- Australia

- /

- Transportation

- /

- ASX:LAU

ASX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The ASX200 is set to open slightly lower today, influenced by mixed performances in the US markets and ongoing global trade tensions. Despite these broader market challenges, penny stocks—often representing smaller or newer companies—continue to offer intriguing opportunities for growth. While the term 'penny stock' may seem outdated, these investments can still reveal hidden value when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lindsay Australia (ASX:LAU) | A$0.71 | A$225.19M | ✅ 4 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.85 | A$149.01M | ✅ 4 ⚠️ 2 View Analysis > |

| Accent Group (ASX:AX1) | A$1.90 | A$1.14B | ✅ 4 ⚠️ 2 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.565 | A$73.83M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.55 | A$393.16M | ✅ 4 ⚠️ 2 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.50 | A$166.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.33 | A$783.26M | ✅ 4 ⚠️ 3 View Analysis > |

| Tasmea (ASX:TEA) | A$2.99 | A$699.78M | ✅ 4 ⚠️ 2 View Analysis > |

| SHAPE Australia (ASX:SHA) | A$3.29 | A$272.21M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,000 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Emerald Resources (ASX:EMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$3.12 billion.

Operations: The company generates revenue primarily from its mine operations, amounting to A$427.32 million.

Market Cap: A$3.12B

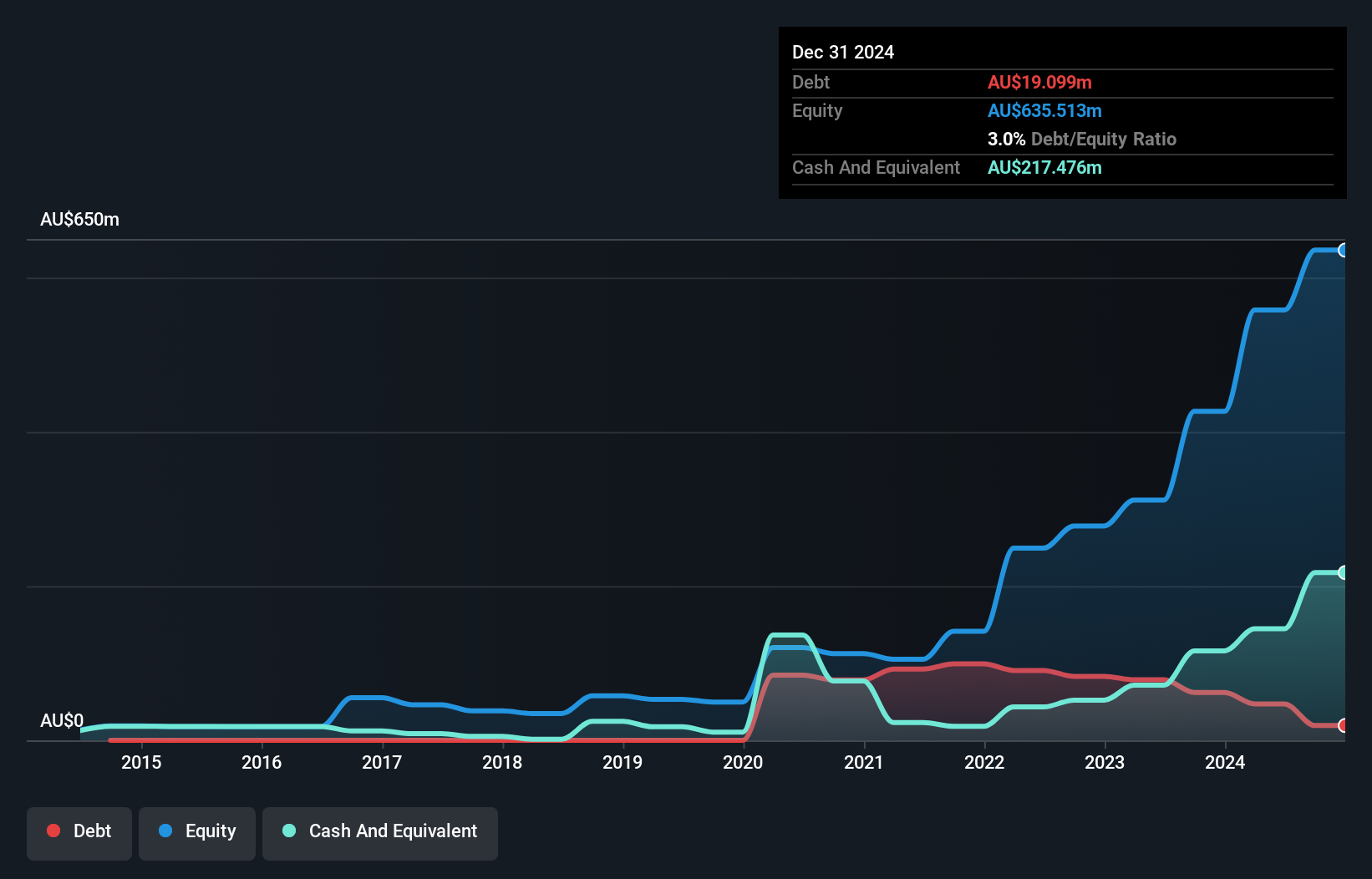

Emerald Resources demonstrates strong financial health with its interest payments well covered by EBIT and operating cash flow covering debt over tenfold. Its net profit margin has improved, reflecting a stable growth trajectory, while earnings have consistently outpaced the industry average. The company trades significantly below estimated fair value and has not diluted shareholders recently. Despite a low return on equity, Emerald's cash reserves exceed total debt, indicating prudent financial management. The seasoned board and management team further bolster confidence in its operations. However, earnings growth has decelerated compared to the past five years but remains robust overall.

- Click here and access our complete financial health analysis report to understand the dynamics of Emerald Resources.

- Explore Emerald Resources' analyst forecasts in our growth report.

Lindsay Australia (ASX:LAU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lindsay Australia Limited offers integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia, with a market cap of A$225.19 million.

Operations: The company's revenue is primarily derived from its Transport segment at A$573.35 million, followed by Rural at A$160.92 million and Hunters at A$100.09 million, with an additional contribution from Corporate activities amounting to A$5.15 million.

Market Cap: A$225.19M

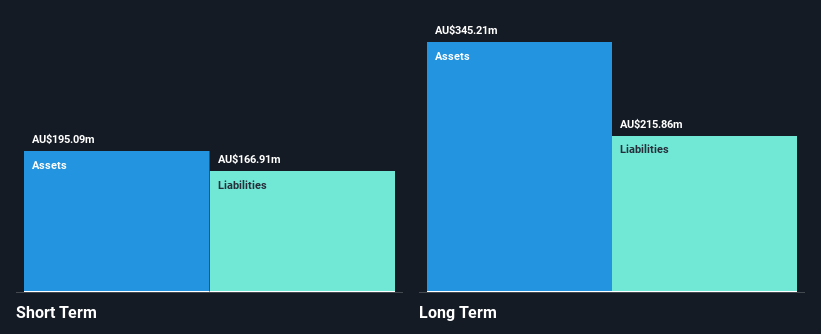

Lindsay Australia presents a mixed picture for investors. While its earnings have grown significantly over the past five years, recent performance shows negative earnings growth and a decline in profit margins. The company's short-term assets exceed its short-term liabilities, but they fall short of covering long-term liabilities. Despite trading below estimated fair value and having well-covered debt by operating cash flow, the stock's return on equity is low and dividend track record unstable. Recent strategic moves include potential acquisition talks with SRT Logistics and a board addition of an experienced non-executive director, which might influence future growth prospects.

- Jump into the full analysis health report here for a deeper understanding of Lindsay Australia.

- Gain insights into Lindsay Australia's future direction by reviewing our growth report.

Qualitas (ASX:QAL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Qualitas (ASX:QAL) is a real estate investment firm specializing in direct investments across various real estate classes and geographies, distressed debt acquisitions and restructuring, third-party capital raisings, and consulting services, with a market cap of A$833.42 million.

Operations: Qualitas generates revenue through its Direct Lending segment, which accounts for A$23.03 million, and its Funds Management segment, contributing A$21.46 million.

Market Cap: A$833.42M

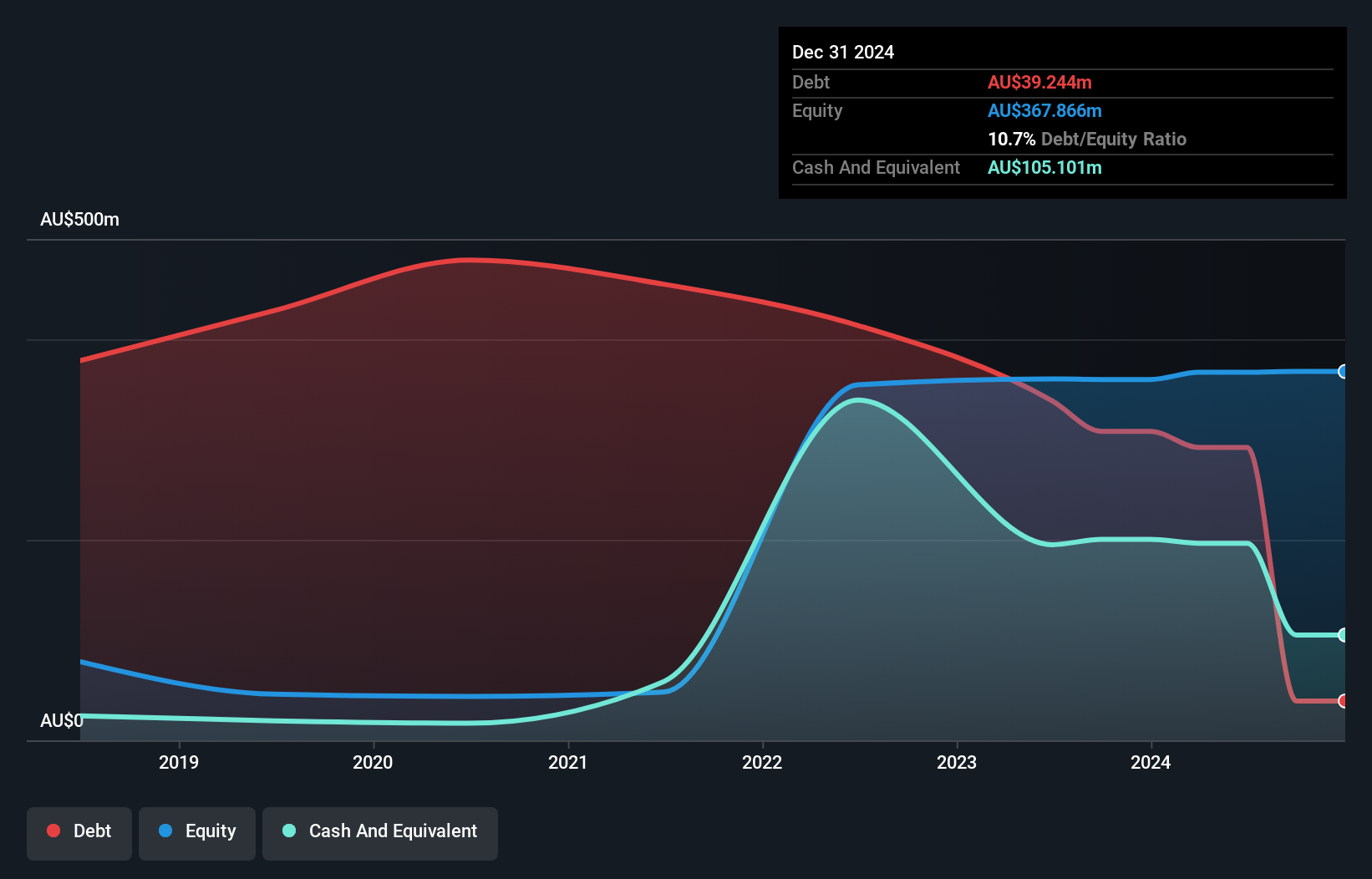

Qualitas demonstrates a robust financial position with significant earnings growth of 21.6% annually over the past five years, supported by strong net profit margins that have improved to 27.6%. The company's short-term assets comfortably cover both short- and long-term liabilities, and it holds more cash than total debt. However, its dividend yield of 2.82% is not well covered by free cash flows, and operating cash flow remains negative. Recent developments include the appointment of Bruce MacDiarmid as an independent non-executive director, potentially enhancing governance given his extensive experience in investment banking and capital markets.

- Take a closer look at Qualitas' potential here in our financial health report.

- Understand Qualitas' earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 997 more companies for you to explore.Click here to unveil our expertly curated list of 1,000 ASX Penny Stocks.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LAU

Lindsay Australia

Provides integrated transport, logistics, and rural supply services to the food processing, food services, fresh produce, and horticulture sectors in Australia.

Undervalued established dividend payer.

Market Insights

Community Narratives