- Australia

- /

- Metals and Mining

- /

- ASX:BHP

How Record Community Investment and Low-Carbon Projects at BHP (ASX:BHP) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- BHP has released its 2025 Community Development Report for Western Australia, marking a record AU$944 million investment in regional development, indigenous partnerships, and local capability building.

- The company's emphasis on sustainable mining includes upcoming low-carbon iron ore projects and new collaborations supporting mental health and safety in mining regions.

- We'll look at how strong momentum in copper and industrial metals could reshape BHP's outlook in light of this latest update.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

BHP Group Investment Narrative Recap

To be a BHP shareholder, you need to believe in the company’s ability to capitalize on long-term demand for critical minerals, while managing the cyclical risks tied to iron ore and regulatory headwinds. The record A$944 million community investment in Western Australia, while affirming BHP’s ESG commitments, does not materially shift the immediate catalysts, which remain driven by copper’s momentum and China’s steel demand volatility. Among recent announcements, BHP’s production guidance for FY 2026 (copper: 1,800–2,000 kt; iron ore: 258–269 Mt) provides clearer targets that are directly linked to the ongoing strength in copper pricing and serve as short-term performance benchmarks for investors watching the impact of resource cycles. Yet, despite strong operational plans, there is the question of how concentrated exposure to Western Australian iron ore…

Read the full narrative on BHP Group (it's free!)

BHP Group's outlook anticipates $49.6 billion in revenue and $10.0 billion in earnings by 2028. This reflects a -1.1% annual revenue decline and a $1.0 billion increase in earnings from the current level of $9.0 billion.

Uncover how BHP Group's forecasts yield a A$43.95 fair value, in line with its current price.

Exploring Other Perspectives

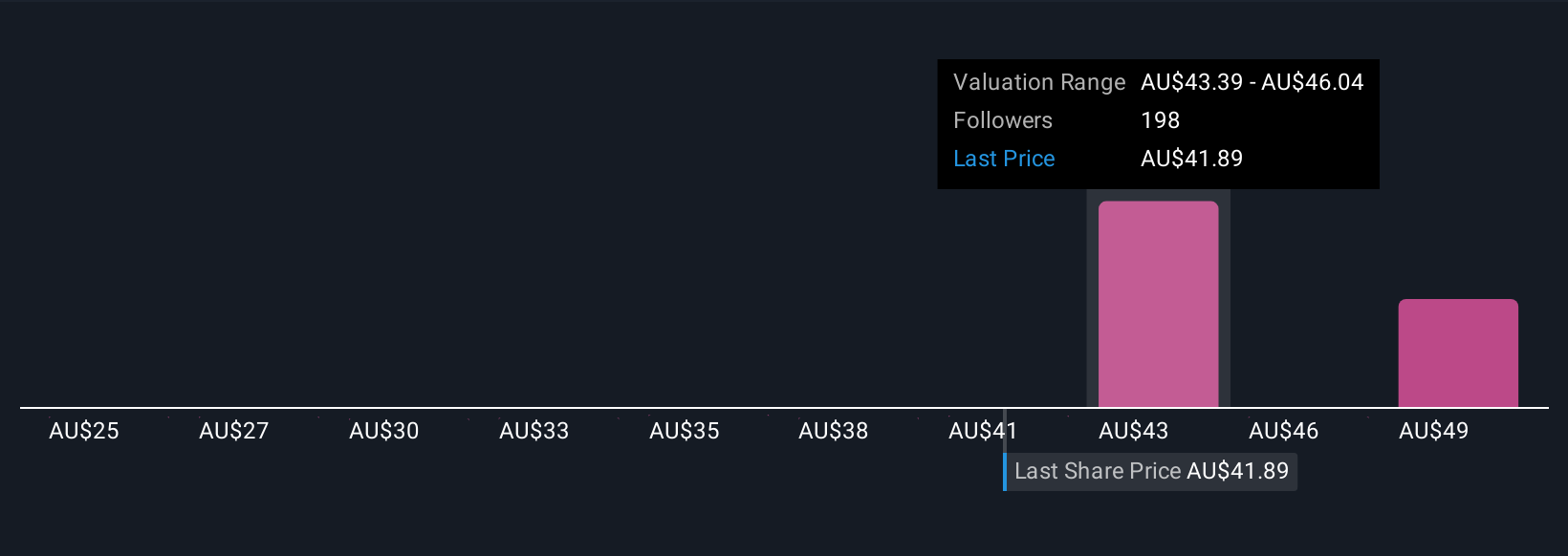

Seventeen Simply Wall St Community fair value estimates for BHP span from A$29.43 to A$47.79 per share, reflecting wide variance in outlooks. However, with project delays and regulatory uncertainty still top of mind, these diverse opinions remind you to always weigh execution risk when evaluating BHP's potential.

Explore 17 other fair value estimates on BHP Group - why the stock might be worth as much as 11% more than the current price!

Build Your Own BHP Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BHP Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BHP Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BHP Group's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BHP Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BHP

BHP Group

Operates as a resources company in Australia, Europe, China, Japan, India, South Korea, rest of Asia, North America, South America, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives