- Australia

- /

- Medical Equipment

- /

- ASX:NAN

Aussie Broadband And 2 Other Promising Penny Stocks On The ASX

Reviewed by Simply Wall St

As the ASX 200 faces a dip into the red, driven by global market hesitations and local economic concerns, investors are keenly watching for opportunities amidst the volatility. Penny stocks, often seen as a nod to past trading eras, continue to offer intriguing possibilities for those seeking growth potential at lower price points. These stocks can be particularly appealing when they combine solid financials with the potential for significant returns, making them worth considering in today's fluctuating market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.58 | A$67.99M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$235.47M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.52 | A$322.48M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.75 | A$96.8M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.62 | A$793.93M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$1.97 | A$110.79M | ★★★★★★ |

| West African Resources (ASX:WAF) | A$1.63 | A$1.86B | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.97 | A$490.37M | ★★★★☆☆ |

Click here to see the full list of 1,047 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Aussie Broadband (ASX:ABB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aussie Broadband Limited offers telecommunications and technology services in Australia with a market capitalization of A$1.12 billion.

Operations: The company generates revenue through several segments, including Residential (A$585.07 million), Wholesale (A$159.73 million), Business (A$96.97 million), Enterprise and Government (A$88.04 million), and Symbio Group (A$69.93 million).

Market Cap: A$1.12B

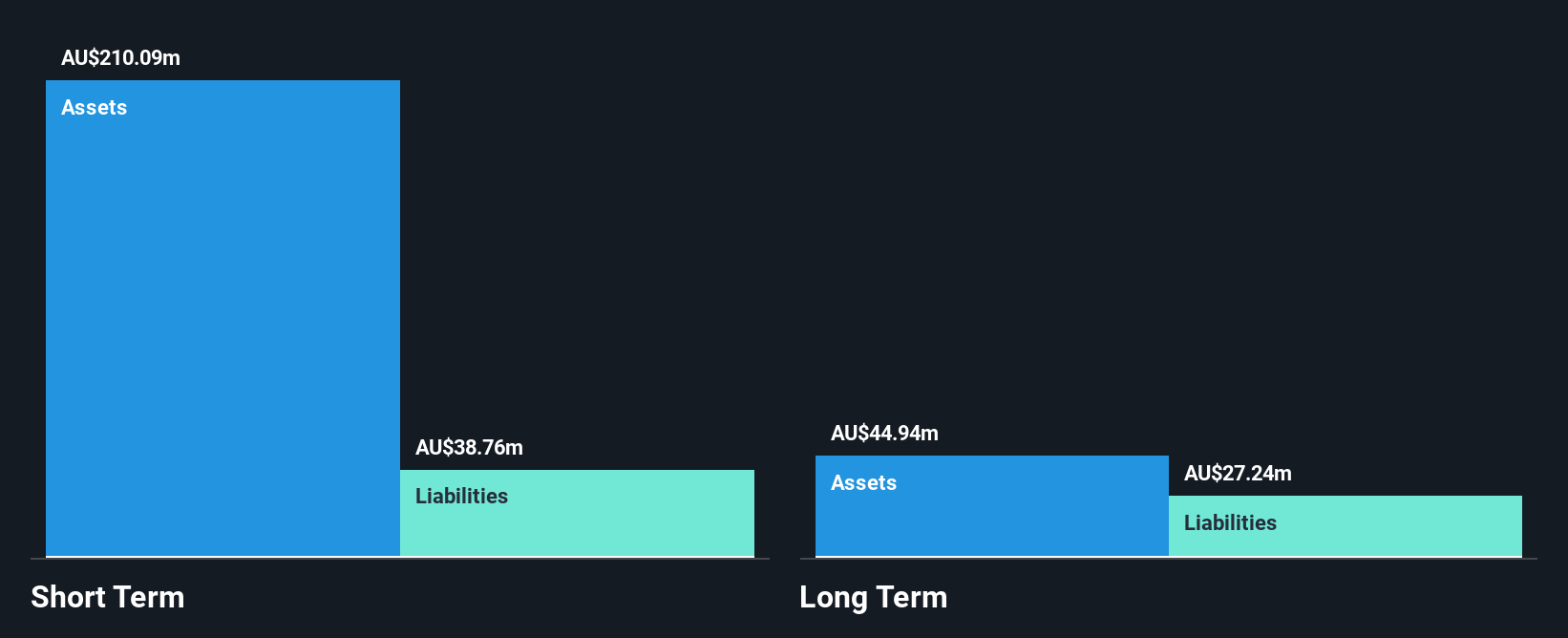

Aussie Broadband, with a market cap of A$1.12 billion, has shown significant growth in earnings over the past five years but experienced slower growth last year at 21.5%. The company maintains a satisfactory net debt to equity ratio of 14.6% and has well-covered interest payments by EBIT. Despite recent shareholder dilution and insider selling, Aussie Broadband's short-term assets exceed its liabilities, indicating financial stability. A share buyback program aims to optimize capital structure and enhance shareholder value while supporting future growth opportunities. However, management's lack of experience may pose challenges in executing strategic initiatives effectively.

- Click here to discover the nuances of Aussie Broadband with our detailed analytical financial health report.

- Assess Aussie Broadband's future earnings estimates with our detailed growth reports.

EcoGraf (ASX:EGR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoGraf Limited focuses on the exploration and production of graphite products for the lithium-ion battery and advanced manufacturing markets in Tanzania and Australia, with a market cap of A$45.40 million.

Operations: The company generates revenue from its operations in Australia, amounting to A$3.49 million.

Market Cap: A$45.4M

EcoGraf Limited, with a market cap of A$45.40 million, is focused on graphite production for battery markets in Tanzania and Australia. Despite being pre-revenue, the company reported A$3.49 million in revenue last year but remains unprofitable with increasing losses over the past five years at 18.4% annually. EcoGraf is debt-free and has sufficient cash runway for more than a year based on current free cash flow trends, though its management team lacks extensive experience with an average tenure of 1.6 years. Recent earnings showed reduced net loss compared to the previous year, suggesting some operational improvements.

- Dive into the specifics of EcoGraf here with our thorough balance sheet health report.

- Examine EcoGraf's past performance report to understand how it has performed in prior years.

Nanosonics (ASX:NAN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanosonics Limited is a global infection prevention company with a market capitalization of A$1 billion.

Operations: The company generates revenue of A$170.01 million from its healthcare equipment segment.

Market Cap: A$1B

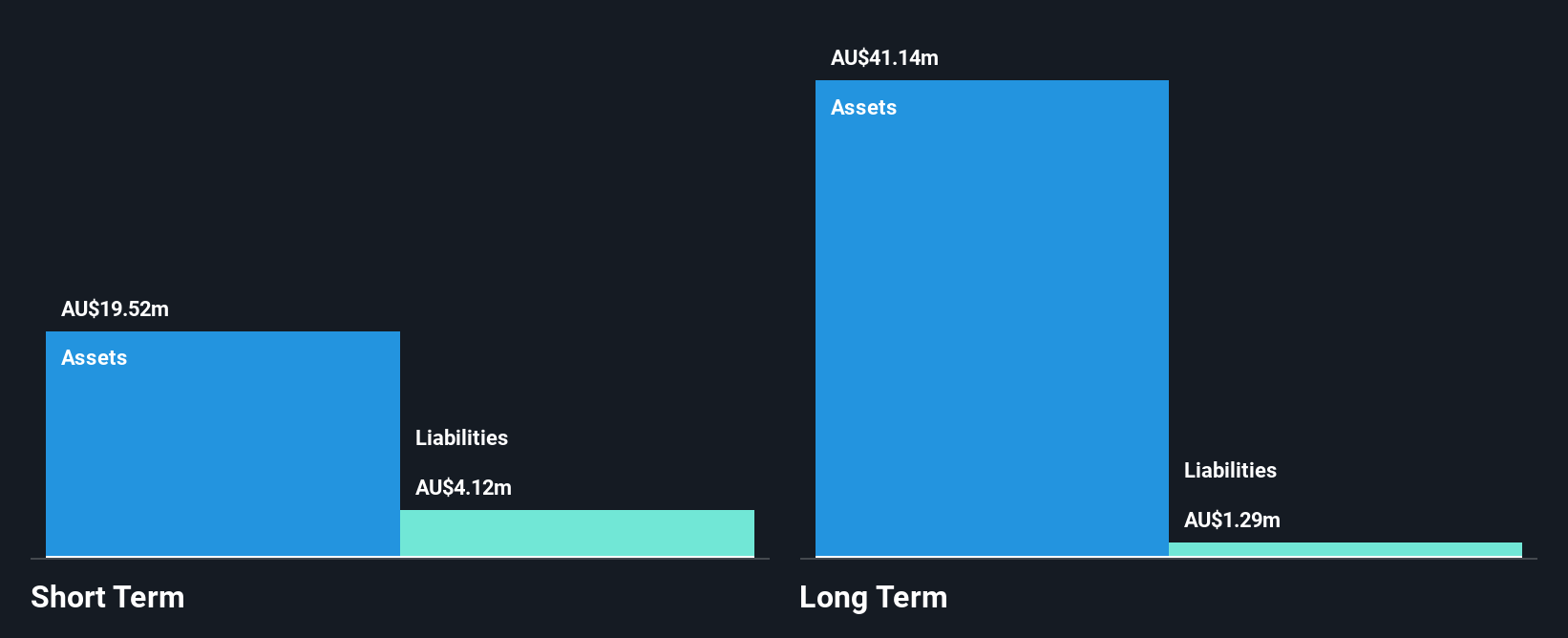

Nanosonics Limited, with a market cap of A$1 billion, generates revenue of A$170.01 million from its healthcare equipment segment. Despite recent negative earnings growth and low return on equity (7.1%), the company remains debt-free and has strong asset coverage over liabilities. The experienced management team and board provide stability amidst executive changes, such as the planned departures of key board members announced recently. While profit margins have decreased to 7.6% from 12% last year, Nanosonics is trading below its estimated fair value, indicating potential for future appreciation if earnings forecasts materialize positively at an expected annual growth rate of 23.96%.

- Click here and access our complete financial health analysis report to understand the dynamics of Nanosonics.

- Gain insights into Nanosonics' future direction by reviewing our growth report.

Summing It All Up

- Explore the 1,047 names from our ASX Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NAN

Flawless balance sheet with reasonable growth potential.