- Australia

- /

- Hospitality

- /

- ASX:GYG

ASX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

The Australian market has shown resilience with the ASX200 edging up by 0.31%, driven by robust performances in sectors like Health Care and Financials, even as Information Technology faced challenges. In this context of sectoral shifts, growth companies with high insider ownership can be particularly appealing as they often reflect strong internal confidence and alignment of interests, potentially offering stability amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Genmin (ASX:GEN) | 12.3% | 117.7% |

| Catalyst Metals (ASX:CYL) | 14.8% | 42.9% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 66.6% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Pointerra (ASX:3DP) | 20.1% | 126.4% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's uncover some gems from our specialized screener.

Catalyst Metals (ASX:CYL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Catalyst Metals Limited is an Australian company focused on exploring and evaluating mineral properties, with a market cap of A$797.72 million.

Operations: The company's revenue segments include A$75.08 million from Tasmania and A$243.77 million from Western Australia.

Insider Ownership: 14.8%

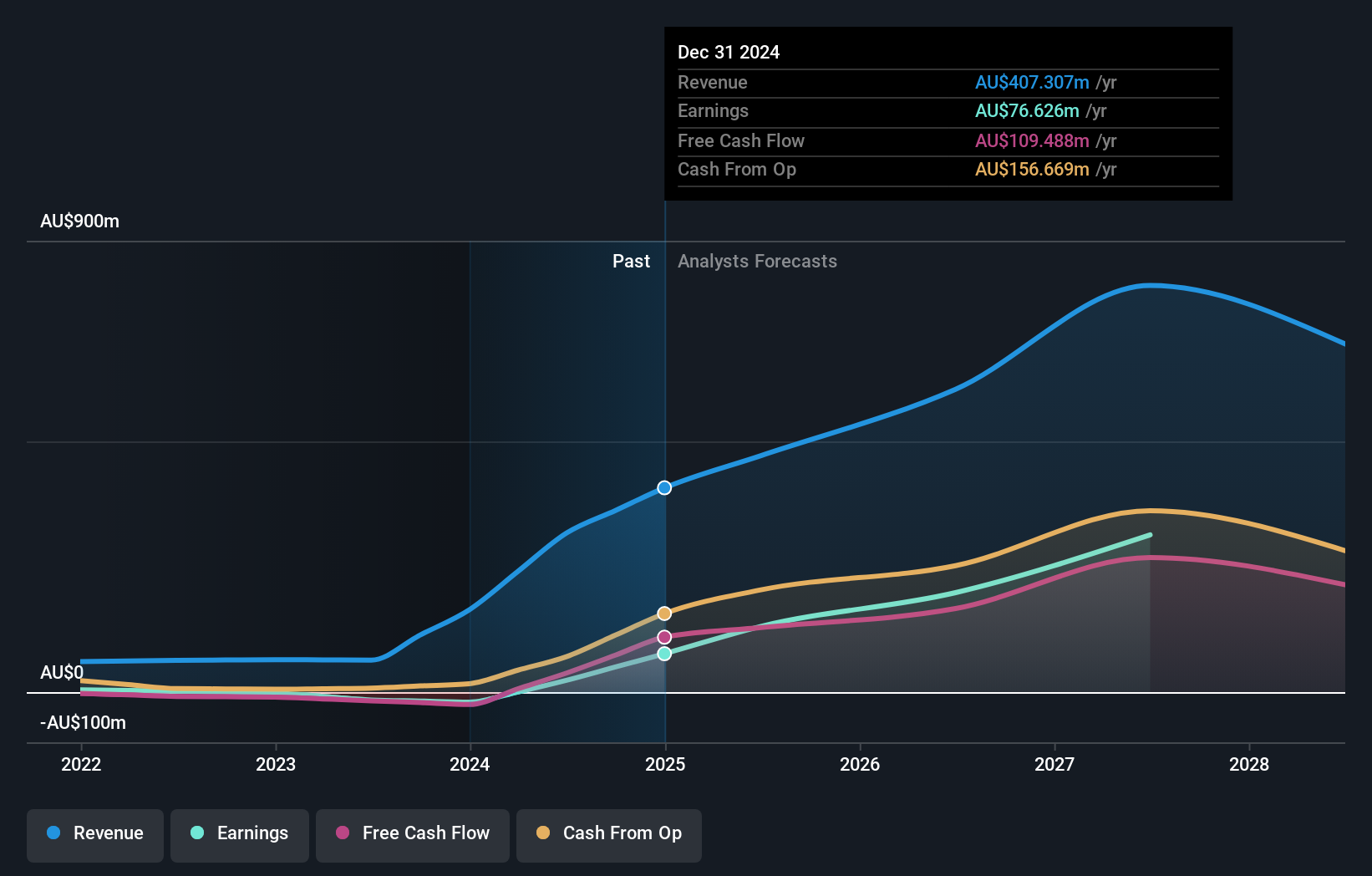

Catalyst Metals has demonstrated significant growth potential, with earnings forecasted to increase by 42.86% annually over the next three years, outpacing the Australian market's average. The company's revenue is also expected to grow at 21.2% per year, surpassing market expectations. Despite past shareholder dilution, Catalyst's recent profitability and inclusion in the S&P/ASX Emerging Companies Index highlight its evolving position in the mining sector. Recent production guidance indicates robust gold output between 105koz and 120koz for FY2025.

- Click to explore a detailed breakdown of our findings in Catalyst Metals' earnings growth report.

- Our comprehensive valuation report raises the possibility that Catalyst Metals is priced lower than what may be justified by its financials.

Emerald Resources (ASX:EMR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Emerald Resources NL focuses on the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.88 billion.

Operations: The company generates revenue primarily from its mine operations, amounting to A$366.04 million.

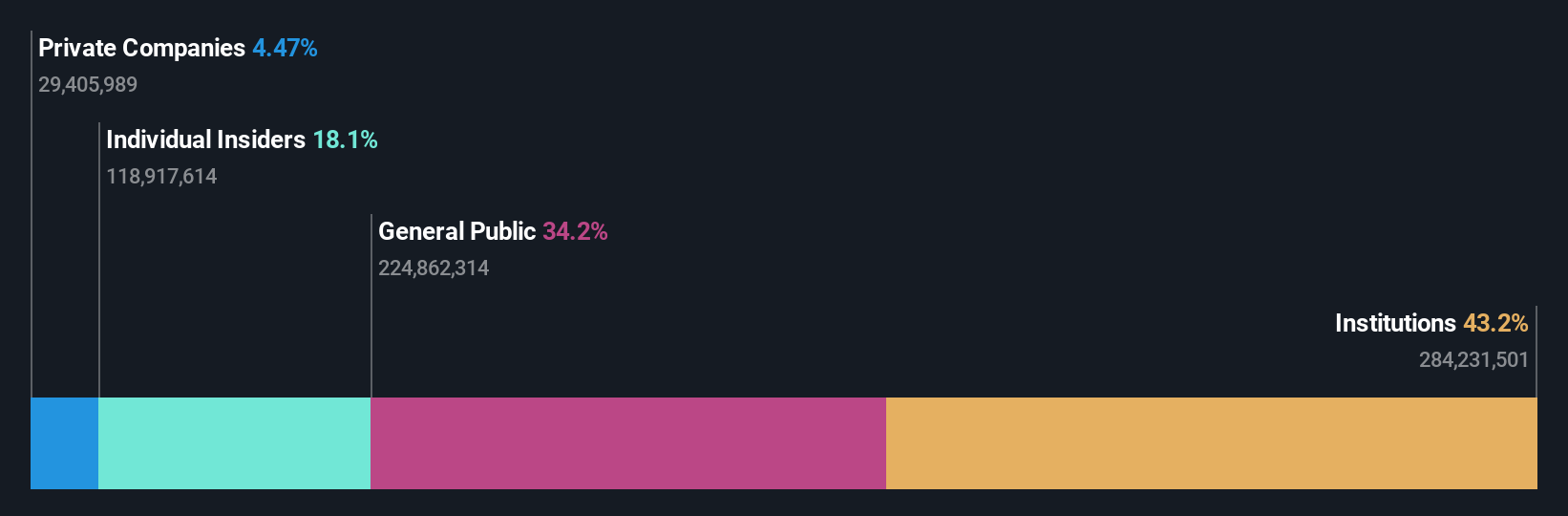

Insider Ownership: 18%

Emerald Resources is positioned for substantial growth, with revenue and earnings expected to grow significantly faster than the Australian market. Despite past shareholder dilution, the company trades well below its estimated fair value. Recent earnings showed improved sales of A$371.07 million and net income of A$84.27 million. Although no recent insider trading activity is noted, potential M&A interest in its assets could impact future developments. Simon Lee's upcoming retirement marks a leadership transition after significant contributions to Emerald's growth trajectory.

- Click here to discover the nuances of Emerald Resources with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Emerald Resources is priced higher than what may be justified by its financials.

Guzman y Gomez (ASX:GYG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guzman y Gomez Limited owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States with a market cap of A$3.96 billion.

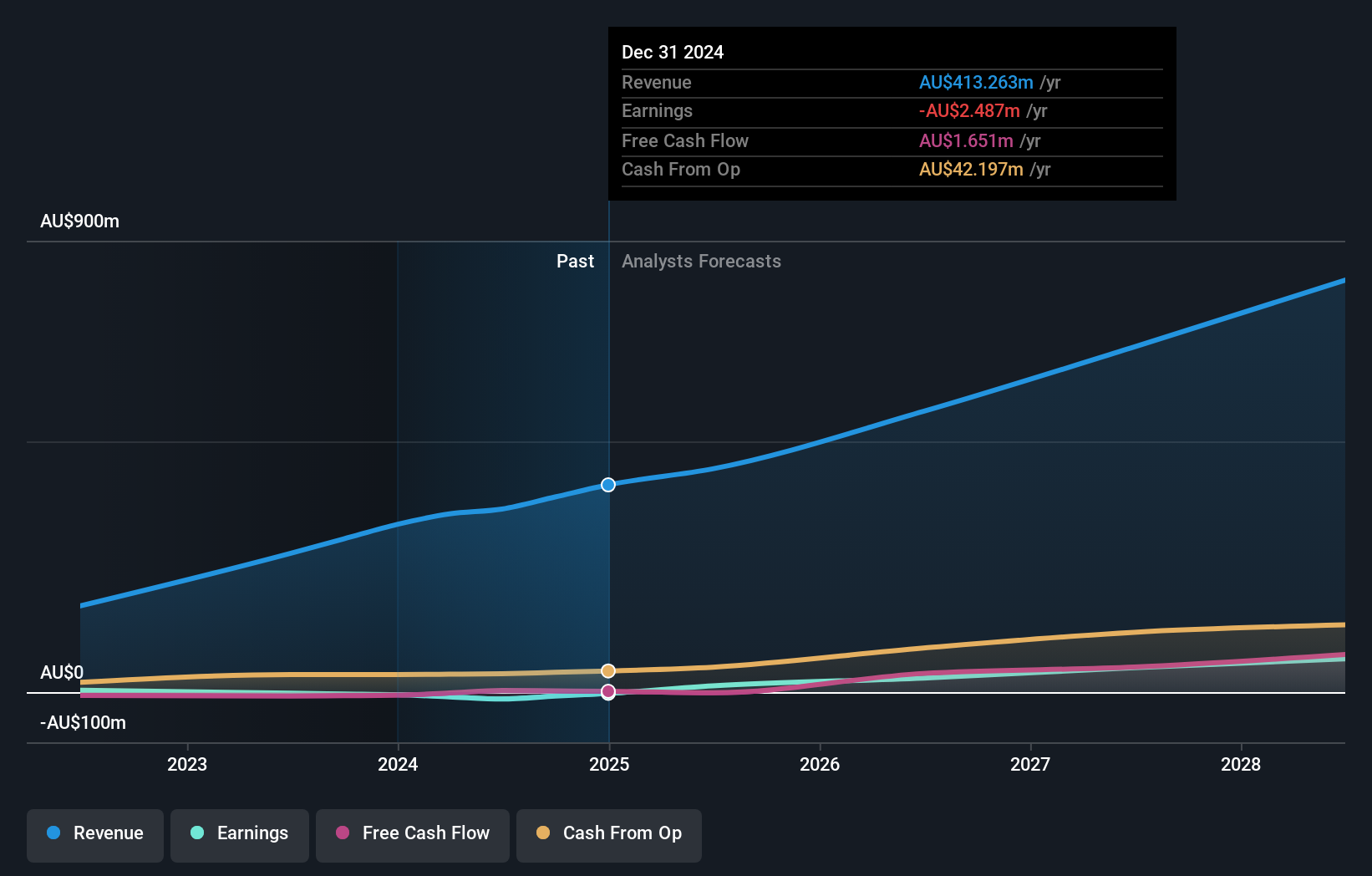

Operations: The company's revenue primarily comes from its quick service restaurant operations, generating A$364.99 million.

Insider Ownership: 13%

Guzman y Gomez is experiencing robust growth, with revenue increasing by A$83.17 million to A$342.21 million in the last year, despite a net loss of A$13.75 million. Forecasts suggest revenue will grow at 17.8% annually, outpacing the Australian market average but below 20%. The company recently joined several S&P/ASX indices, reflecting its growing market presence. While profitability is expected within three years, no recent insider trading activity has been reported.

- Unlock comprehensive insights into our analysis of Guzman y Gomez stock in this growth report.

- In light of our recent valuation report, it seems possible that Guzman y Gomez is trading beyond its estimated value.

Turning Ideas Into Actions

- Get an in-depth perspective on all 96 Fast Growing ASX Companies With High Insider Ownership by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GYG

Guzman y Gomez

Owns, operates, and franchises quick service restaurants in Australia, Singapore, Japan, and the United States.

Flawless balance sheet with reasonable growth potential.