- Australia

- /

- Construction

- /

- ASX:NWH

ASX Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

Australian shares are mirroring U.S. trends, with the ASX 200 futures indicating a potential gain as Wall Street's major indices continue to reach new highs. Amidst this backdrop of market optimism, penny stocks—though an older term—remain relevant for investors seeking opportunities in smaller or emerging companies. By focusing on those with strong financials and growth potential, investors can uncover promising prospects among these often-overlooked stocks.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.37 | A$106.04M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.20 | A$103.78M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.62 | A$118.21M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$445.59M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.26 | A$2.58B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.73 | A$457.43M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.63 | A$884.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.835 | A$147.8M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 462 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

EcoGraf (ASX:EGR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoGraf Limited focuses on the exploration and production of graphite products for lithium-ion battery and advanced manufacturing markets in Tanzania and Australia, with a market cap of A$145.32 million.

Operations: The company's revenue segment includes A$3.94 million from its operations in Australia.

Market Cap: A$145.32M

EcoGraf Limited, with a market cap of A$145.32 million, is a pre-revenue company focusing on graphite products for battery markets. Recent developments include the grant of a second HFfree® purification patent by IP Australia, enhancing its intellectual property portfolio and supporting its environmentally sustainable production strategy in Tanzania. Despite being unprofitable and having declining earnings over the past five years, EcoGraf maintains a strong balance sheet with no debt and sufficient cash runway for over a year. The company's short-term assets significantly exceed liabilities, providing financial stability as it seeks to capitalize on growing global demand for battery materials.

- Get an in-depth perspective on EcoGraf's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into EcoGraf's track record.

Falcon Metals (ASX:FAL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Falcon Metals Limited is involved in the discovery, exploration, and development of mineral deposits in Australia with a market cap of A$66.38 million.

Operations: Falcon Metals Limited does not report any revenue segments.

Market Cap: A$66.38M

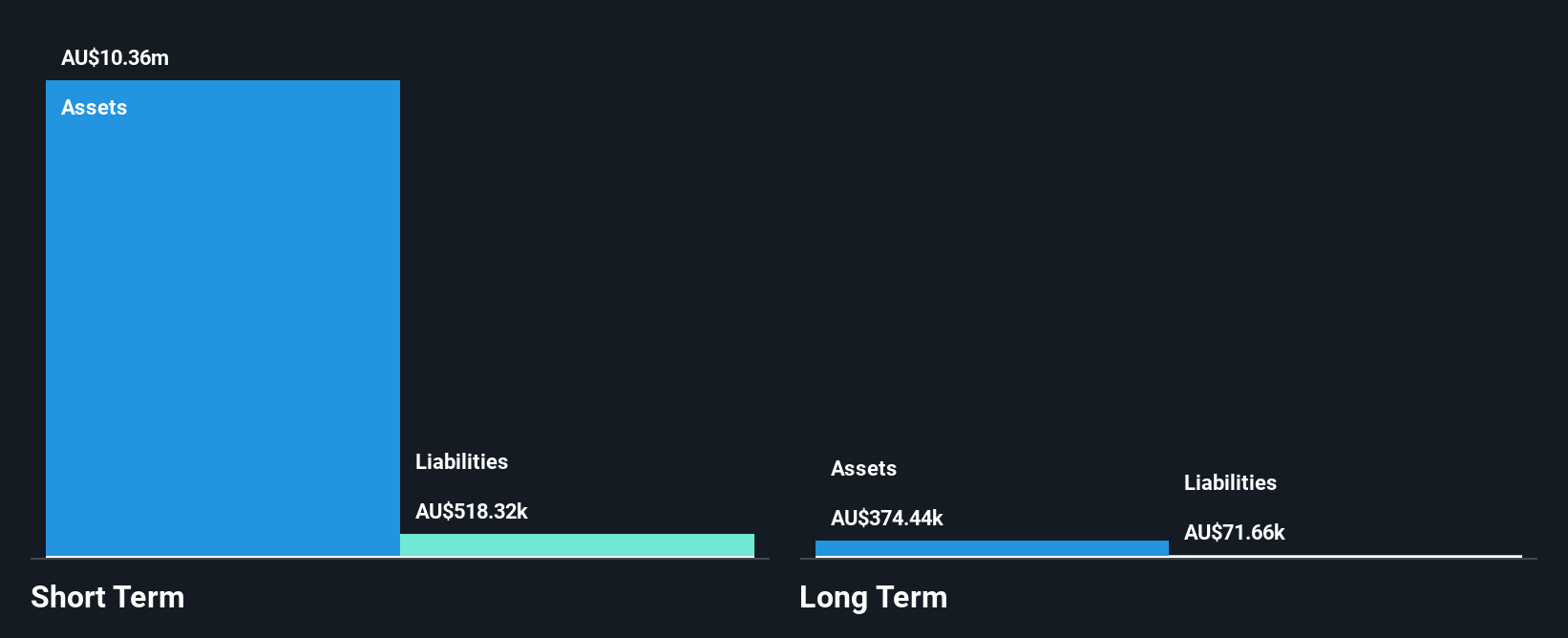

Falcon Metals Limited, with a market cap of A$66.38 million, is a pre-revenue company focused on mineral exploration in Australia. The company has no debt and maintains sufficient short-term assets (A$10.4M) to cover both its short-term (A$518.3K) and long-term liabilities (A$71.7K). Despite being unprofitable with negative return on equity (-57.88%), Falcon's experienced management team and board provide stability as it navigates high volatility, which has increased from 20% to 33% over the past year. The firm holds enough cash runway for approximately 1.8 years if current cash flow trends persist without significant dilution to shareholders recently observed.

- Dive into the specifics of Falcon Metals here with our thorough balance sheet health report.

- Evaluate Falcon Metals' historical performance by accessing our past performance report.

NRW Holdings (ASX:NWH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NRW Holdings Limited offers diversified contract services to Australia's resources and infrastructure sectors and has a market cap of A$1.41 billion.

Operations: The company's revenue is primarily derived from its Mining segment at A$1.56 billion, followed by MET at A$853.22 million and Civil at A$776.06 million.

Market Cap: A$1.41B

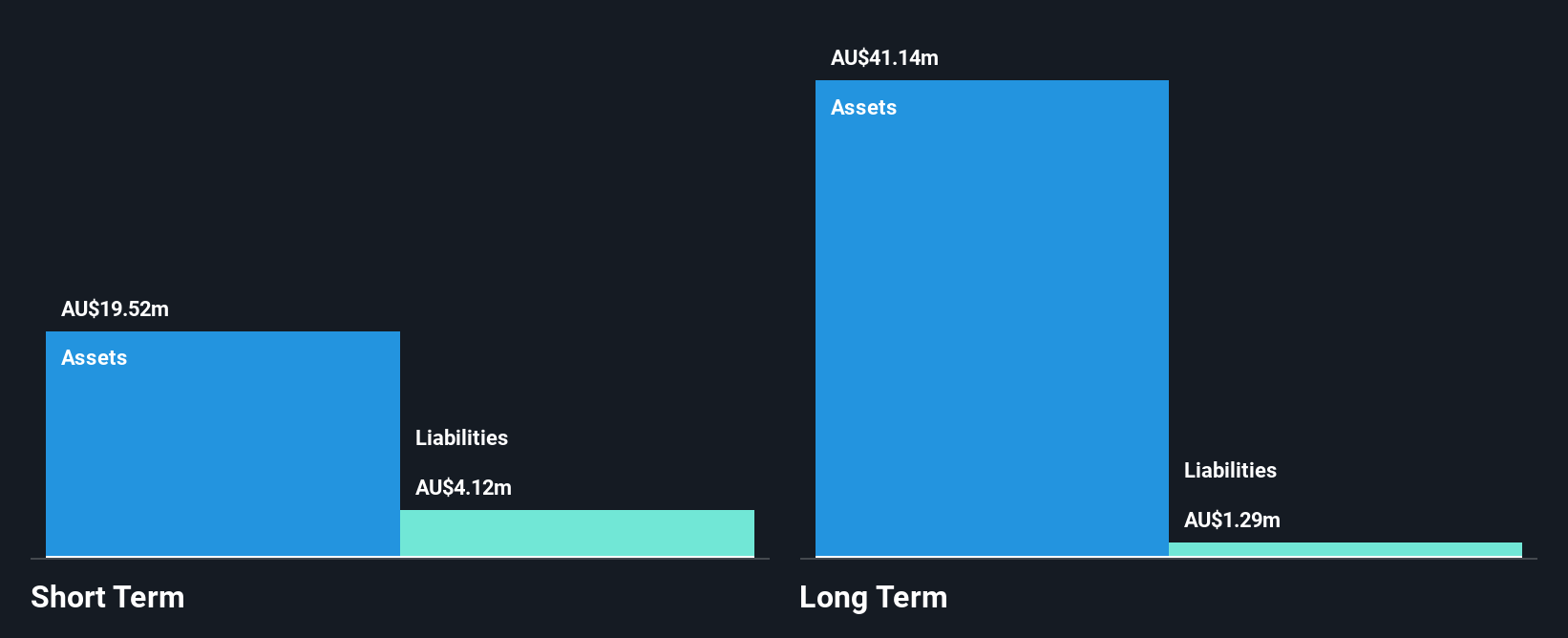

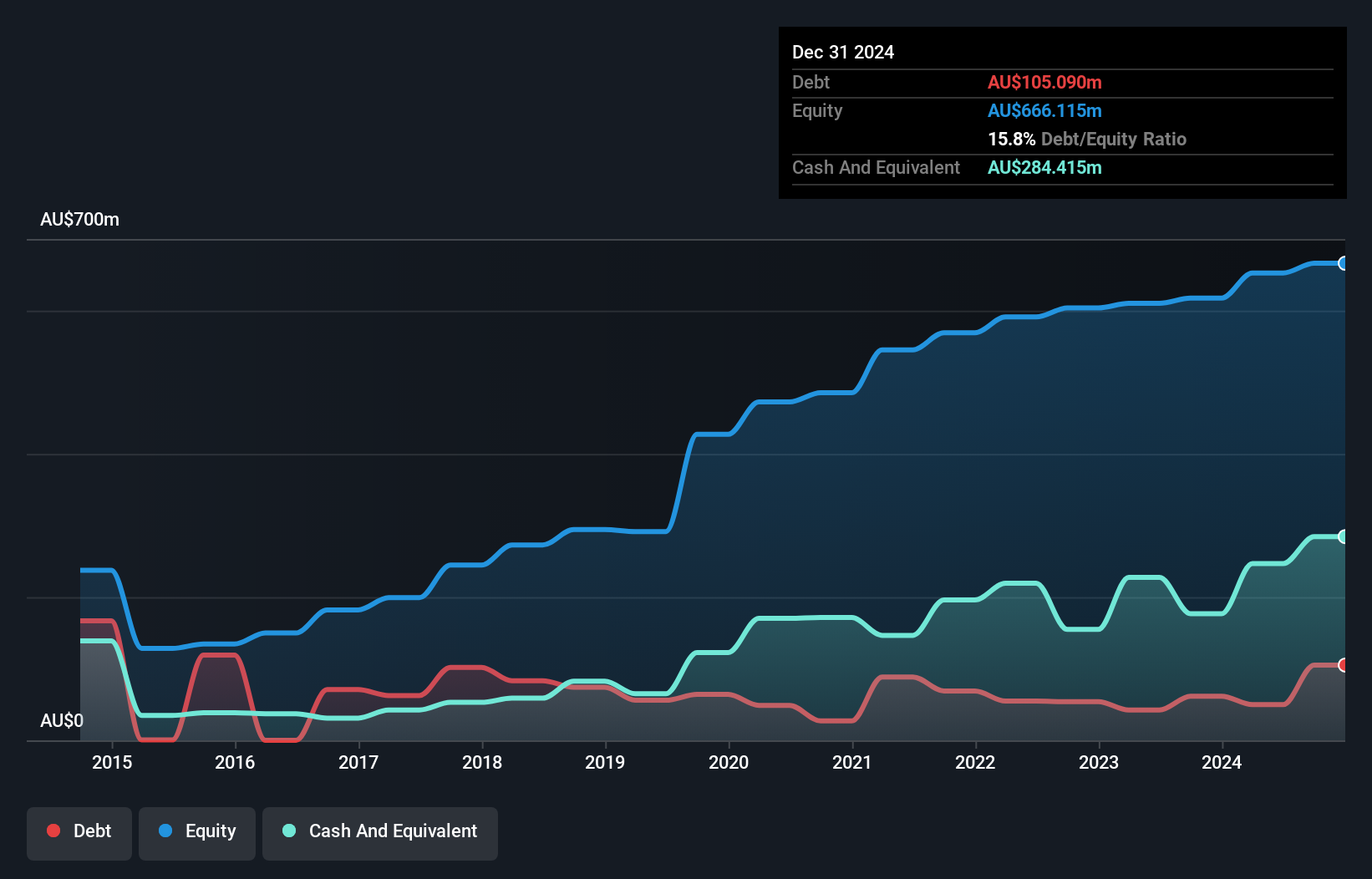

NRW Holdings, with a market cap of A$1.41 billion, demonstrates financial strength through its diversified revenue streams and solid asset coverage. The company generates substantial income from its Mining (A$1.56 billion), MET (A$853.22 million), and Civil segments (A$776.06 million). Its short-term assets exceed both short- and long-term liabilities, indicating sound liquidity management. Earnings growth has accelerated recently, outpacing industry averages with stable profit margins and high-quality earnings reported over the past year. Despite a low return on equity at 17.3%, NRW's debt is well-covered by operating cash flow, suggesting prudent financial control amidst an unstable dividend track record.

- Take a closer look at NRW Holdings' potential here in our financial health report.

- Learn about NRW Holdings' future growth trajectory here.

Turning Ideas Into Actions

- Investigate our full lineup of 462 ASX Penny Stocks right here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NRW Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NWH

NRW Holdings

Through its subsidiaries, provides diversified contract services to the resources and infrastructure sectors in Australia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success