- Australia

- /

- Metals and Mining

- /

- ASX:BLY

Here's Why Shareholders May Want To Be Cautious With Increasing Boart Longyear Limited's (ASX:BLY) CEO Pay Packet

In the past three years, the share price of Boart Longyear Limited (ASX:BLY) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 25 May 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also influence management through voting on resolutions such as executive remuneration. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Boart Longyear

How Does Total Compensation For Jeff Olsen Compare With Other Companies In The Industry?

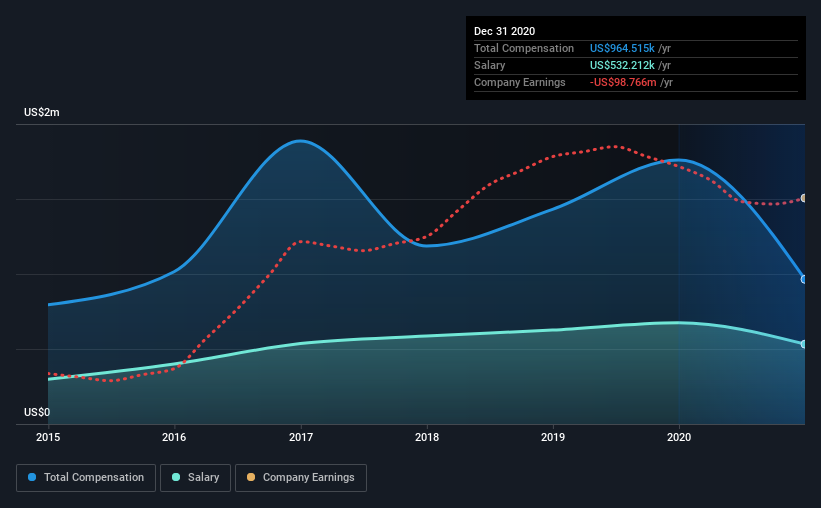

According to our data, Boart Longyear Limited has a market capitalization of AU$42m, and paid its CEO total annual compensation worth US$965k over the year to December 2020. We note that's a decrease of 45% compared to last year. We note that the salary of US$532.2k makes up a sizeable portion of the total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below AU$257m, reported a median total CEO compensation of US$236k. This suggests that Jeff Olsen is paid more than the median for the industry. Furthermore, Jeff Olsen directly owns AU$111k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$532k | US$675k | 55% |

| Other | US$432k | US$1.1m | 45% |

| Total Compensation | US$965k | US$1.8m | 100% |

On an industry level, roughly 69% of total compensation represents salary and 31% is other remuneration. It's interesting to note that Boart Longyear allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Boart Longyear Limited's Growth

Boart Longyear Limited has seen its earnings per share (EPS) increase by 48% a year over the past three years. Its revenue is down 12% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Boart Longyear Limited Been A Good Investment?

Few Boart Longyear Limited shareholders would feel satisfied with the return of -88% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for Boart Longyear you should be aware of, and 1 of them can't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Boart Longyear, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Boart Longyear Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BLY

Boart Longyear Group

Boart Longyear Group Ltd., together with its subsidiaries, provides drilling services, drilling equipment, and performance tooling for mining and mineral drilling companies in North America, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives