- Australia

- /

- Metals and Mining

- /

- ASX:EVG

3 ASX Penny Stocks With Market Caps Up To A$200M

Reviewed by Simply Wall St

The Australian stock market has been experiencing slight fluctuations, with the ASX200 recently down by 0.25% to 8178 points, amidst broader global economic shifts such as Wall Street's record highs following political developments in the United States. In this context, investors might consider exploring penny stocks—often representing smaller or newer companies—as they can still present unique growth opportunities despite being a somewhat outdated term. These stocks can offer potential advantages when backed by strong financial health and solid fundamentals, providing a chance for growth at lower price points without many of the typical risks associated with this investment area.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.815 | A$295.51M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.645 | A$806.18M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.03 | A$134.6M | ★★★★★★ |

| Joyce (ASX:JYC) | A$4.51 | A$133.03M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$61M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.31 | A$111.83M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$5.00 | A$493.33M | ★★★★☆☆ |

Click here to see the full list of 1,036 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ark Mines (ASX:AHK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ark Mines Limited is involved in the acquisition and exploration of mineral properties in Australia, with a market capitalization of A$11.92 million.

Operations: Ark Mines Limited currently has no reported revenue segments.

Market Cap: A$11.92M

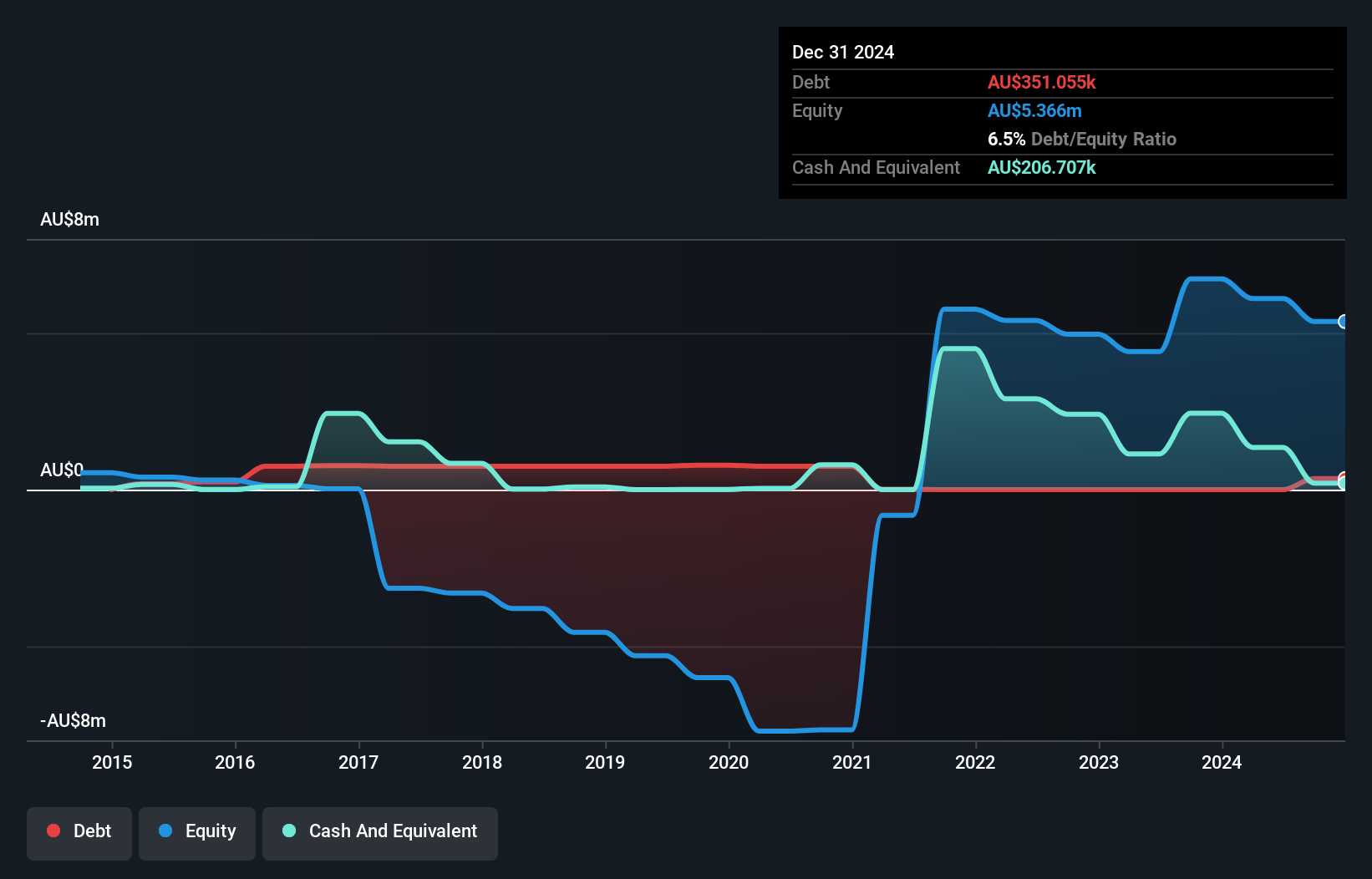

Ark Mines Limited, with a market cap of A$11.92 million, is pre-revenue and unprofitable. Despite having no long-term liabilities and being debt-free, the company faces financial challenges with less than a year of cash runway based on current free cash flow. Its share price has been highly volatile over the past three months. However, Ark Mines' short-term assets (A$1.4M) comfortably cover its short-term liabilities (A$250.5K). The management team and board are experienced, averaging tenures of 13 years or more. Recent presentations at major conferences indicate ongoing efforts to engage investors and stakeholders.

- Dive into the specifics of Ark Mines here with our thorough balance sheet health report.

- Learn about Ark Mines' historical performance here.

Evion Group (ASX:EVG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Evion Group NL is an integrated graphite developer with operations in Madagascar, India, and Europe, and has a market cap of A$12.65 million.

Operations: The company generated A$0.11 million from its exploration activities.

Market Cap: A$12.65M

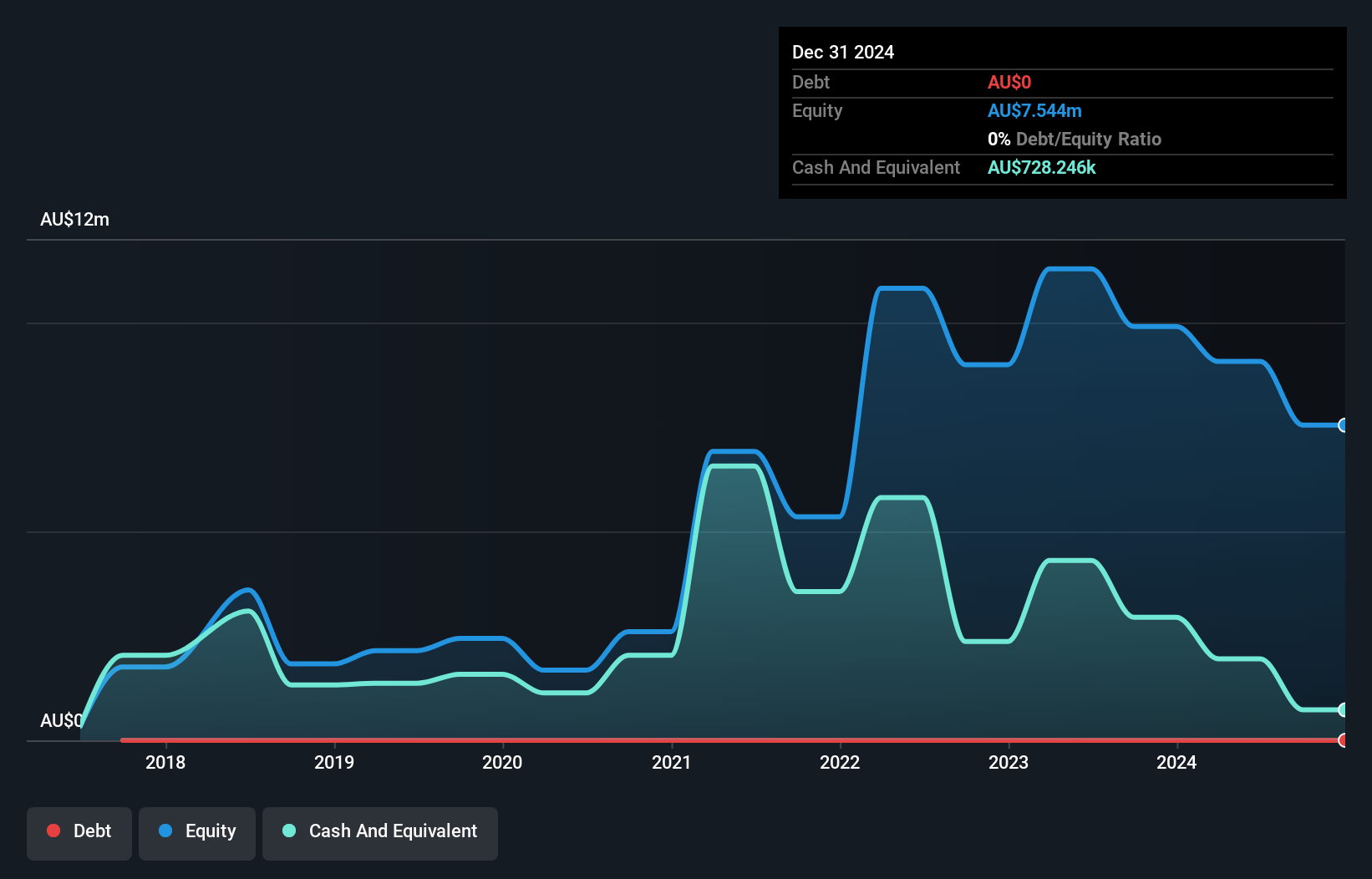

Evion Group NL, with a market cap of A$12.65 million, is pre-revenue and unprofitable. The company reported a net loss of A$3.21 million for the year ended June 30, 2024, slightly improved from the previous year's loss. Despite being debt-free and having short-term assets (A$2.3M) that exceed liabilities (A$655.5K), Evion faces financial challenges with less than a year of cash runway based on current free cash flow trends. The share price has been highly volatile recently, and both its management team and board are relatively inexperienced with average tenures under two years.

- Click here and access our complete financial health analysis report to understand the dynamics of Evion Group.

- Assess Evion Group's previous results with our detailed historical performance reports.

Saunders International (ASX:SND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Saunders International Limited, with a market cap of A$101.76 million, offers design, construction, fabrication, shutdown, maintenance, and industrial automation services for steel storage tanks and concrete bridges in Australia and the Pacific Region.

Operations: The company's revenue is primarily derived from its Steel Storage Tanks, Concrete Bridges, and Structural Mechanical Piping segment, generating A$216.08 million.

Market Cap: A$101.76M

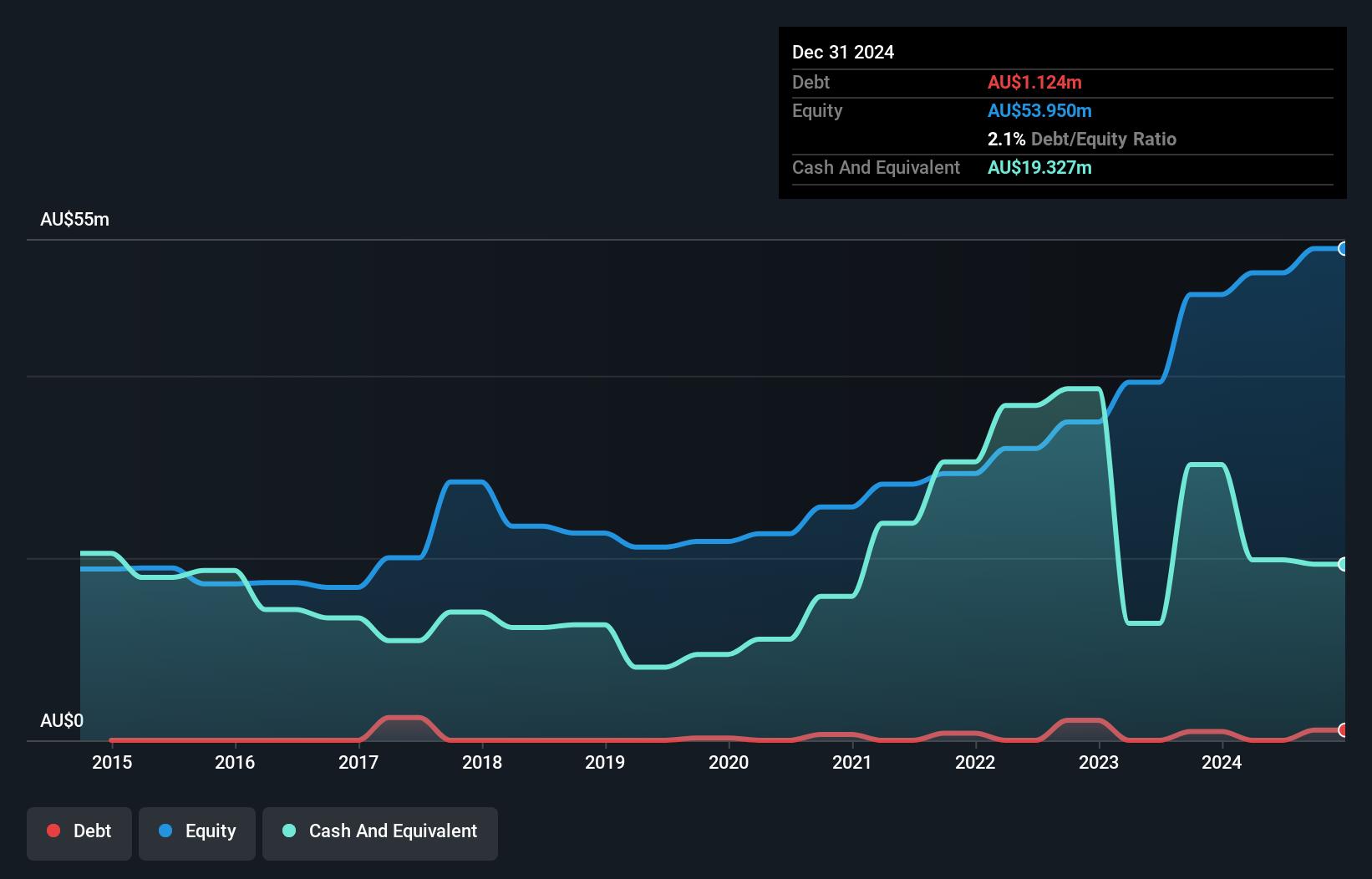

Saunders International Limited, with a market cap of A$101.76 million, has demonstrated stability in its financial operations, reporting revenue of A$216.08 million for the year ending June 30, 2024. Despite facing shareholder dilution over the past year and a slight decline in net income to A$9.36 million from A$9.49 million, the company maintains a debt-free status and covers long-term liabilities with short-term assets worth A$66.9M against liabilities of A$50.9M. Recent leadership changes include appointing Alex Dunne as CFO, potentially strengthening its financial management team amidst an unstable dividend track record.

- Unlock comprehensive insights into our analysis of Saunders International stock in this financial health report.

- Gain insights into Saunders International's historical outcomes by reviewing our past performance report.

Seize The Opportunity

- Embark on your investment journey to our 1,036 ASX Penny Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evion Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EVG

Evion Group

Operates as an integrated graphite developer in Madagascar, India, and Europe.

Flawless balance sheet moderate.

Market Insights

Community Narratives