- Australia

- /

- Capital Markets

- /

- ASX:AEF

Discovering Australia's Undiscovered Gems for September 2024

Reviewed by Simply Wall St

The Australian market has shown resilience with the ASX200 closing up 0.3% at 8,099.9 points, driven by strong performances in the Materials and Real Estate sectors. Despite some drag from Financials, there are still promising opportunities to be found among small-cap stocks. In this environment, identifying a good stock often means looking for companies that can capitalize on sector-specific strengths or unique market conditions. Here are three undiscovered gems in Australia that could offer potential growth based on current trends and economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Bisalloy Steel Group | 0.95% | 10.27% | 24.14% | ★★★★★★ |

| Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

| Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

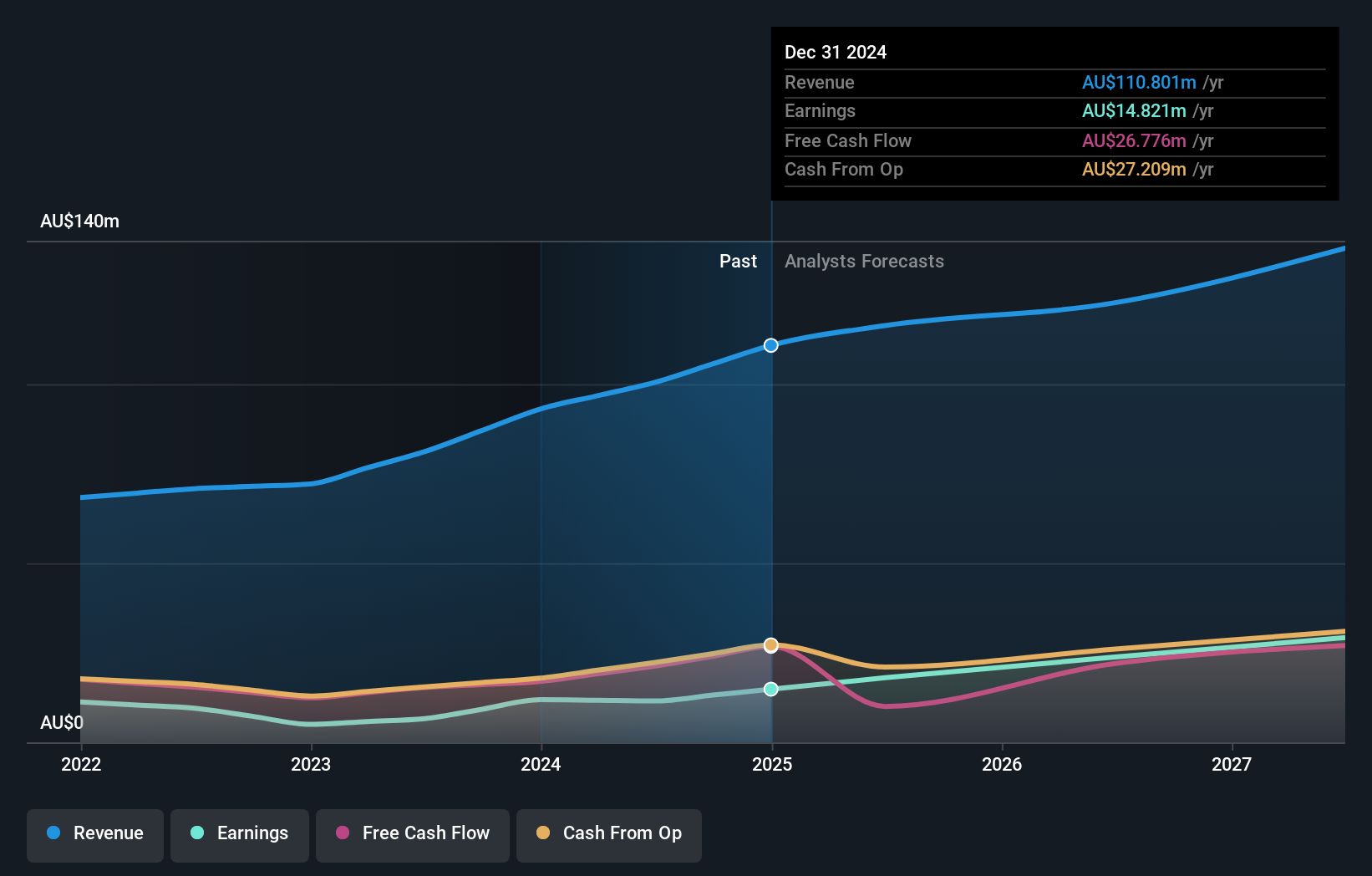

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$495.11 million.

Operations: The company generates revenue primarily from its funds management segment, which reported A$100.49 million in revenue.

Australian Ethical Investment (AEI) has demonstrated remarkable performance with earnings growth of 75.3% over the past year, outpacing the Capital Markets industry’s 17.7%. Despite a one-off A$8.6M loss impacting its financials to June 2024, AEI remains debt-free for five years and reported net income of A$11.53M on sales of A$100.49M for FY2024. The company announced a fully franked final dividend of 6 cents per share, bringing the annual dividend to 9 cents, up by 29%.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Catalyst Metals Limited explores and evaluates mineral properties in Australia, with a market cap of A$602.84 million.

Operations: Catalyst Metals Limited generates revenue primarily from its operations in Tasmania (A$75.08 million) and Western Australia (A$243.77 million).

Catalyst Metals, an emerging player in Australia's mining sector, recently reported a net income of A$23.56 million for the year ended June 30, 2024, compared to a net loss of A$15.63 million the previous year. The company achieved annual group gold production of 110koz and expects FY2025 gold production to range between 105koz to 120koz. Trading at nearly 90% below its estimated fair value, Catalyst also has high-quality earnings and has reduced project capital costs significantly through strategic development plans for Plutonic East and Trident deposits.

- Delve into the full analysis health report here for a deeper understanding of Catalyst Metals.

Assess Catalyst Metals' past performance with our detailed historical performance reports.

Emerald Resources (ASX:EMR)

Simply Wall St Value Rating: ★★★★★☆

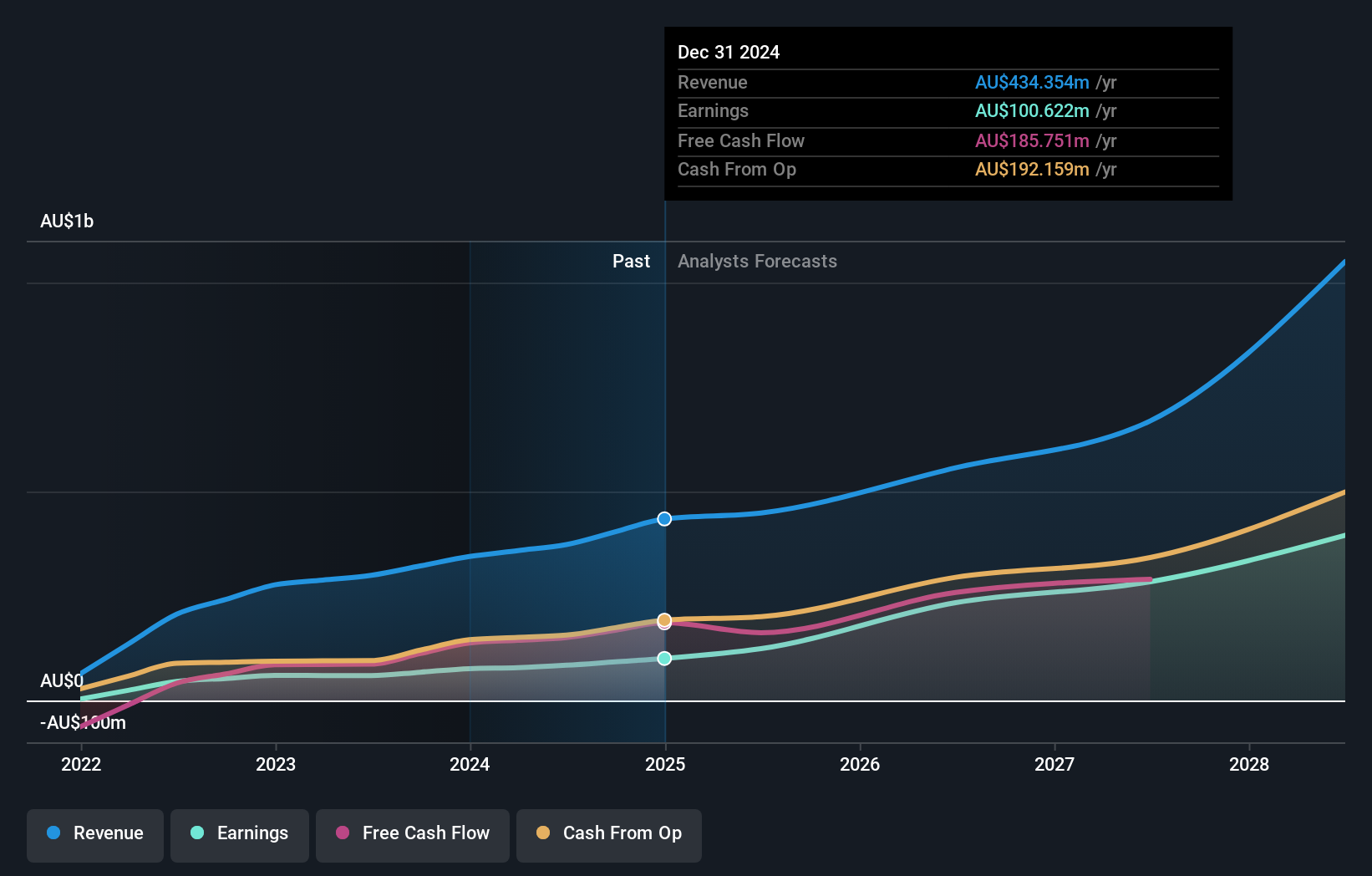

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.68 billion.

Operations: Emerald Resources NL generates revenue primarily from mine operations, amounting to A$366.04 million. The company also has a minor revenue stream of A$5.04 million from other sources.

Emerald Resources, a promising player in the Australian mining sector, has demonstrated impressive financial health. With earnings growing 41.9% last year and forecasted to grow 30.1% annually, the company is trading at 57.6% below its estimated fair value. Its debt-to-equity ratio increased from 0% to 8.5% over five years but remains manageable with interest payments well covered by EBIT (18.6x). Recent earnings reported A$371 million in sales and A$84 million in net income for FY2024, reflecting solid performance improvements from the previous year.

Summing It All Up

- Click this link to deep-dive into the 53 companies within our ASX Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Australian Ethical Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEF

Australian Ethical Investment

Australian Ethical Investment Ltd is a publicly owned investment manager.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives