- Australia

- /

- Metals and Mining

- /

- ASX:EVN

Evaluating Evolution Mining (ASX:EVN): Is the Current Valuation Justified by Its Steady Performance and Sector Resilience?

Evolution Mining (ASX:EVN) is generating interest as investors take note of its steady performance in the ASX 200 and respected standing within Australia’s resource-driven economy. The company’s long-term approach draws attention as the gold sector continues to show resilience.

See our latest analysis for Evolution Mining.

Momentum has been firmly on Evolution Mining’s side over the past several months, with the share price notching an impressive 43.8% gain over the last quarter and now sitting at A$10.50. This surge helped the company deliver a remarkable 104.4% total shareholder return over the past year. These results suggest growing optimism for gold miners, as investors seek both stability and long-term upside.

If the recent momentum in gold stocks has you looking for your next opportunity, now is a great time to expand your search and discover fast growing stocks with high insider ownership

This recent rally raises the key question for investors: Is Evolution Mining still trading at an attractive valuation, or has the share price already factored in its future growth potential and left little room for further upside?

Most Popular Narrative: 20.4% Overvalued

With Evolution Mining trading at A$10.50, the most widely followed narrative suggests its fair value is just A$8.72, implying the share price is running well ahead of fundamental projections based on future earnings and profit margins. This gap between market enthusiasm and valuation fundamentals calls for a closer look at the assumptions behind the narrative’s discounted cash flow analysis and what truly drives the premium being paid in the current rally.

The company's positive reputation for sustainability and robust ESG practices, highlighted as a driver for institutional investor interest and better access to capital, could already be reflected in a premium valuation. This leaves limited upside if ESG-led capital flows moderate or if industry ESG standards rise further.

Curious what power metrics are fueling this price? The story hints at ambitious margin expansion, rising revenues, and aggressive expectations for future profit multiples. Want to see the specific forecasts underpinning this bullish valuation? Dive in for the narrative’s logic, as some numbers may surprise anyone betting on higher prices.

Result: Fair Value of $8.72 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sustained rally in gold prices or efficient cost controls could challenge the overvaluation call and renew bullish sentiment around Evolution Mining.

Find out about the key risks to this Evolution Mining narrative.

Another View: Perspective from Earnings Ratios

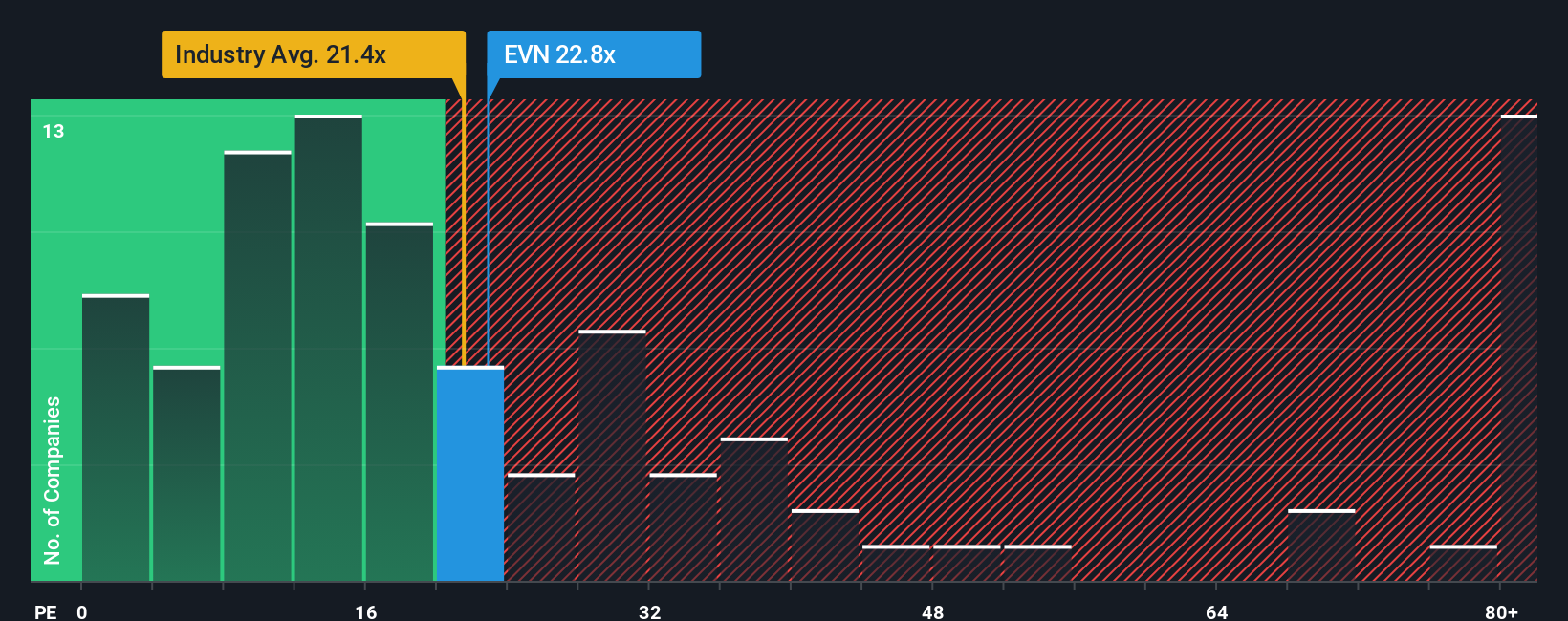

Taking a different approach, Evolution Mining trades at a price-to-earnings ratio of 22.8x. This is lower than similar peers averaging 47.6x, and just below the industry average of 23x. However, it is slightly above its fair ratio of 21.4x, signaling the market is pricing in some extra optimism. Does this gap highlight resilience, or suggest the shares may be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evolution Mining Narrative

If the above view does not align with your take, or if you want to dig into the numbers firsthand, you can shape your own perspective with fresh data in just a few minutes, and Do it your way

A great starting point for your Evolution Mining research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass you by. Leverage the Simply Wall Street screener to pinpoint stocks building momentum across exciting sectors and investment themes right now.

- Tap into high potential by checking out these 3568 penny stocks with strong financials positioned for breakout growth in dynamic market environments.

- Find future-focused companies at attractive valuations with these 878 undervalued stocks based on cash flows that could strengthen your portfolio returns.

- Capture passive income opportunities by reviewing these 17 dividend stocks with yields > 3% which consistently deliver yields above 3% and reward shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evolution Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EVN

Evolution Mining

Engages in the exploration, mine development and operation, and sale of gold and gold-copper concentrates in Australia and Canada.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Why I invest in Sofina (Dividend growth)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion