- Australia

- /

- Metals and Mining

- /

- ASX:FFM

FireFly Metals (ASX:FFM): Assessing Valuation Following High-Grade Green Bay Drilling Results

Reviewed by Simply Wall St

FireFly Metals (ASX:FFM) just revealed further high-grade drilling results at its Green Bay Copper-Gold Project, confirming an 800 metre core where two mineralisation zones converge. This extension indicates meaningful resource growth potential.

See our latest analysis for FireFly Metals.

On the back of these standout drilling results, FireFly Metals’ share price has surged. Its 1-month share price return sits at 31.8%, with a remarkable 98.9% rise year-to-date. Short-term momentum is clearly building, and the company’s 3-year total shareholder return of 172.9% shows how investor interest can gather pace when exploration milestones suggest deeper value may be unlocked.

If you’re keen to expand your shortlist beyond resources, now’s a smart time to discover fast growing stocks with high insider ownership

But with FireFly’s share price already surging following recent drilling results, does the stock still offer value at current levels? Or is the market already pricing in much of the project’s growth potential?

Price-to-Book of 3.7x: Is it justified?

With FireFly Metals trading at a price-to-book ratio of 3.7x, well above the industry average of 2.2x, the stock appears expensive when using this valuation lens. At the last close of A$1.76, investors are paying a significant premium compared to similar Australian Metals and Mining stocks.

The price-to-book ratio compares a company’s market price to the value of its net assets. This makes it a widely used benchmark in the capital-heavy mining sector. For an unprofitable company like FireFly Metals, a higher ratio could reflect optimistic hopes for future discoveries and development, but it also raises the bar for project delivery.

FireFly’s elevated multiple stands out from its industry peers. The average for comparable companies is 2.2x, so this valuation signals that the market is already factoring in significant upside for the Green Bay project. Unless rapid progress and commercialisation materialise, such a premium can be hard to sustain.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 3.7x (OVERVALUED)

However, negative earnings and reliance on optimistic asset valuations mean that any operational setbacks could quickly pressure FireFly Metals’ premium valuation.

Find out about the key risks to this FireFly Metals narrative.

Another View: Deep Discount on SWS DCF Model

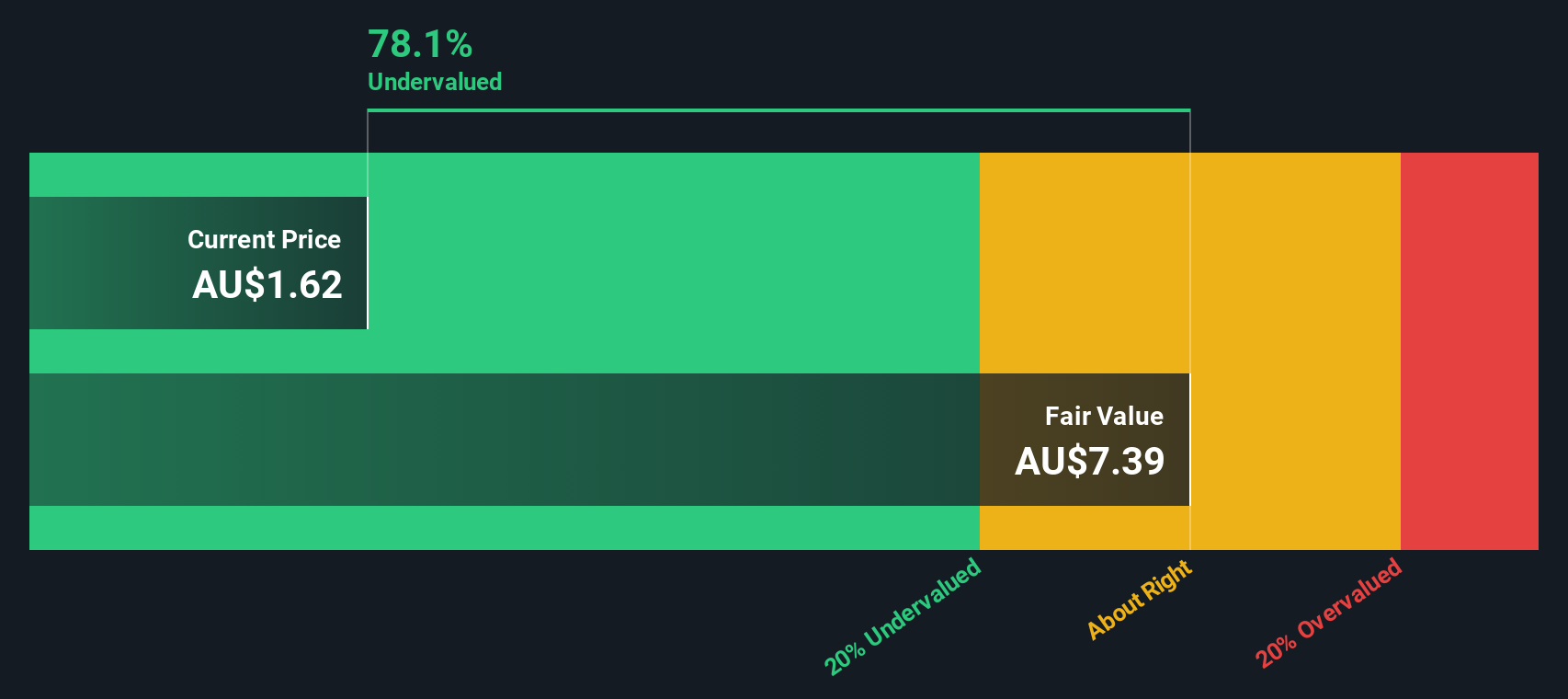

While the price-to-book ratio suggests FireFly Metals is expensive compared to its industry, our SWS DCF model presents a different perspective. The DCF model puts FireFly’s fair value at A$7.97, which is over four times above its current share price. Could the market be missing something big here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FireFly Metals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FireFly Metals Narrative

If you see the story from a different angle or want to dive deeper, you can review the figures and build your view in just a few minutes with Do it your way.

A great starting point for your FireFly Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Get ahead of the crowd by using the Simply Wall Street Screener to pinpoint companies that match your strategy and might be under the radar. Don’t let great opportunities slip by while others act first.

- Tap into fresh market leaders by checking out these 26 AI penny stocks, and see which businesses are driving real-world change with artificial intelligence innovation.

- Boost your income stream with these 21 dividend stocks with yields > 3%, connecting you to stocks offering yields above 3% for a potentially reliable cash flow.

- Unlock value others may be overlooking by scanning these 848 undervalued stocks based on cash flows, created to highlight shares trading at attractive price points based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:FFM

FireFly Metals

Engages in the exploration and evaluation of mineral deposits in Australia and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives