With the Reserve Bank's recent decision to hold interest rates steady and earnings season concluded, Australian shares are experiencing a period of uncertainty, with the ASX 200 attempting to rebound from a six-week low. In this context, penny stocks—though an older term—remain relevant for investors seeking opportunities in smaller or emerging companies that may offer growth potential. By focusing on those with solid financial health and clear growth prospects, investors can uncover promising options within this niche market segment.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.485 | A$139M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.23 | A$105.2M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.895 | A$55.73M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.04 | A$467.22M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.76 | A$277.51M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.17 | A$1.33B | ✅ 4 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.98 | A$275.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.59 | A$2.43B | ✅ 3 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.39 | A$628.01M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Clover (ASX:CLV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Corporation Limited is involved in the production, refining, and sale of natural oils and encapsulated powders across various regions including Australia, New Zealand, Asia, Europe, the Middle East, and the Americas with a market cap of A$116.06 million.

Operations: The company generates revenue of A$86.00 million from its Nutritional Oil and Microencapsulated Powders segment.

Market Cap: A$116.06M

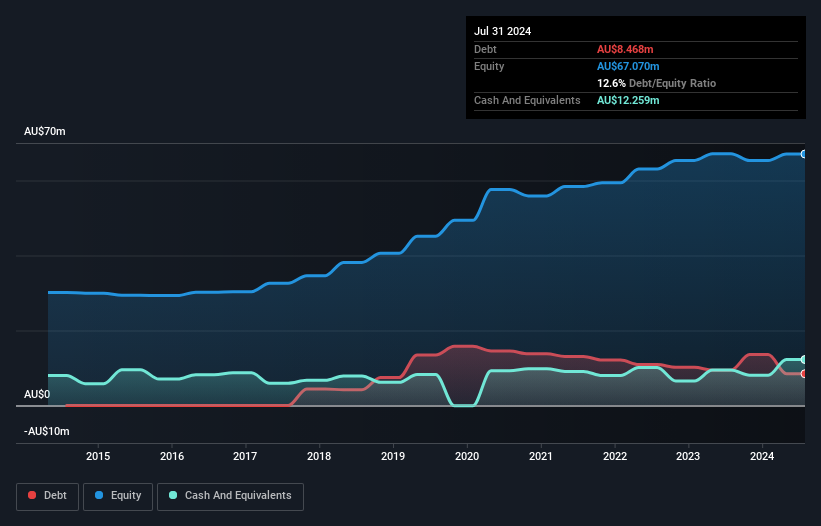

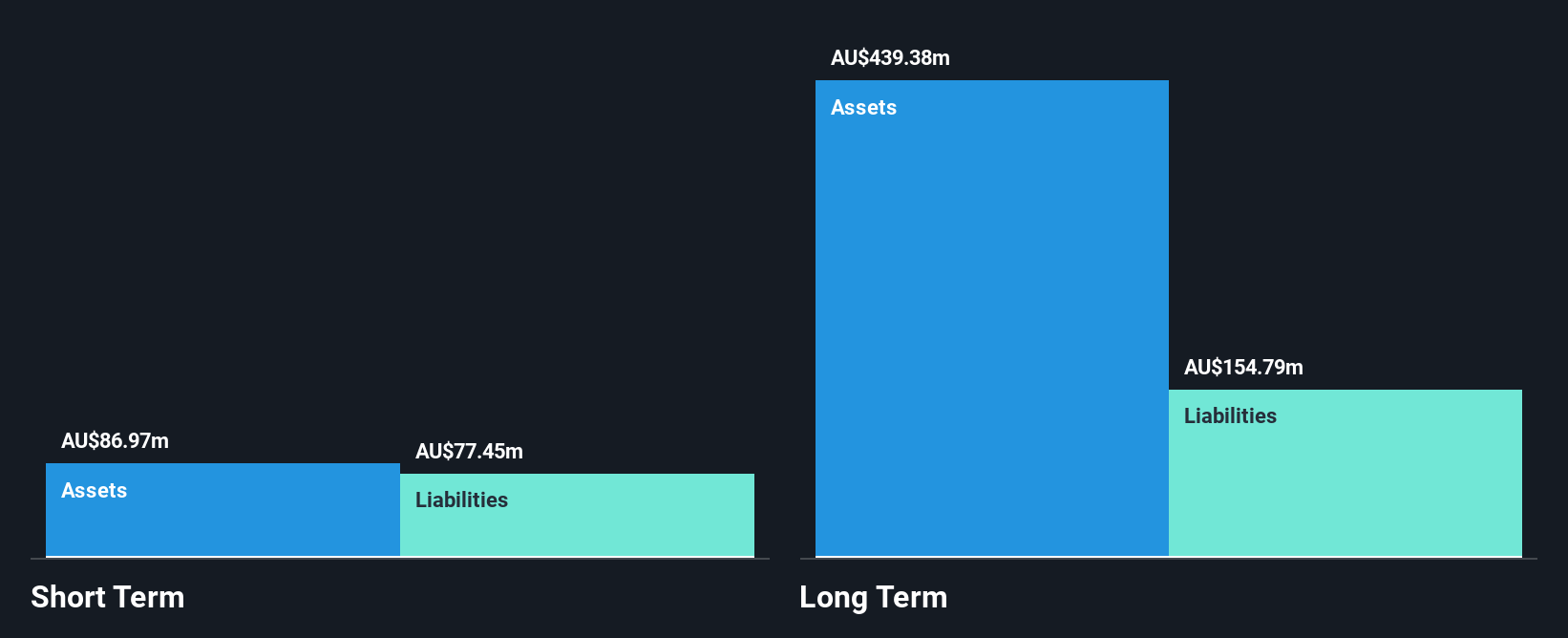

Clover Corporation Limited has demonstrated significant financial improvement, with earnings jumping from A$1.45 million to A$7.02 million in the past year, reflecting a substantial growth rate that outpaces its industry peers. Its debt management is robust, with cash reserves surpassing total debt and short-term assets covering both short and long-term liabilities effectively. The company's net profit margin has improved to 8.2%, and it maintains high-quality earnings without shareholder dilution over the past year. However, despite trading below estimated fair value, Clover's return on equity remains low at 9.7%, and its dividend history is unstable.

- Jump into the full analysis health report here for a deeper understanding of Clover.

- Understand Clover's earnings outlook by examining our growth report.

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of mineral properties with a market capitalization of A$1.11 billion.

Operations: The company's revenue is primarily derived from its Chatree segment, which generated A$336.75 million.

Market Cap: A$1.11B

Kingsgate Consolidated Limited has faced challenges with a significant drop in earnings growth over the past year, contrasting with its previous five-year profitability trend. Despite this, the company maintains high-quality earnings and a satisfactory net debt to equity ratio of 12.5%. Kingsgate's operating cash flow effectively covers its debt obligations, while short-term assets exceed short-term liabilities. However, long-term liabilities remain uncovered by current assets. Recent board changes and inclusion in the S&P/ASX Small Ordinaries Index highlight ongoing corporate developments. The stock trades significantly below estimated fair value but has experienced lower profit margins compared to last year.

- Navigate through the intricacies of Kingsgate Consolidated with our comprehensive balance sheet health report here.

- Evaluate Kingsgate Consolidated's prospects by accessing our earnings growth report.

Straker (ASX:STG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Straker Limited, along with its subsidiaries, offers language services and technology solutions across the Asia Pacific, Europe, the Middle East, Africa, and North America with a market cap of A$30.88 million.

Operations: The company generates NZ$44.86 million from its Business Services segment.

Market Cap: A$30.88M

Straker Limited, with a market cap of A$30.88 million, is navigating the penny stock landscape by leveraging strategic partnerships and technological advancements. Despite being unprofitable, it boasts a positive cash flow and a stable three-year cash runway. Recent collaborations include an expanded partnership with IBM valued at US$28 million over three years, focusing on AI-driven solutions and small language models. Additionally, Straker secured a contract with the EU's Translation Centre worth NZD 1.06 million over four years. Board changes bring seasoned expertise to support its growth trajectory in the competitive language services sector.

- Get an in-depth perspective on Straker's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Straker's future.

Next Steps

- Discover the full array of 416 ASX Penny Stocks right here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CLV

Clover

Engages in the production, refining, and sale of natural oils and encapsulated powders in Australia, New Zealand, Asia, Europe, the Middle East, and the Americas.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion