- Australia

- /

- Metals and Mining

- /

- ASX:BCN

Discovering Opportunities: 3 ASX Penny Stocks With Market Caps Under A$20M

Reviewed by Simply Wall St

The Australian market is experiencing a cautious optimism, with the ASX200 poised for a modest rise despite mixed signals from global markets and economic factors. Penny stocks, often overlooked due to their smaller size and perceived volatility, still hold potential for investors seeking unique opportunities in today's financial landscape. These stocks can offer surprising value when backed by solid financials, making them an intriguing option for those looking to explore under-the-radar companies with promising prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,029 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Beacon Minerals (ASX:BCN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beacon Minerals Limited, with a market cap of A$86.41 million, is involved in the exploration, development, and production of minerals in Western Australia.

Operations: The company generates revenue of A$82.90 million from its mineral exploration and development activities.

Market Cap: A$86.41M

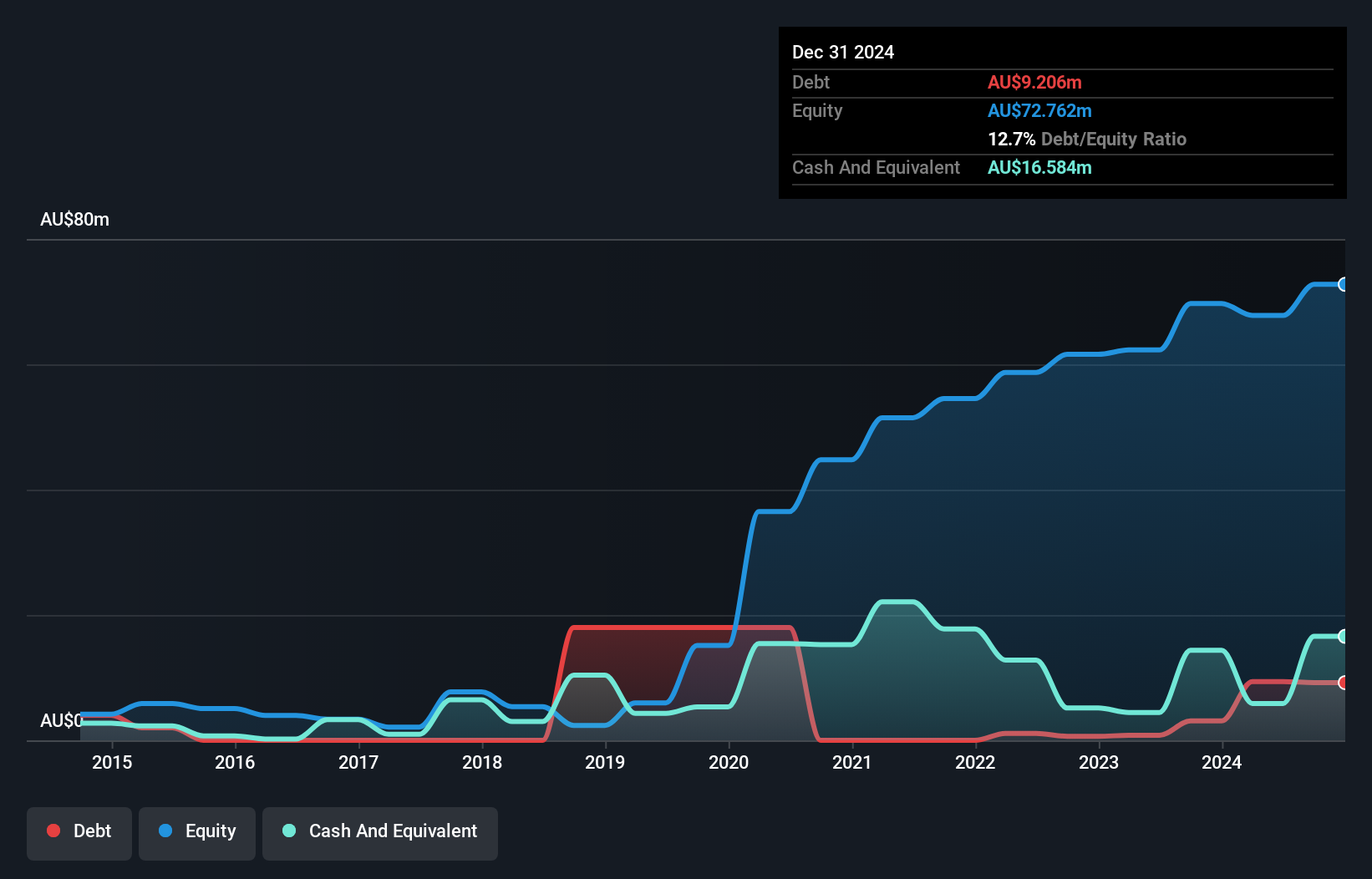

Beacon Minerals Limited has shown significant financial improvement, with its debt to equity ratio decreasing from 301% to 13.8% over five years, and operating cash flow covering debt well. The company reported A$83.38 million in revenue for the year ending June 2024, with net income rising to A$8.74 million from A$5.22 million the previous year, reflecting improved profit margins and high-quality earnings growth of 75.8%. Despite short-term assets exceeding short-term liabilities, long-term liabilities remain uncovered by current assets. Recent executive changes could bolster strategic direction following a follow-on equity offering of approximately A$10 million.

- Dive into the specifics of Beacon Minerals here with our thorough balance sheet health report.

- Evaluate Beacon Minerals' historical performance by accessing our past performance report.

Locality Planning Energy Holdings (ASX:LPE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Locality Planning Energy Holdings Limited offers energy solutions in Queensland and Northern New South Wales, with a market cap of A$29.65 million.

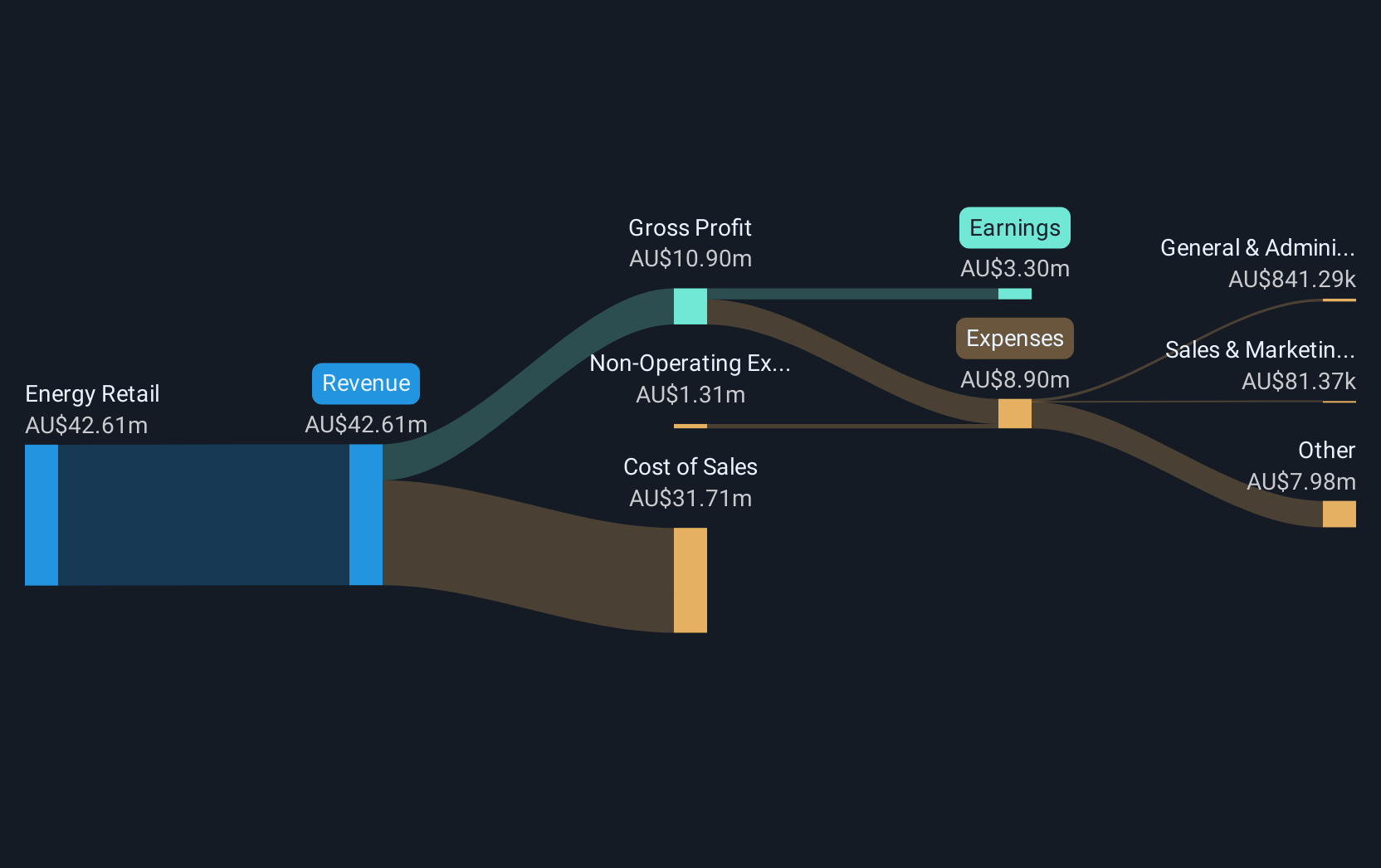

Operations: The company generates revenue from its Energy Retail segment, amounting to A$40.55 million.

Market Cap: A$29.65M

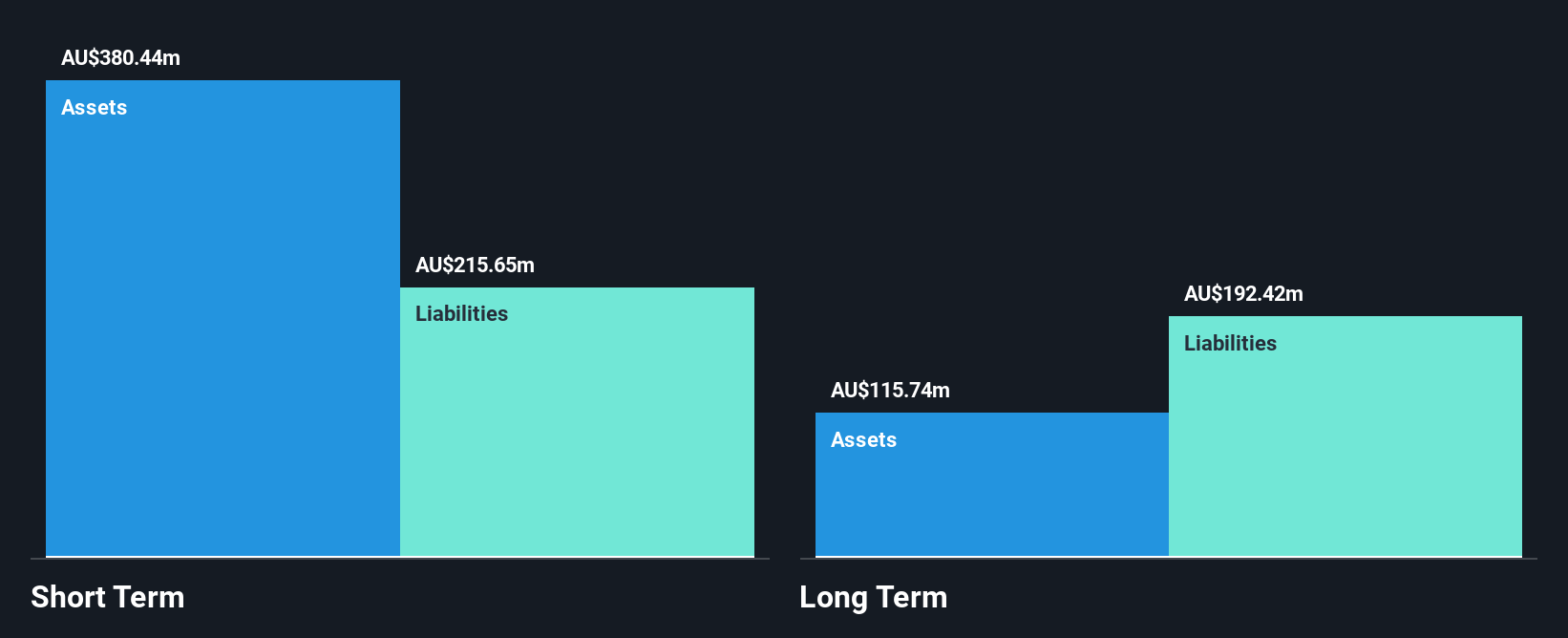

Locality Planning Energy Holdings has demonstrated financial stability, with short-term assets of A$17.7 million exceeding both short-term and long-term liabilities. The company transitioned to profitability, reporting net income of A$2.01 million for the year ending June 2024, a significant turnaround from a net loss the previous year. Revenue increased to A$40.55 million from A$38.58 million, reflecting improved operations in its energy retail segment. Despite low return on equity at 18.4%, debt levels are well-managed with more cash than total debt and solid interest coverage, though the management team lacks experience with an average tenure of just 0.6 years.

- Jump into the full analysis health report here for a deeper understanding of Locality Planning Energy Holdings.

- Explore historical data to track Locality Planning Energy Holdings' performance over time in our past results report.

NobleOak Life (ASX:NOL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NobleOak Life Limited manufactures and distributes life insurance products in Australia with a market cap of A$140.81 million.

Operations: NobleOak Life Limited generates its revenue through three main segments: Genus (A$14.98 million), Direct (A$86.65 million), and Strategic Partnerships (A$275.19 million).

Market Cap: A$140.81M

NobleOak Life Limited, with a market cap of A$140.81 million, has demonstrated financial resilience despite challenges. The company reported a net income of A$9.28 million for the year ending June 2024, down from A$13.51 million the previous year, reflecting pressure on profit margins which decreased to 2.5% from 3.9%. Its price-to-earnings ratio of 15.2x suggests it may be undervalued compared to the broader Australian market at 19.5x. NobleOak's short-term assets significantly exceed both short-term and long-term liabilities, and it remains debt-free with high-quality earnings projected to grow by nearly 24% annually.

- Unlock comprehensive insights into our analysis of NobleOak Life stock in this financial health report.

- Review our growth performance report to gain insights into NobleOak Life's future.

Next Steps

- Reveal the 1,029 hidden gems among our ASX Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beacon Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BCN

Beacon Minerals

Engages in the mineral exploration, development, and production activities in Western Australia.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives