- Australia

- /

- Hospitality

- /

- ASX:WEB

ASX Penny Stocks Spotlight: Emerald Resources And Two More To Consider

Reviewed by Simply Wall St

As Australian shares aim for a modest rise, the market remains influenced by global events, including record highs in U.S. indices and geopolitical tensions. Amidst these broader market dynamics, penny stocks continue to capture investor interest due to their potential for growth at relatively low price points. While the term "penny stocks" might seem outdated, these investments often involve smaller or newer companies that can offer significant upside when backed by strong financial fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.365 | A$104.6M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.29 | A$108.03M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$118.24M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.86 | A$440.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Duratec (ASX:DUR) | A$1.435 | A$362.18M | ✅ 3 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.785 | A$471.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$363.6M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.77 | A$867.44M | ✅ 5 ⚠️ 3 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.15 | A$196.92M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 468 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Emerald Resources (ASX:EMR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.60 billion.

Operations: The company generates revenue primarily from its Mine Operations segment, which accounts for A$427.32 million.

Market Cap: A$2.6B

Emerald Resources has demonstrated significant financial strength and growth, with its earnings increasing by 32.2% over the past year, surpassing industry averages. The company maintains a solid balance sheet, as its debt is well covered by operating cash flow and it holds more cash than total debt. Recent production guidance indicates robust gold output from the Okvau Gold Mine through 2026, suggesting operational stability. Despite a low Return on Equity of 15.6%, Emerald's net profit margins have improved to 23.2%, reflecting efficient management practices without shareholder dilution in the past year.

- Unlock comprehensive insights into our analysis of Emerald Resources stock in this financial health report.

- Explore Emerald Resources' analyst forecasts in our growth report.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market cap of A$717.37 million.

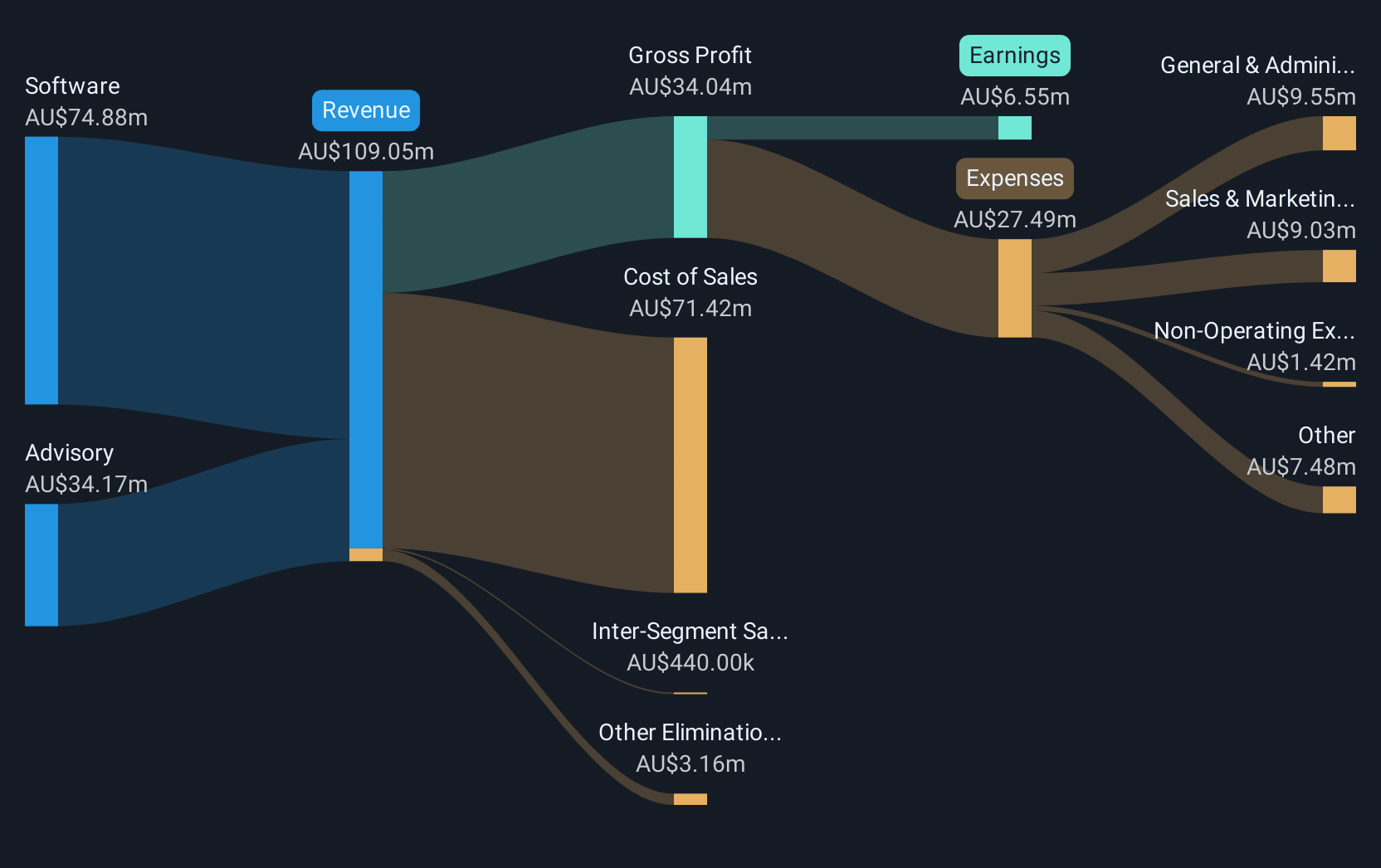

Operations: RPMGlobal Holdings generates revenue primarily from its Software segment, which accounts for A$74.88 million, and its Advisory services, contributing A$34.17 million.

Market Cap: A$717.37M

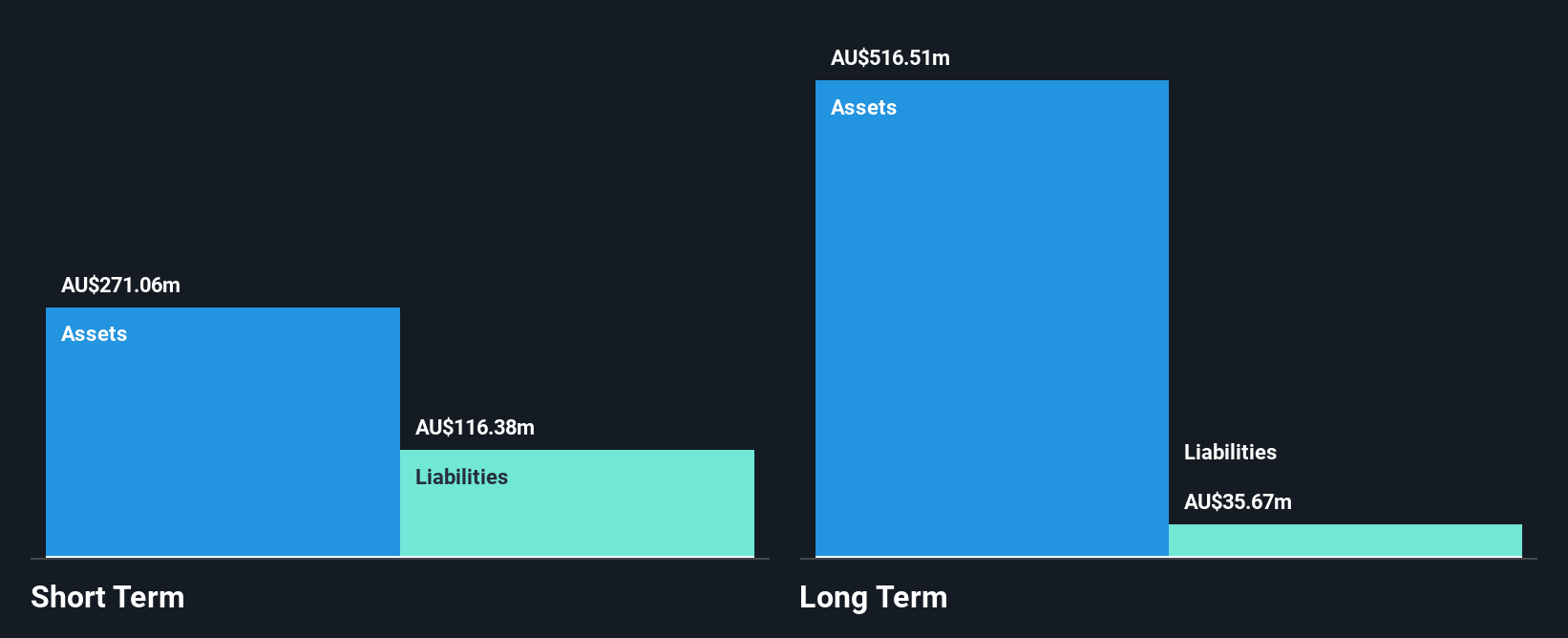

RPMGlobal Holdings has shown financial resilience with no debt over the past five years, supported by experienced management and board members. Despite a stable weekly volatility of 7%, RPMGlobal faces challenges with declining earnings, forecasted to decrease by an average of 27.2% annually over the next three years. The company's net profit margin has dropped from 9.7% last year to 6.2%, and its Return on Equity is considered low at 12%. However, RPMGlobal's short-term assets comfortably cover both short-term and long-term liabilities, ensuring a solid liquidity position amidst these challenges.

- Take a closer look at RPMGlobal Holdings' potential here in our financial health report.

- Evaluate RPMGlobal Holdings' prospects by accessing our earnings growth report.

Web Travel Group (ASX:WEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Web Travel Group Limited offers online travel booking services across Australia, the United Arab Emirates, the United Kingdom, and internationally, with a market cap of A$1.61 billion.

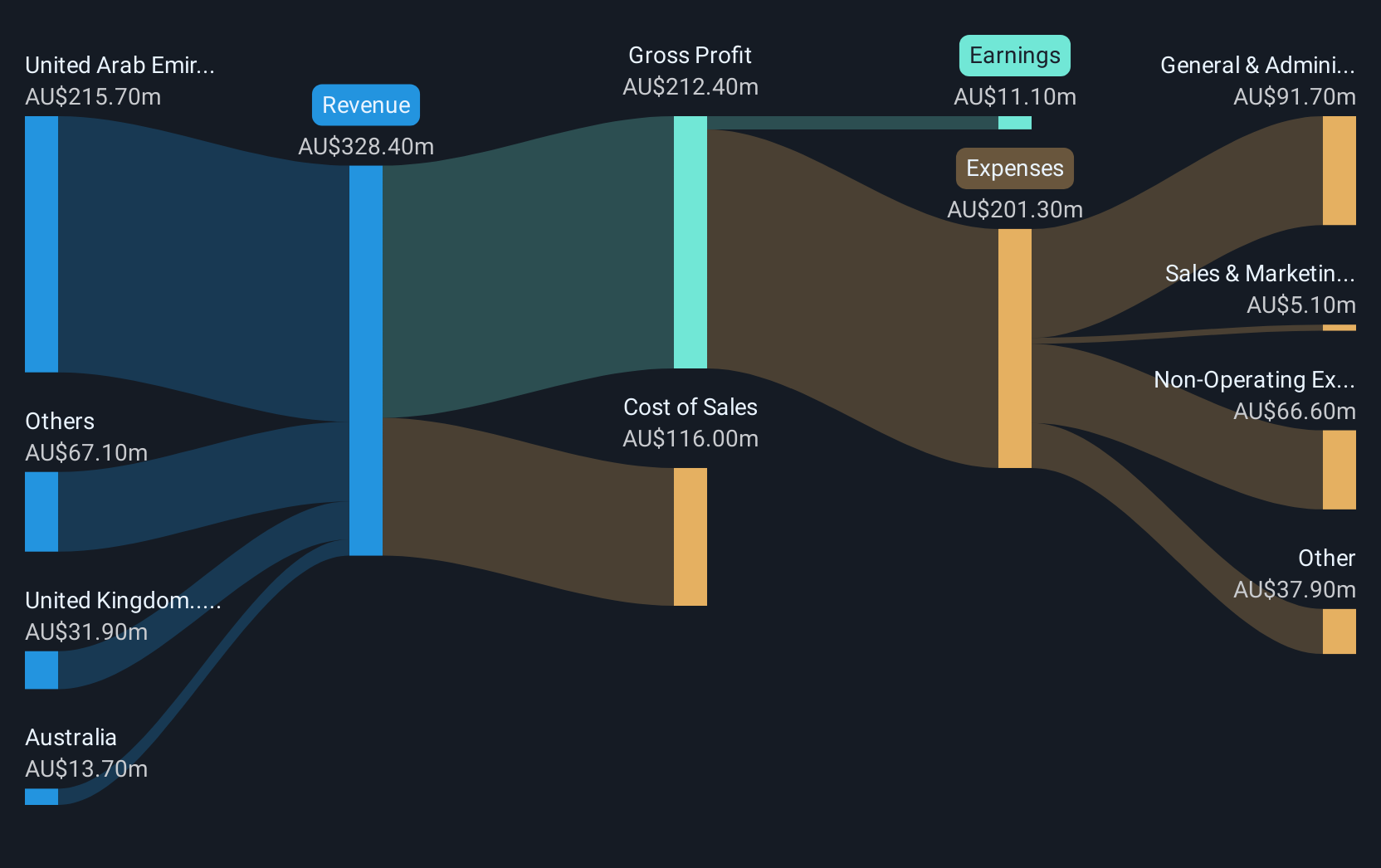

Operations: The company generates revenue from its Business to Business Travel (B2B) segment, amounting to A$328.4 million.

Market Cap: A$1.61B

Web Travel Group's financial profile reveals a mixed picture for potential investors. While the company boasts a substantial market cap of A$1.61 billion and generates significant revenue from its B2B segment, recent earnings growth has been negative at -85.9%, with profit margins dropping to 3.4% from 24.6% last year, partly due to large one-off losses impacting results. Despite these challenges, the company's short-term assets exceed both short-term and long-term liabilities, providing financial stability. Upcoming board changes may bring fresh perspectives as Melanie Wilson and Paul Scurrah join as independent non-executive directors in July 2025.

- Get an in-depth perspective on Web Travel Group's performance by reading our balance sheet health report here.

- Gain insights into Web Travel Group's future direction by reviewing our growth report.

Turning Ideas Into Actions

- Take a closer look at our ASX Penny Stocks list of 468 companies by clicking here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Web Travel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WEB

Web Travel Group

Provides online travel booking services in Australia, the United Arab Emirates, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives