- Australia

- /

- Metals and Mining

- /

- ASX:ELV

Does Elevra Lithium’s (ASX:ELV) Employee Share Plan Reveal Shifting Confidence in Resource Sector Momentum?

Reviewed by Sasha Jovanovic

- Elevra Lithium Limited recently filed a shelf registration for A$8.40 million, covering 3,500,000 ordinary shares as part of an Employee Share Ownership Plan related offering.

- This move comes as investor interest in lithium stocks revives, partly fueled by sector-wide optimism in the broader resources market.

- We'll now explore how broad sector rotation into resources and rising lithium sentiment shapes Elevra Lithium’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Elevra Lithium's Investment Narrative?

To get behind Elevra Lithium as a shareholder right now, you need to have confidence in the ongoing sector rotation into resources, especially as sentiment for lithium stocks improves. The company’s recent shelf registration, offering A$8.4 million in ordinary shares through its Employee Share Ownership Plan, should not materially change the most important short-term catalysts, namely, broader demand trends for lithium and ongoing capital requirements driven by consistent operating losses. While this event reflects efforts to align employee and shareholder interests amid a resurging resources market, its near-term impact on Elevra’s earnings turnaround or path to profitability appears limited, given persistent losses and recent dilution from other capital raisings. Instead, the key immediate risks remain unprofitable operations, recent management changes, and a volatile share price, especially if sector optimism were to reverse just as the company seeks to execute on growth ambitions and new project developments. Yet, seasoned investors will want to weigh the impact of management turnover alongside their optimism.

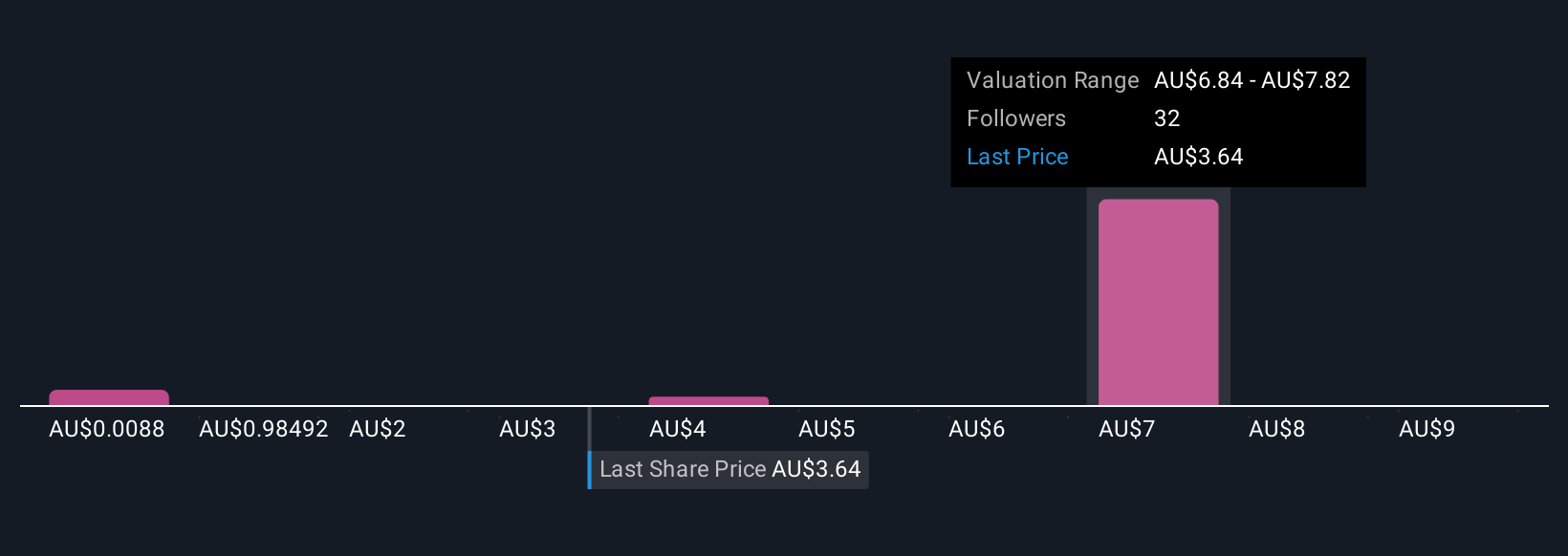

The valuation report we've compiled suggests that Elevra Lithium's current price could be quite moderate.Exploring Other Perspectives

Explore 11 other fair value estimates on Elevra Lithium - why the stock might be worth less than half the current price!

Build Your Own Elevra Lithium Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elevra Lithium research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Elevra Lithium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elevra Lithium's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elevra Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ELV

Elevra Lithium

Engages in the identification, acquisition, exploration, and development of mineral assets in Australia and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.