- Australia

- /

- Metals and Mining

- /

- ASX:SFX

3 ASX Penny Stocks With Market Caps Under A$200M

Reviewed by Simply Wall St

The ASX200 is set to open 0.15% lower today, reflecting mixed performances among US indices, with notable fluctuations in tech stocks and commodities. For investors considering smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area offering potential value. By focusing on those with strong financials and growth potential, these stocks can present opportunities for stability and upside in the current market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.88 | A$306.1M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$337.98M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.72 | A$225.52M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.62 | A$72.68M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.60 | A$784.13M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.94 | A$130.6M | ★★★★★★ |

| Perenti (ASX:PRN) | A$1.165 | A$1.08B | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.34 | A$114.39M | ★★★★★☆ |

Click here to see the full list of 1,035 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Australian Strategic Materials (ASX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Strategic Materials Ltd is an integrated producer of critical metals for advanced and clean technologies in Australia, with a market cap of A$103.35 million.

Operations: The company's revenue is derived from two segments: Korea, contributing A$1.57 million, and the Dubbo Project, contributing A$1.53 million.

Market Cap: A$103.35M

Australian Strategic Materials Ltd, with a market cap of A$103.35 million, is navigating the challenging landscape of penny stocks in Australia. Despite its unprofitable status and declining earnings over the past five years, ASM's financial health shows improvement with a significant reduction in debt to equity ratio and short-term assets exceeding liabilities. Recent A$5 million government funding underpins efforts to advance its Dubbo Project, aiming for rare earth production efficiency. However, shareholder dilution and high share price volatility persist as concerns. The company has a cash runway for over a year but lacks meaningful revenue generation currently.

- Navigate through the intricacies of Australian Strategic Materials with our comprehensive balance sheet health report here.

- Gain insights into Australian Strategic Materials' past trends and performance with our report on the company's historical track record.

Sheffield Resources (ASX:SFX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sheffield Resources Limited is involved in the evaluation and development of mineral sands in Australia, with a market cap of A$82.91 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$82.91M

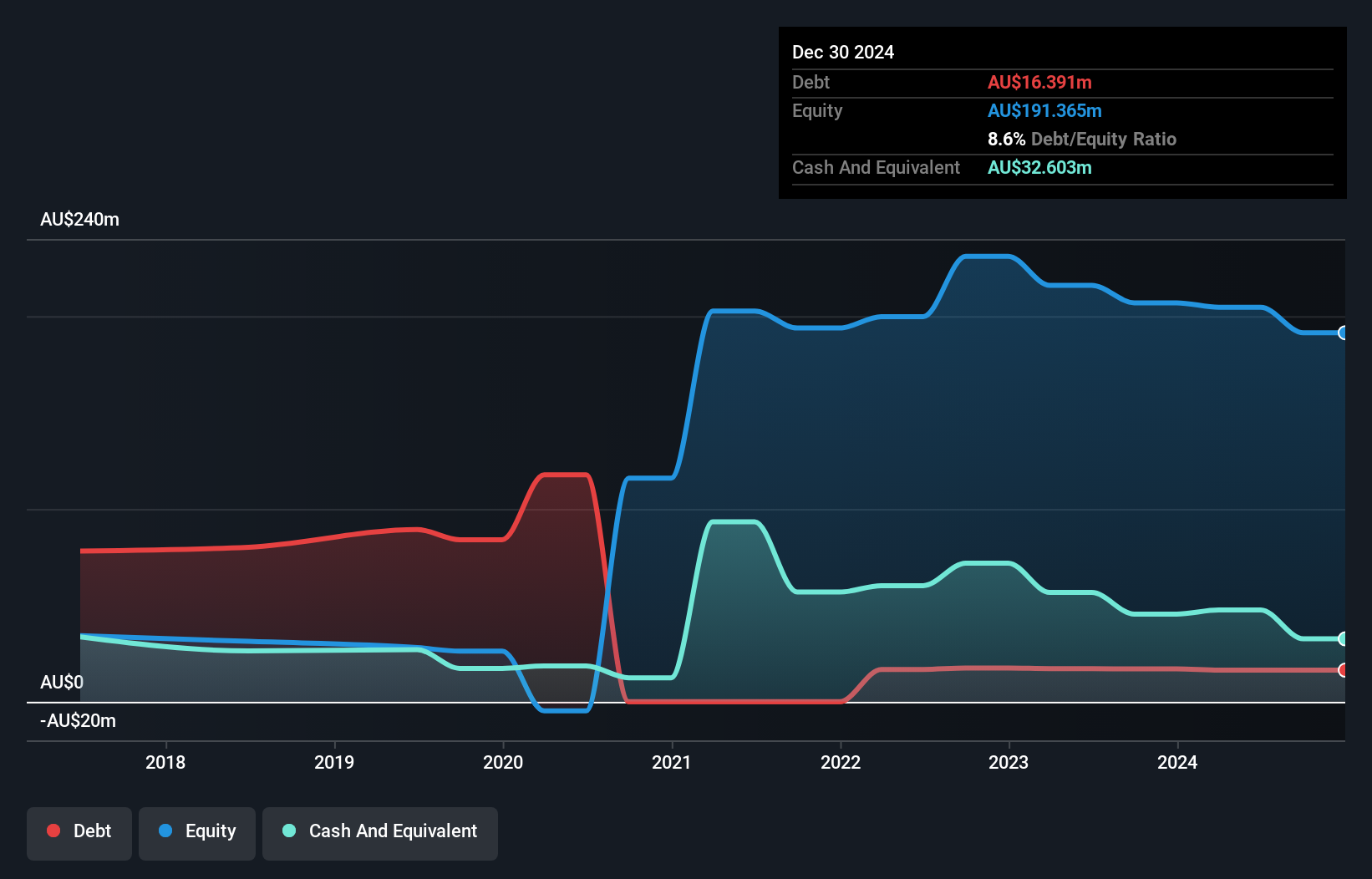

Sheffield Resources Limited, with a market cap of A$82.91 million, is currently pre-revenue, reflecting its early-stage status in the mineral sands sector. The company remains debt-free and has sufficient cash to cover operations for nearly two years if free cash flow maintains its historical growth rate. Despite an increased net loss of A$32.19 million for the year ending June 2024, Sheffield's short-term assets comfortably exceed liabilities, providing some financial stability. Its board members are experienced with an average tenure of 4.4 years; however, the company's profitability challenges continue to impact investor sentiment in this volatile segment.

- Jump into the full analysis health report here for a deeper understanding of Sheffield Resources.

- Review our historical performance report to gain insights into Sheffield Resources' track record.

Reject Shop (ASX:TRS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Reject Shop Limited operates as a retailer of discount variety merchandise in Australia, with a market capitalization of A$110 million.

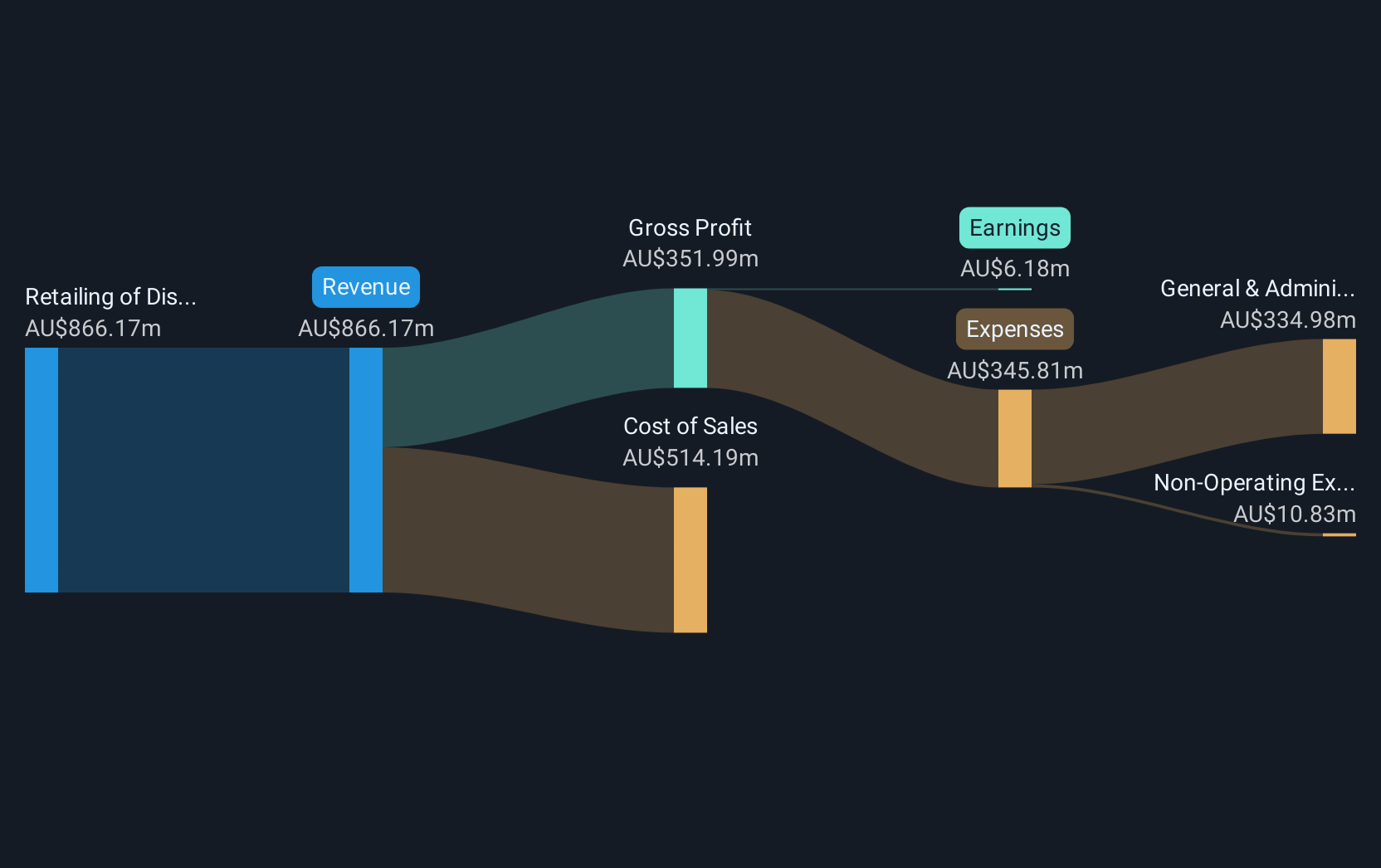

Operations: The company's revenue is generated entirely from its retailing of discount variety merchandise, amounting to A$852.74 million.

Market Cap: A$110.01M

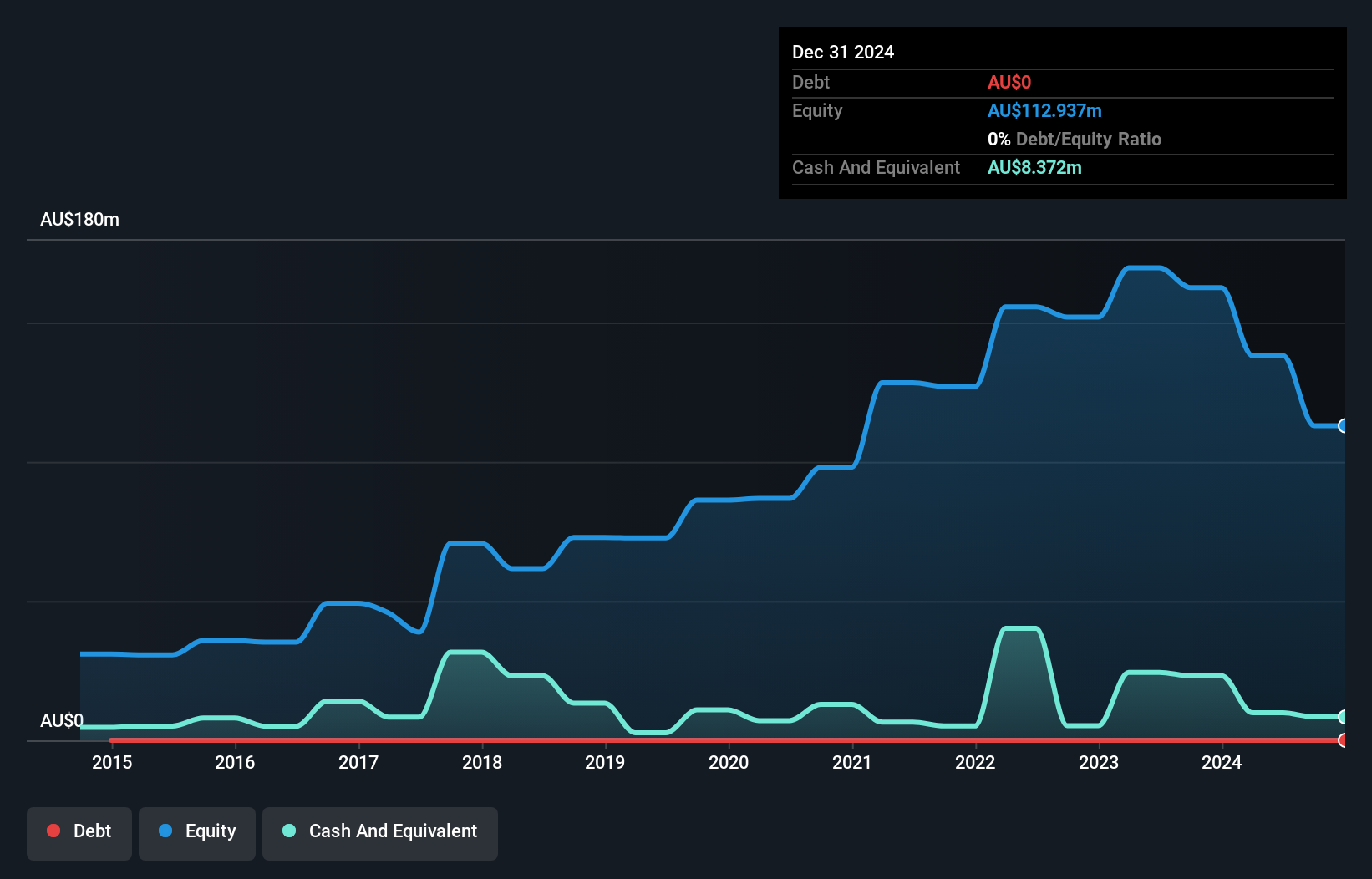

The Reject Shop Limited, with a market cap of A$110 million, operates debt-free and has stable short-term assets exceeding both its short and long-term liabilities. Despite recent negative earnings growth of -54.2% over the past year, the company remains profitable with net income reported at A$4.71 million for the year ending June 2024. The company executed a significant share buyback program, repurchasing 3.15% of shares for A$5 million by September 2024, which may indicate confidence in its financial position despite declining profit margins from 1.3% to 0.6%. Earnings are projected to grow by over one-third annually moving forward.

- Dive into the specifics of Reject Shop here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Reject Shop's future.

Next Steps

- Click this link to deep-dive into the 1,035 companies within our ASX Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SFX

Sheffield Resources

Engages in the evaluation and development of mineral sands in Australia.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives