The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Brickworks (ASX:BKW), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Our analysis indicates that BKW is potentially undervalued!

How Fast Is Brickworks Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. It is awe-striking that Brickworks' EPS went from AU$1.61 to AU$5.73 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. This could point to the business hitting a point of inflection.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Brickworks shareholders can take confidence from the fact that EBIT margins are up from 2.3% to 4.5%, and revenue is growing. Both of which are great metrics to check off for potential growth.

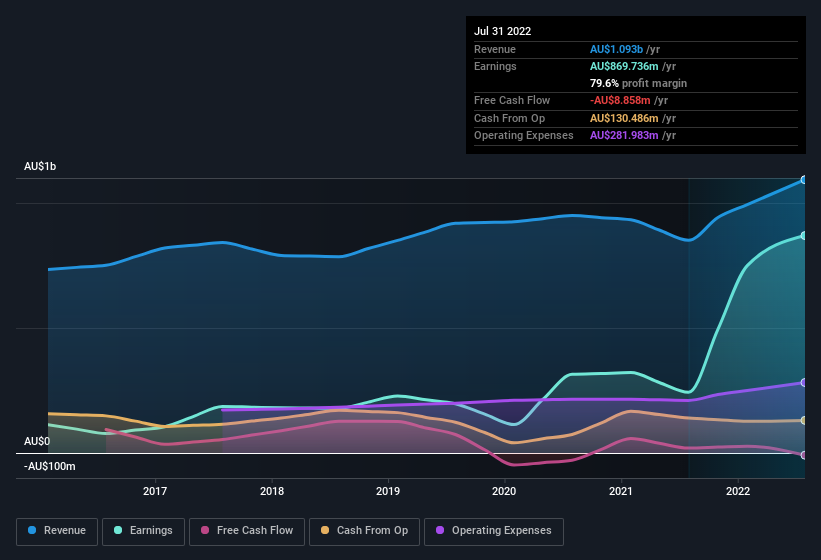

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Brickworks' future EPS 100% free.

Are Brickworks Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Even though some insiders sold down their holdings, their actions speak louder than words with AU$357k more invested than sold by people who know they company best. An optimistic sign for those with Brickworks in their watchlist. We also note that it was the MD & Executive Director, Lindsay Partridge, who made the biggest single acquisition, paying AU$715k for shares at about AU$21.57 each.

On top of the insider buying, it's good to see that Brickworks insiders have a valuable investment in the business. Given insiders own a significant chunk of shares, currently valued at AU$123m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

Is Brickworks Worth Keeping An Eye On?

Brickworks' earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Brickworks belongs near the top of your watchlist. Still, you should learn about the 3 warning signs we've spotted with Brickworks (including 2 which make us uncomfortable).

Keen growth investors love to see insider buying. Thankfully, Brickworks isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Brickworks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BKW

Brickworks

Engages in the manufacture, sale, and distribution of building products for the residential and commercial markets in Australia and North America.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives