- Australia

- /

- Metals and Mining

- /

- ASX:EVN

Will Evolution Mining’s (ASX:EVN) Focus on Sustainability Redefine Its Competitive Edge in Gold?

Reviewed by Sasha Jovanovic

- In recent news, Evolution Mining highlighted its strong fundamentals and operational resilience within the ASX 200, emphasizing its robust position in Australia’s gold sector and resources industry.

- A key insight from this update is Evolution Mining’s focus on disciplined capital use and sustainable mining, contributing to its long-term stability in an evolving market.

- We’ll explore how Evolution Mining’s emphasis on operational efficiency and sustainability could shape its investment narrative in light of these developments.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Evolution Mining Investment Narrative Recap

To be a shareholder in Evolution Mining, an investor needs to believe in the ongoing strength of Australia's gold sector and Evolution's capacity to maintain stable production, disciplined capital management, and robust operational efficiency. The latest update confirming strong fundamentals reinforces the view of Evolution as a steady performer, though it does not materially alter the biggest short-term risk: rising operating costs, even with current margin stability remaining a key near-term catalyst.

Among recent developments, the commissioning of the expanded Mungari mill ahead of schedule and under budget stands out. This operational milestone directly supports Evolution’s efficiency and scale ambitions, making it highly relevant to any discussion about the company’s ability to sustain margins and deliver on production guidance in the face of potential cost inflation.

However, investors should be aware that even with operational gains, persistent labor cost pressures could eventually challenge...

Read the full narrative on Evolution Mining (it's free!)

Evolution Mining's outlook anticipates A$4.9 billion in revenue and A$1.1 billion in earnings by 2028. This implies a 4.1% annual revenue growth rate and an earnings increase of about A$174 million from current earnings of A$926.2 million.

Uncover how Evolution Mining's forecasts yield a A$9.92 fair value, a 5% downside to its current price.

Exploring Other Perspectives

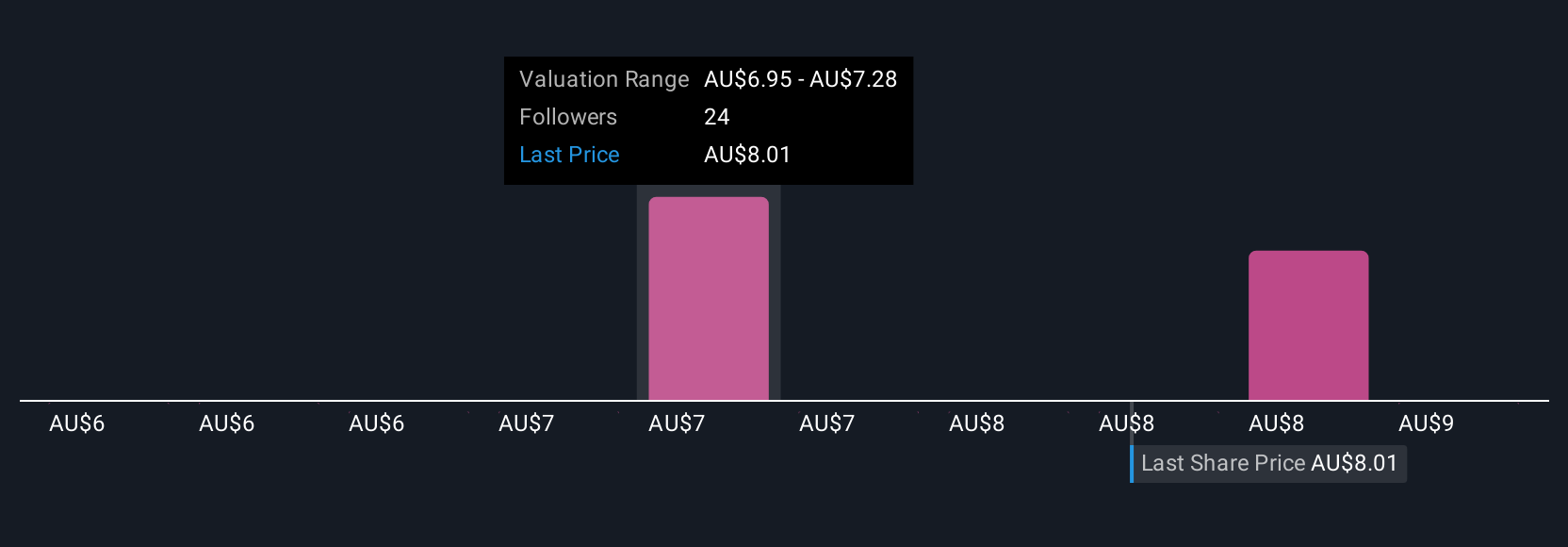

Six individual fair value estimates from the Simply Wall St Community span A$6.13 to A$11.26 per share. While some anticipate margin stability, many participants recognize cost pressures may test Evolution Mining’s future earnings, prompting you to compare different viewpoints.

Explore 6 other fair value estimates on Evolution Mining - why the stock might be worth 42% less than the current price!

Build Your Own Evolution Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evolution Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Evolution Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evolution Mining's overall financial health at a glance.

No Opportunity In Evolution Mining?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolution Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EVN

Evolution Mining

Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives