- Australia

- /

- Metals and Mining

- /

- ASX:BIS

Here's Why I Think Bisalloy Steel Group (ASX:BIS) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Bisalloy Steel Group (ASX:BIS). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Bisalloy Steel Group

How Quickly Is Bisalloy Steel Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Bisalloy Steel Group has grown EPS by 42% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

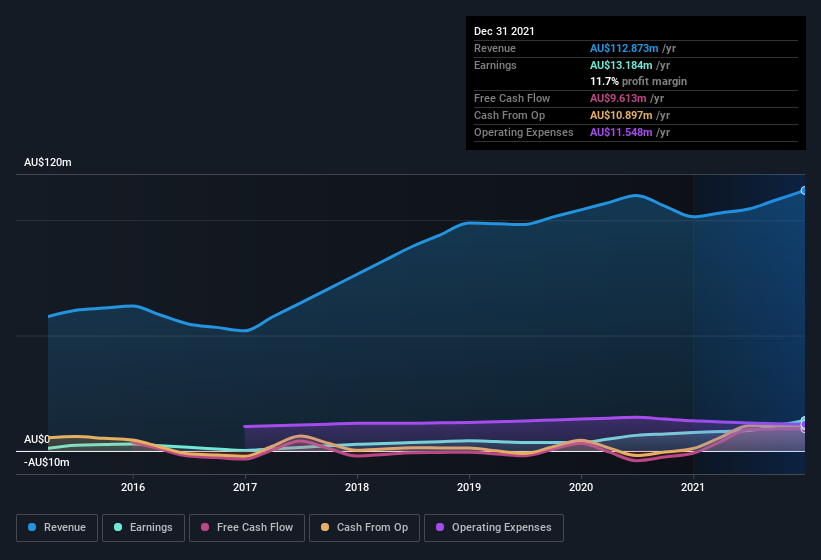

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Bisalloy Steel Group shareholders can take confidence from the fact that EBIT margins are up from 10% to 15%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Bisalloy Steel Group isn't a huge company, given its market capitalization of AU$89m. That makes it extra important to check on its balance sheet strength.

Are Bisalloy Steel Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's worth noting that there was some insider selling of Bisalloy Steel Group shares last year, worth -AU$9.2k. But this is outweighed by the Director Michael Gundy who spent AU$96k buying shares, at an average price of around around AU$1.55.

On top of the insider buying, it's good to see that Bisalloy Steel Group insiders have a valuable investment in the business. To be specific, they have AU$22m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 24% of the company; visible skin in the game.

Is Bisalloy Steel Group Worth Keeping An Eye On?

Bisalloy Steel Group's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Bisalloy Steel Group deserves timely attention. We should say that we've discovered 3 warning signs for Bisalloy Steel Group that you should be aware of before investing here.

The good news is that Bisalloy Steel Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Bisalloy Steel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BIS

Bisalloy Steel Group

Engages in the manufacture and sale of quenched and tempered, high-tensile, and abrasion resistant steel plates in Australia, Indonesia, Thailand, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives