- Australia

- /

- Consumer Durables

- /

- ASX:SHM

Caravel Minerals Leads Our ASX Penny Stock Spotlight With Two More Picks

Reviewed by Simply Wall St

As the Australian market faces a potential dip, influenced by global tech earnings and cautious investor sentiment, attention turns to opportunities within the local landscape. Penny stocks, despite their somewhat antiquated name, remain a relevant area of interest for investors seeking value in smaller or newer companies. These stocks can offer significant potential when underpinned by strong financials; we explore three such examples that stand out for their stability and growth prospects amidst current market dynamics.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.03M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.61 | A$72.09M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.895 | A$104.82M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.805 | A$281.08M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$322.48M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.72 | A$828.23M | ★★★★★☆ |

| Joyce (ASX:JYC) | A$4.35 | A$124.48M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.14 | A$63.17M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.175 | A$1.08B | ★★★★★★ |

| SRG Global (ASX:SRG) | A$1.12 | A$682.42M | ★★★★★★ |

Click here to see the full list of 1,033 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Caravel Minerals (ASX:CVV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caravel Minerals Limited, with a market cap of A$81.26 million, explores for mineral tenements through its subsidiaries.

Operations: Caravel Minerals Limited does not report specific revenue segments.

Market Cap: A$81.26M

Caravel Minerals Limited, with a market cap of A$81.26 million, is currently pre-revenue and unprofitable, facing increased losses over the past five years. Despite this, the company has a seasoned management team and board of directors with an average tenure exceeding five years. Caravel recently raised A$5 million through a follow-on equity offering to bolster its financial position. The company reported a reduced net loss for the year ended June 30, 2024, at A$6.41 million compared to A$11.07 million previously. Caravel's short-term assets significantly exceed its liabilities, providing some financial stability amid high volatility in stock performance.

- Navigate through the intricacies of Caravel Minerals with our comprehensive balance sheet health report here.

- Assess Caravel Minerals' future earnings estimates with our detailed growth reports.

Magnetic Resources (ASX:MAU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Magnetic Resources NL is involved in the exploration of mineral tenements in Western Australia and has a market capitalization of A$333.43 million.

Operations: The company generates its revenue from mineral exploration activities amounting to A$0.50 million.

Market Cap: A$333.43M

Magnetic Resources NL, with a market cap of A$333.43 million, is pre-revenue and unprofitable, having reported a net loss of A$12.34 million for the year ended June 30, 2024. The company recently completed a follow-on equity offering raising A$10 million to extend its cash runway beyond the current five-month forecast based on free cash flow estimates. Despite shareholder dilution over the past year, Magnetic remains debt-free with short-term assets of A$9.6 million surpassing liabilities significantly. The board's average tenure is 6.7 years, indicating experienced governance amidst stable weekly stock volatility at 6%.

- Click here and access our complete financial health analysis report to understand the dynamics of Magnetic Resources.

- Gain insights into Magnetic Resources' past trends and performance with our report on the company's historical track record.

Shriro Holdings (ASX:SHM)

Simply Wall St Financial Health Rating: ★★★★★★

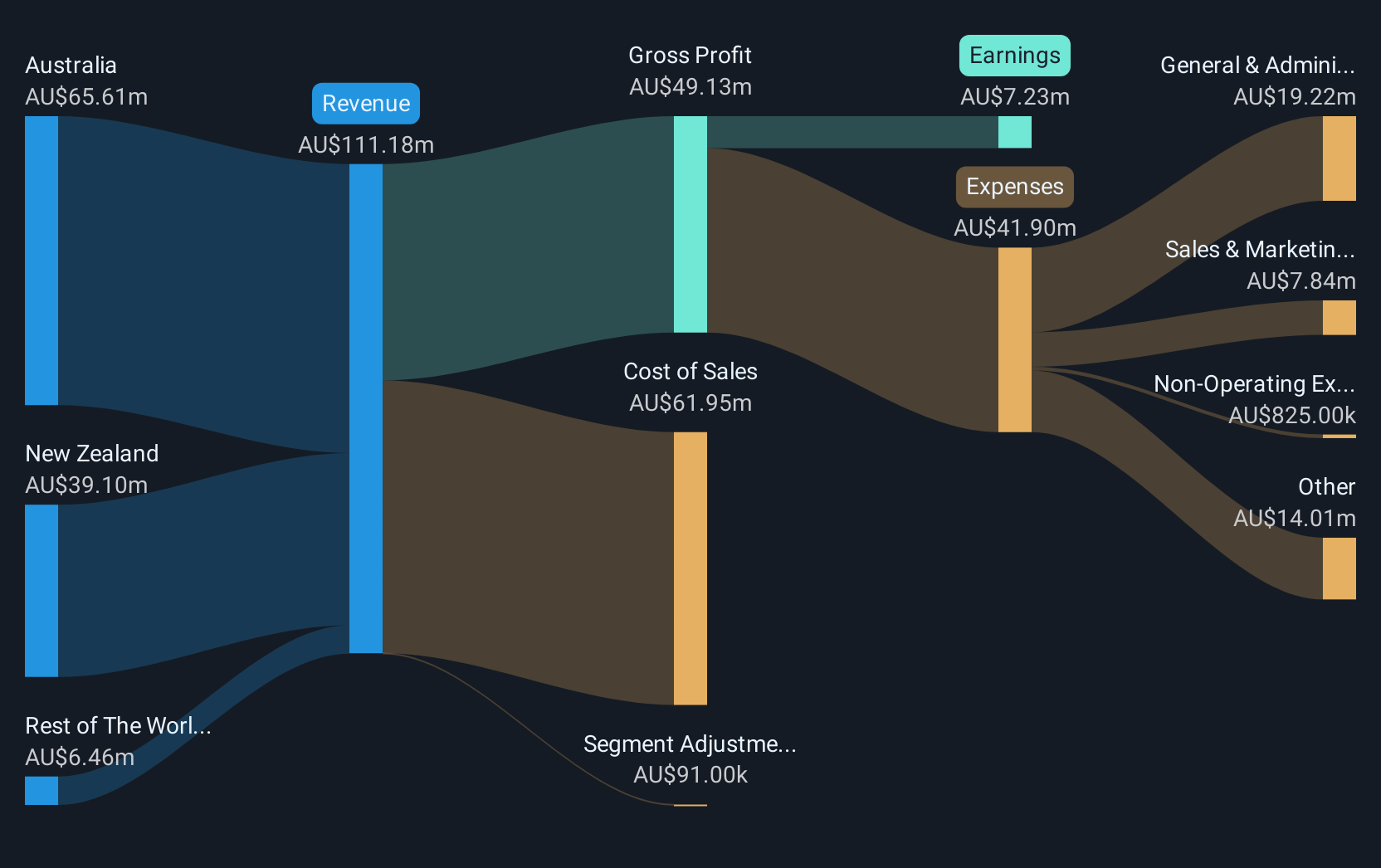

Overview: Shriro Holdings Limited manufactures, markets, and distributes consumer products in Australia, New Zealand, and internationally with a market cap of A$74.72 million.

Operations: The company's revenue is derived from Australia (A$71.48 million), New Zealand (A$40.05 million), and the Rest of the World (A$7.97 million).

Market Cap: A$74.72M

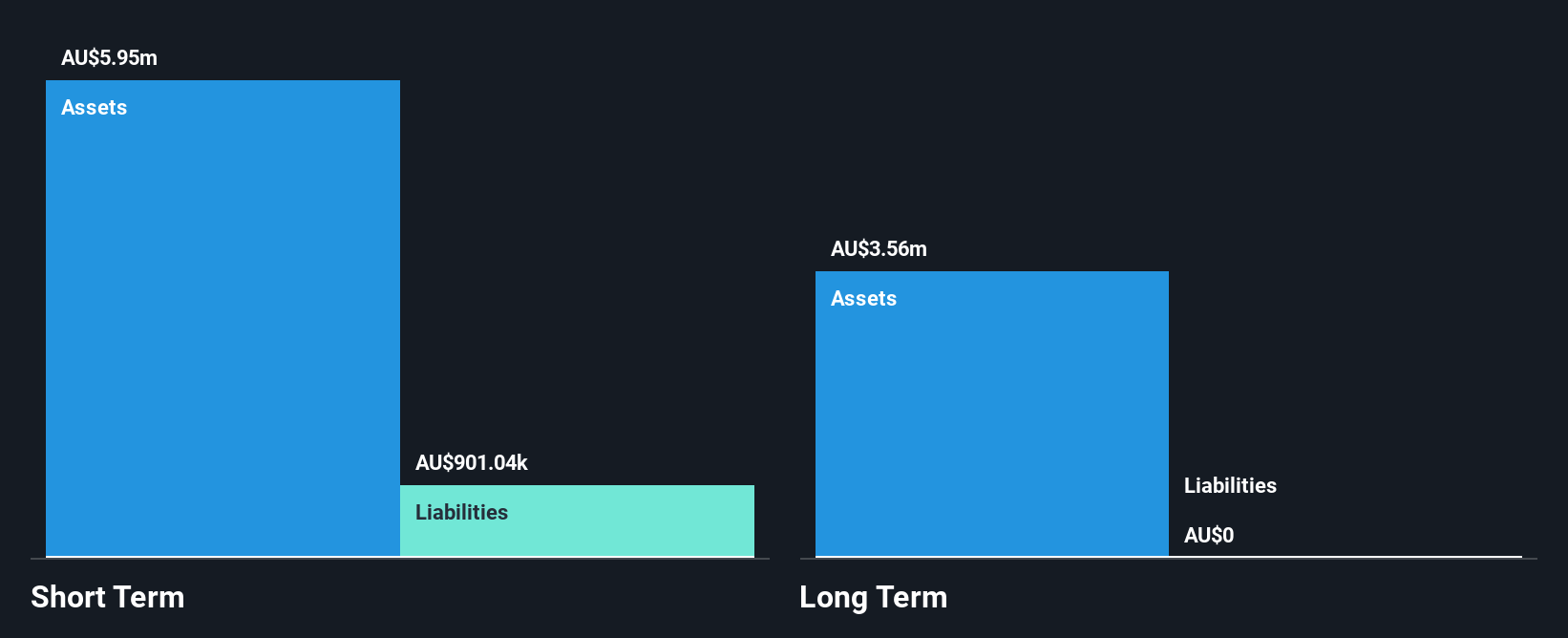

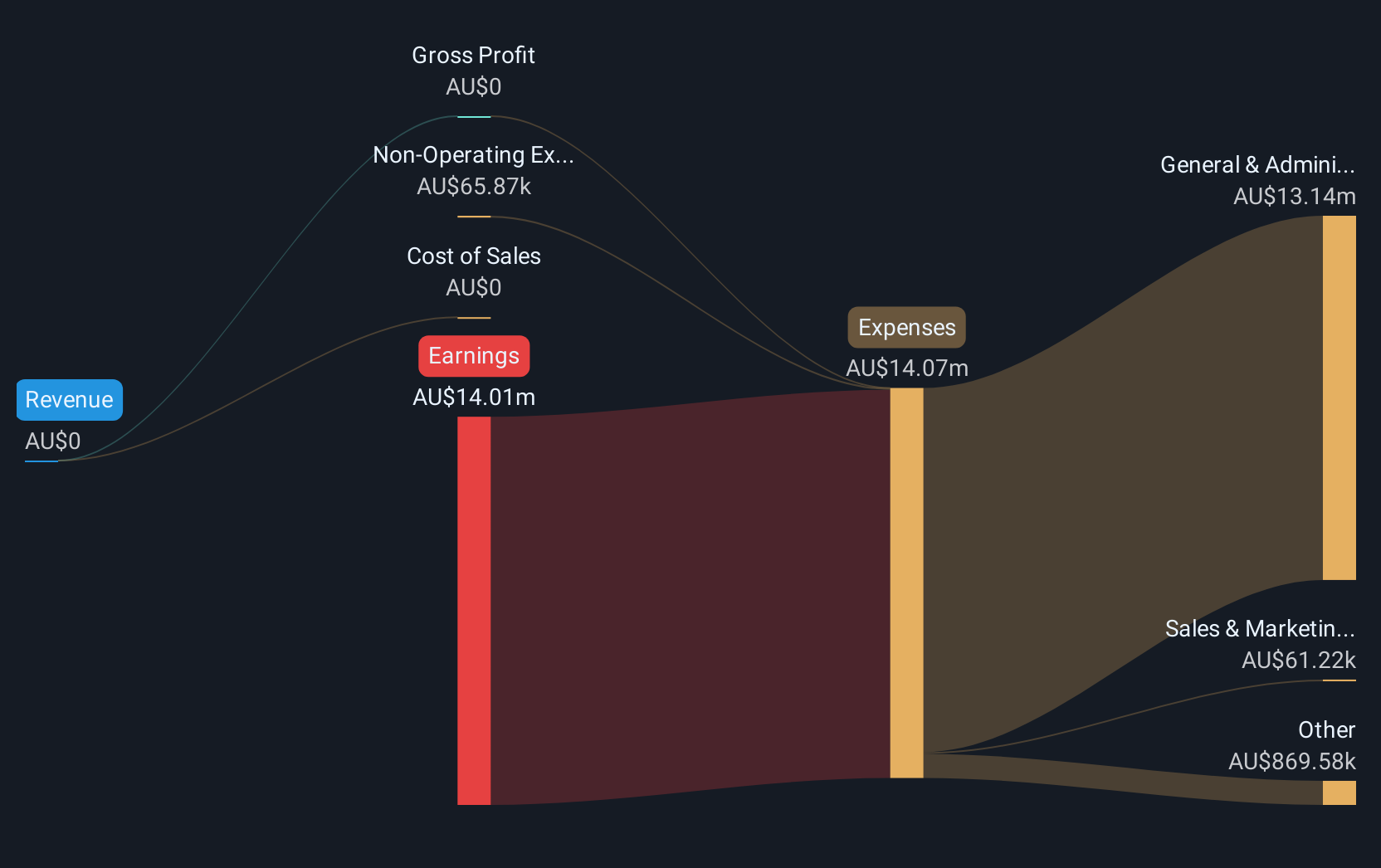

Shriro Holdings, with a market cap of A$74.72 million, operates debt-free and is valued at 80.6% below its estimated fair value, offering potential upside for investors. Despite high-quality earnings and experienced management, the company faces challenges with negative earnings growth of -25.9% over the past year and declining profit margins from 7.9% to 6.1%. Recent results show a drop in sales to A$119.27 million and net income to A$6.91 million compared to the previous year, alongside a reduced dividend of A$0.03 per share for the six-month period ending June 2024.

- Dive into the specifics of Shriro Holdings here with our thorough balance sheet health report.

- Examine Shriro Holdings' past performance report to understand how it has performed in prior years.

Summing It All Up

- Click through to start exploring the rest of the 1,030 ASX Penny Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SHM

Shriro Holdings

Manufactures, markets, and distributes consumer products in Australia, New Zealand, and internationally.

Flawless balance sheet, good value and pays a dividend.