- Australia

- /

- Metals and Mining

- /

- ASX:ASQ

Share Price Aside, Australian Silica Quartz Group (ASX:ASQ) Has Delivered Shareholders A 58% Return.

While it may not be enough for some shareholders, we think it is good to see the Australian Silica Quartz Group Ltd. (ASX:ASQ) share price up 11% in a single quarter.

See our latest analysis for Australian Silica Quartz Group

We don't think Australian Silica Quartz Group's revenue of AU$118,940 is enough to establish significant demand. This state of affairs suggests that venture capitalists won't provide funds on attractive terms. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, investors may be hoping that Australian Silica Quartz Group finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt.

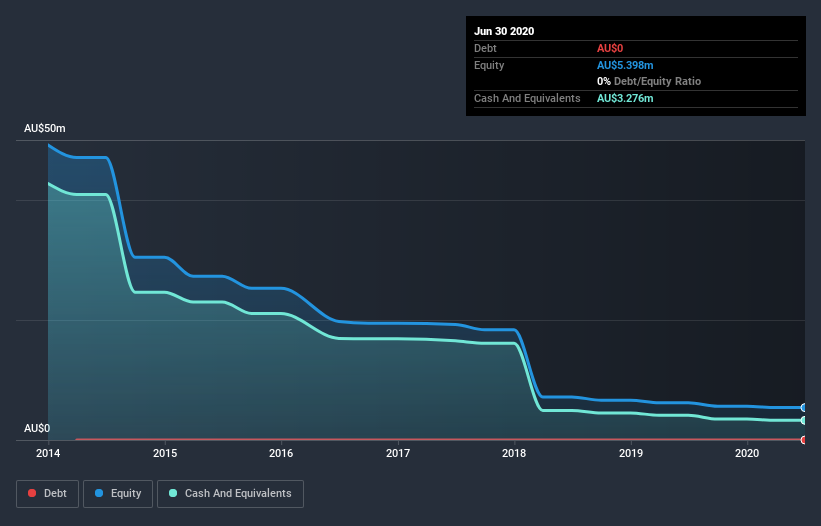

When it last reported its balance sheet, Australian Silica Quartz Group could boast a strong position. That allows management to focus on growing the business, and not feel like the recent capital raising was a matter of urgency. But with the share price diving 3% per year, over 3 years , it could be that the price was previously too hyped up. The image below shows how Australian Silica Quartz Group's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Australian Silica Quartz Group's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Australian Silica Quartz Group hasn't been paying dividends, but its TSR of 58% exceeds its share price return of -11%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Investors in Australian Silica Quartz Group had a tough year, with a total loss of , against a market gain of about 3.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 26%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Australian Silica Quartz Group (including 1 which is concerning) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade Australian Silica Quartz Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ASQ

Australian Silica Quartz Group

Acquires, explores, and develops hard rock quartz and high-grade silica sand properties in Australia.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026