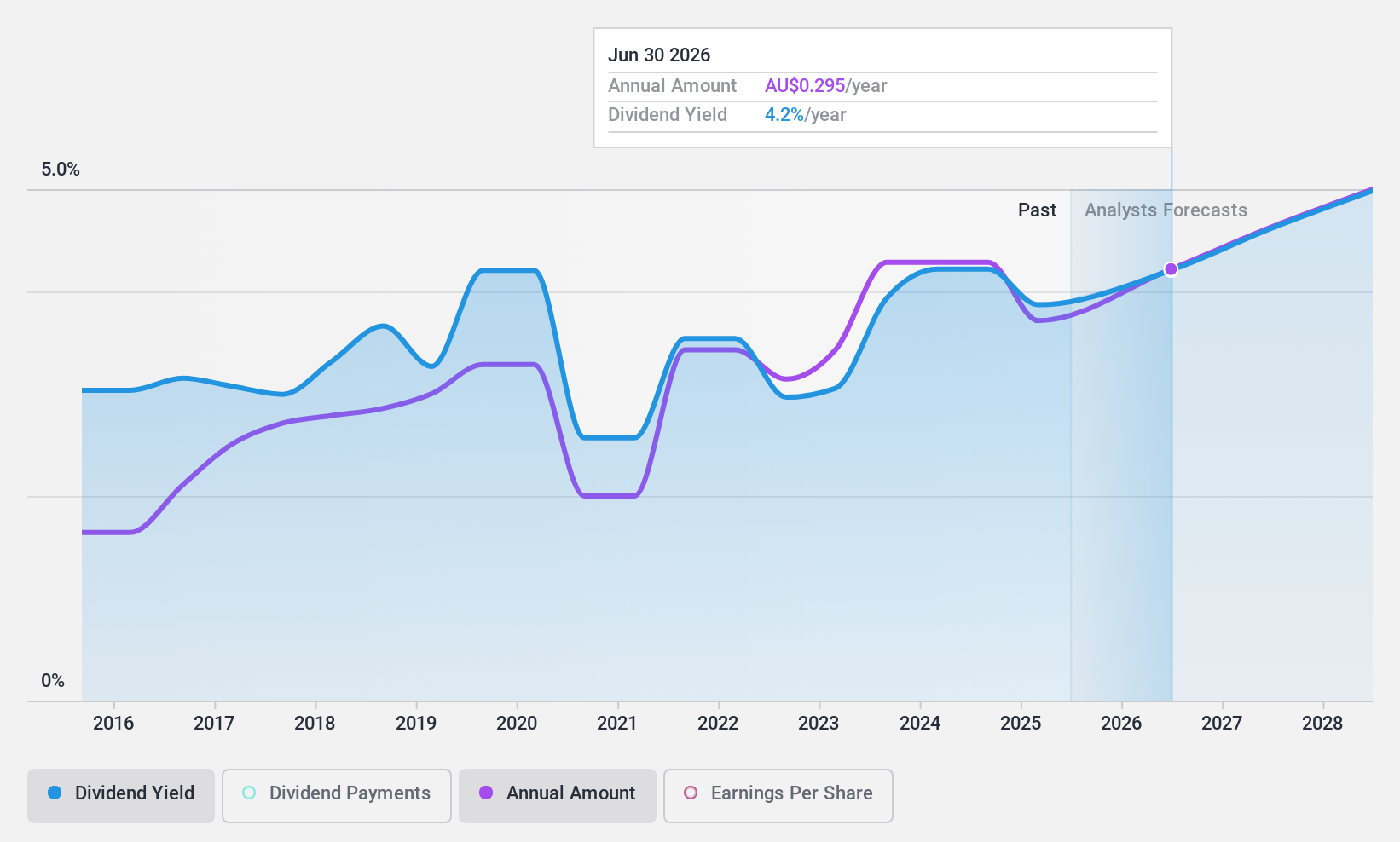

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: nib holdings limited, along with its subsidiaries, operates in the underwriting and distribution of private health, life, and living insurance for residents, international students, and visitors in Australia and New Zealand with a market cap of A$2.83 billion.

Operations: nib holdings limited generates revenue from several segments, including Australian Residents Health Insurance (A$2.65 billion), New Zealand Insurance (A$373.10 million), International (Inbound) Health Insurance (A$203.50 million), NIB Travel (A$96.80 million), and Nib Thrive (A$51.30 million).

Dividend Yield: 5%

nib holdings offers a dividend yield lower than the top 25% of Australian payers, with dividends covered by earnings and cash flows. Despite growth in earnings, its dividend history is marked by volatility and unreliability over the past decade. Trading significantly below estimated fair value suggests potential for capital appreciation. Recent board changes include Edward Close's appointment as director in December 2024, signaling possible strategic shifts ahead.

- Unlock comprehensive insights into our analysis of nib holdings stock in this dividend report.

- The analysis detailed in our nib holdings valuation report hints at an deflated share price compared to its estimated value.

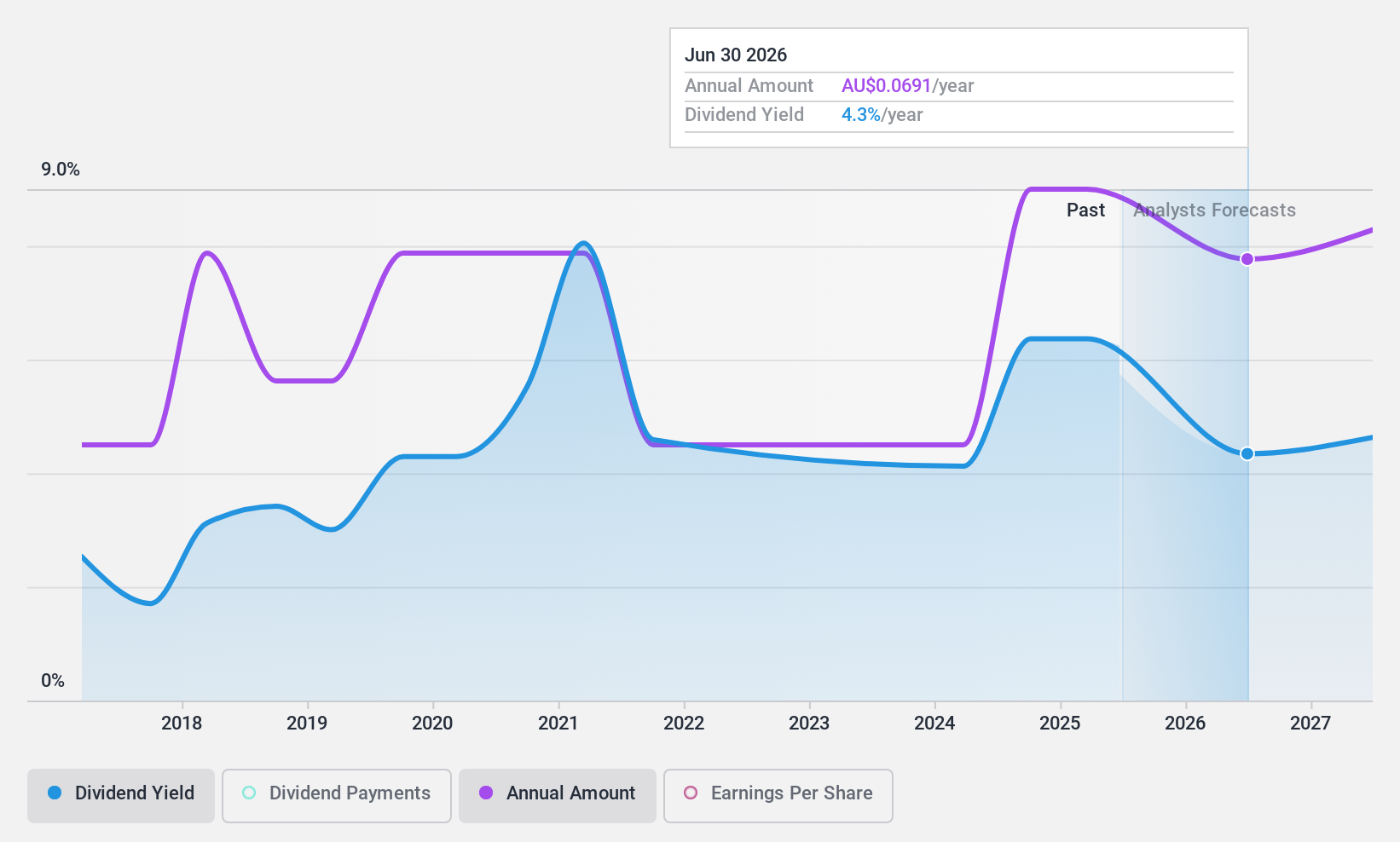

Perenti (ASX:PRN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Perenti Limited is a global mining services company with a market capitalization of A$1.28 billion.

Operations: Perenti Limited's revenue is primarily derived from Contract Mining Services at A$2.54 billion, followed by Drilling Services at A$598.10 million and Mining Services and Idoba at A$239.06 million.

Dividend Yield: 5.8%

Perenti's dividend yield is slightly below the top 25% of Australian payers, and its history shows volatility over the past decade. However, dividends are well-supported by both earnings and cash flows, with a payout ratio of 55.3% and a cash payout ratio of 48.3%. Trading at a significant discount to its estimated fair value suggests capital appreciation potential. Earnings growth forecasts further support sustainable dividend payments despite historical instability.

- Click here to discover the nuances of Perenti with our detailed analytical dividend report.

- According our valuation report, there's an indication that Perenti's share price might be on the cheaper side.

Make It Happen

- Take a closer look at our Top ASX Dividend Stocks list of 31 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PRN

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives