- Australia

- /

- Metals and Mining

- /

- ASX:BCB

Bowen Coking Coal Limited (ASX:BCB) Analysts Just Cut Their EPS Forecasts

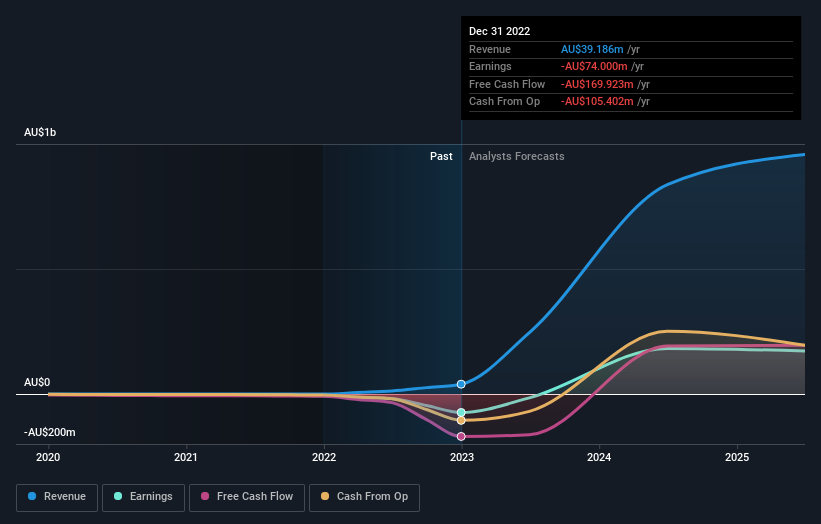

The latest analyst coverage could presage a bad day for Bowen Coking Coal Limited (ASX:BCB), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

After this downgrade, Bowen Coking Coal's two analysts are now forecasting revenues of AU$246m in 2023. This would be a huge improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 85% to AU$0.006. Before this latest update, the analysts had been forecasting revenues of AU$342m and earnings per share (EPS) of AU$0.043 in 2023. So we can see that the consensus has become notably more bearish on Bowen Coking Coal's outlook with these numbers, making a pretty serious reduction to this year's revenue estimates. Furthermore, they expect the business to be loss-making this year, compared to their previous forecasts of a profit.

Check out our latest analysis for Bowen Coking Coal

The consensus price target was broadly unchanged at AU$0.45, perhaps implicitly signalling that the weaker earnings outlook is not expected to have a long-term impact on the valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Bowen Coking Coal analyst has a price target of AU$0.49 per share, while the most pessimistic values it at AU$0.40. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that the analysts have a clear view on its prospects.

Of course, another way to look at these forecasts is to place them into context against the industry itself. It's clear from the latest estimates that Bowen Coking Coal's rate of growth is expected to accelerate meaningfully, with the forecast 5x annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 99% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 1.9% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Bowen Coking Coal is expected to grow much faster than its industry.

The Bottom Line

The biggest low-light for us was that the forecasts for Bowen Coking Coal dropped from profits to a loss this year. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of Bowen Coking Coal.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Bowen Coking Coal's business, like recent substantial insider selling. Learn more, and discover the 2 other warning signs we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Bowen Coking Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BCB

Bowen Coking Coal

Engages in the exploration, development, and production of metallurgical coal in Australia.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026