- Australia

- /

- Metals and Mining

- /

- ASX:BIS

Here's Why Bisalloy Steel Group (ASX:BIS) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Bisalloy Steel Group Limited (ASX:BIS) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Bisalloy Steel Group

What Is Bisalloy Steel Group's Net Debt?

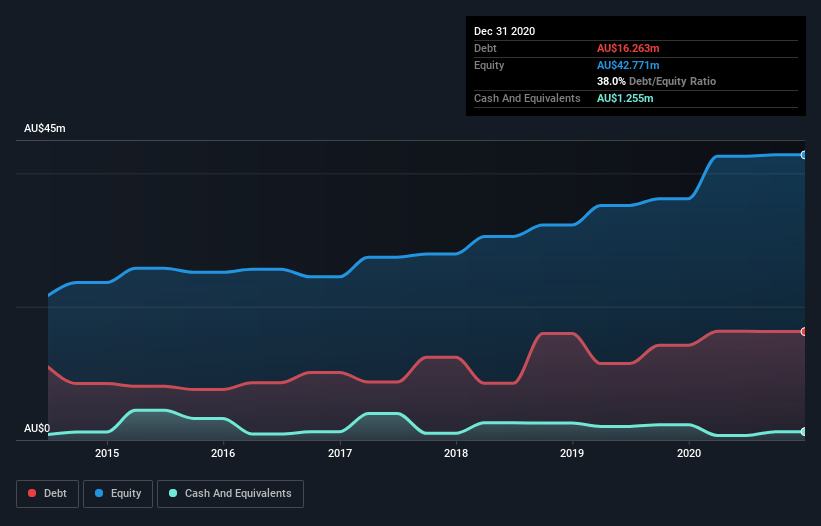

As you can see below, at the end of December 2020, Bisalloy Steel Group had AU$16.3m of debt, up from AU$14.2m a year ago. Click the image for more detail. However, it does have AU$1.26m in cash offsetting this, leading to net debt of about AU$15.0m.

How Healthy Is Bisalloy Steel Group's Balance Sheet?

The latest balance sheet data shows that Bisalloy Steel Group had liabilities of AU$27.4m due within a year, and liabilities of AU$10.1m falling due after that. Offsetting these obligations, it had cash of AU$1.26m as well as receivables valued at AU$16.3m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by AU$20.0m.

This deficit isn't so bad because Bisalloy Steel Group is worth AU$49.9m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 1.2 times EBITDA, Bisalloy Steel Group is arguably pretty conservatively geared. And it boasts interest cover of 8.2 times, which is more than adequate. Better yet, Bisalloy Steel Group grew its EBIT by 103% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Bisalloy Steel Group's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Bisalloy Steel Group created free cash flow amounting to 8.6% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

When it comes to the balance sheet, the standout positive for Bisalloy Steel Group was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to convert EBIT to free cash flow. When we consider all the elements mentioned above, it seems to us that Bisalloy Steel Group is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Bisalloy Steel Group you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Bisalloy Steel Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bisalloy Steel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BIS

Bisalloy Steel Group

Engages in the manufacture and sale of quenched and tempered, high-tensile, and abrasion resistant steel plates in Australia, Indonesia, Thailand, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives