- Australia

- /

- Metals and Mining

- /

- ASX:ASM

Is Australian Strategic Materials' (ASX:ASM) Discounted Equity Raise a Strategic Bet or a Necessary Compromise?

Reviewed by Sasha Jovanovic

- Australian Strategic Materials recently completed a follow-on equity offering, raising A$55.16 million through the issuance of a total 45,967,502 new ordinary shares at A$1.20 per share, offered at discounts to prevailing market prices.

- This capital raise highlights the company's drive to secure funding for future projects while resulting in some dilution for existing shareholders.

- We’ll explore how this equity offering and the associated dilution may influence Australian Strategic Materials' investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Australian Strategic Materials' Investment Narrative?

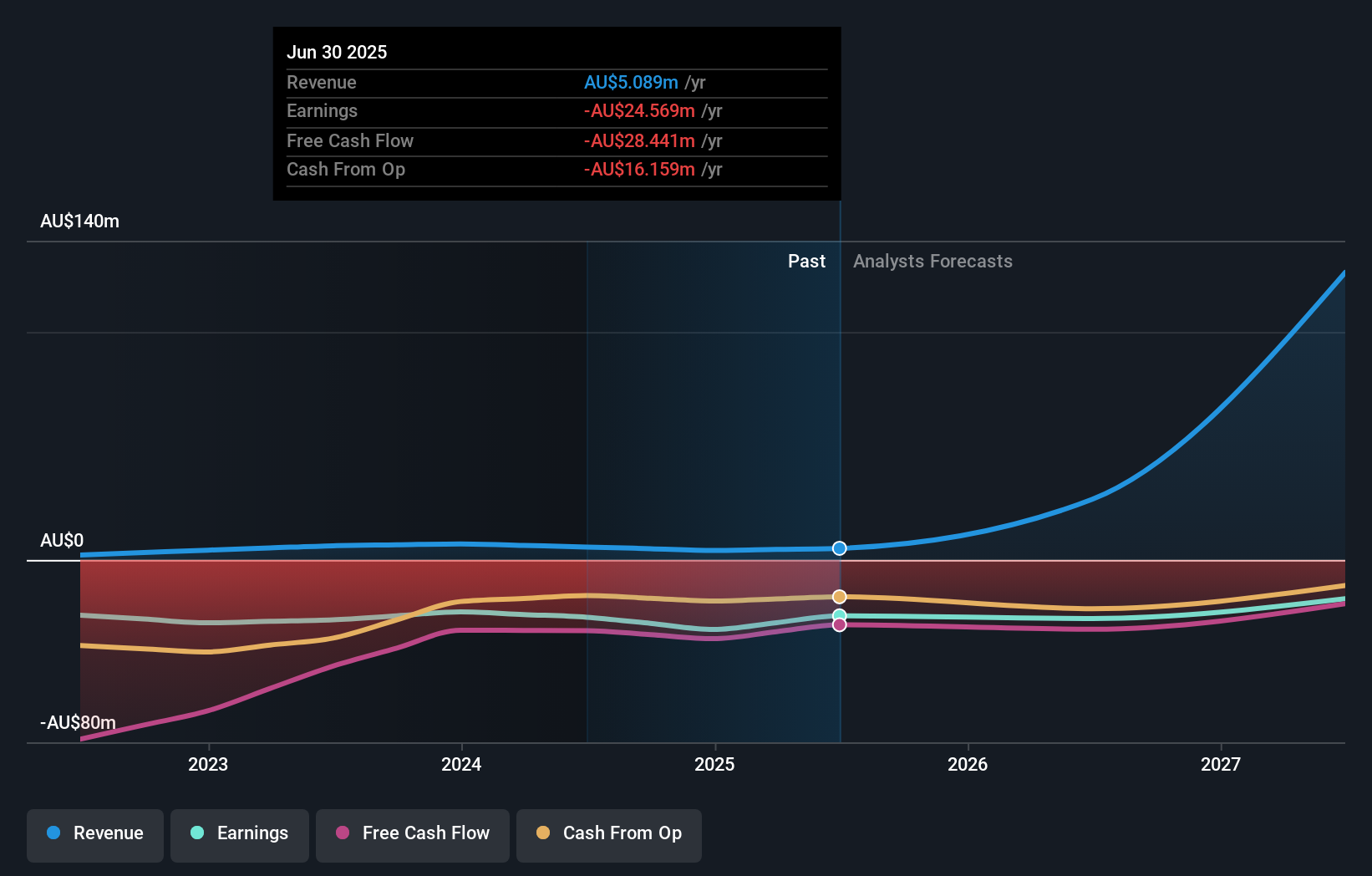

To be comfortable owning Australian Strategic Materials, an investor has to believe in the company’s ability to scale rare earths production and transition losses into meaningful revenues, while managing ongoing funding needs. The recent A$55.16 million equity raising brings fresh capital to support these ambitions, yet also results in further dilution for current shareholders on top of an already rising share count. This injection could relieve immediate funding pressures and help address auditor concerns about long-term viability, shifting the conversation about near-term survival away from liquidity and more toward execution on growth projects. However, key short-term catalysts such as project approvals or production milestones remain crucial, while material risks like persistent losses and leadership changes are now seen through the lens of improved funding but not eliminated. The share price has shown high volatility, so it's important to weigh whether these moves truly buffer against the company's largest challenges.

By contrast, the company's ability to remain a going concern still hangs in the balance.

Exploring Other Perspectives

Explore 2 other fair value estimates on Australian Strategic Materials - why the stock might be worth less than half the current price!

Build Your Own Australian Strategic Materials Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Australian Strategic Materials research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Australian Strategic Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Australian Strategic Materials' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ASM

Australian Strategic Materials

Operates as an integrated producer of critical metals for technologies in Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives