- Australia

- /

- Metals and Mining

- /

- ASX:CYL

Catalyst Metals Limited's (ASX:CYL) Shares Leap 65% Yet They're Still Not Telling The Full Story

Despite an already strong run, Catalyst Metals Limited (ASX:CYL) shares have been powering on, with a gain of 65% in the last thirty days. The annual gain comes to 164% following the latest surge, making investors sit up and take notice.

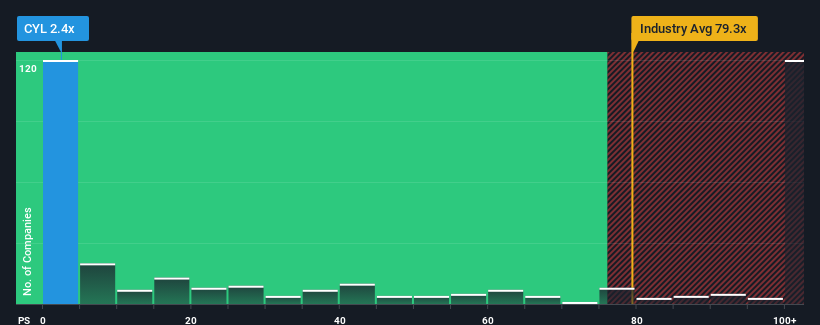

In spite of the firm bounce in price, Catalyst Metals' price-to-sales (or "P/S") ratio of 2.4x might still make it look like a strong buy right now compared to the wider Metals and Mining industry in Australia, where around half of the companies have P/S ratios above 79.3x and even P/S above 485x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Catalyst Metals

How Has Catalyst Metals Performed Recently?

Catalyst Metals could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Catalyst Metals' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Catalyst Metals' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 154% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 142% over the next year. That's shaping up to be materially higher than the 42% growth forecast for the broader industry.

In light of this, it's peculiar that Catalyst Metals' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Catalyst Metals' P/S

Even after such a strong price move, Catalyst Metals' P/S still trails the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Catalyst Metals' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Catalyst Metals that you should be aware of.

If you're unsure about the strength of Catalyst Metals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CYL

Catalyst Metals

Engages in the mineral exploration and evaluation in Australia.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success