- Australia

- /

- Metals and Mining

- /

- ASX:EVG

Increases to CEO Compensation Might Be Put On Hold For Now at BlackEarth Minerals NL (ASX:BEM)

Under the guidance of CEO Tom Revy, BlackEarth Minerals NL (ASX:BEM) has performed reasonably well recently. As shareholders go into the upcoming AGM on 25 November 2022, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Our analysis indicates that BEM is potentially overvalued!

How Does Total Compensation For Tom Revy Compare With Other Companies In The Industry?

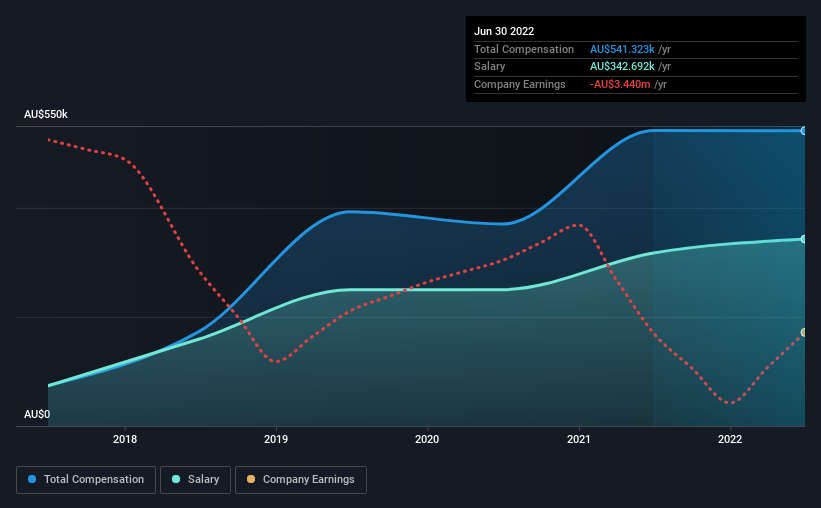

At the time of writing, our data shows that BlackEarth Minerals NL has a market capitalization of AU$26m, and reported total annual CEO compensation of AU$541k for the year to June 2022. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at AU$342.7k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below AU$301m, we found that the median total CEO compensation was AU$371k. This suggests that Tom Revy is paid more than the median for the industry. Furthermore, Tom Revy directly owns AU$1.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | AU$343k | AU$317k | 63% |

| Other | AU$199k | AU$224k | 37% |

| Total Compensation | AU$541k | AU$542k | 100% |

Talking in terms of the industry, salary represented approximately 60% of total compensation out of all the companies we analyzed, while other remuneration made up 40% of the pie. Our data reveals that BlackEarth Minerals allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

BlackEarth Minerals NL's Growth

BlackEarth Minerals NL's earnings per share (EPS) grew 28% per year over the last three years. The trailing twelve months of revenue was pretty much the same as the prior period.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has BlackEarth Minerals NL Been A Good Investment?

We think that the total shareholder return of 86%, over three years, would leave most BlackEarth Minerals NL shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 5 warning signs for BlackEarth Minerals you should be aware of, and 2 of them are a bit concerning.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Evion Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:EVG

Evion Group

Operates as an integrated graphite developer in Madagascar, India, and Europe.

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026