- Australia

- /

- Metals and Mining

- /

- ASX:ARN

Aldoro Resources And 2 Other ASX Penny Stocks To Consider

Reviewed by Simply Wall St

The Santa Rally is well and truly underway in global stock markets despite geopolitics rocking the boat, with the ASX 200 also expected to stay mostly green in early December. In this context, penny stocks—though an outdated term—remain a relevant area for investors seeking opportunities beyond the mainstream. These smaller or less-established companies can present a mix of value and growth potential when supported by strong financials, making them intriguing options for those looking to explore under-the-radar investments.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.595 | A$69.75M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$2.01 | A$327.26M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.545 | A$337.98M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.765 | A$97.63M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.61 | A$789.03M | ★★★★★☆ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$112.47M | ★★★★★★ |

| Big River Industries (ASX:BRI) | A$1.30 | A$110.99M | ★★★★★☆ |

| Servcorp (ASX:SRV) | A$4.84 | A$477.54M | ★★★★☆☆ |

Click here to see the full list of 1,045 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Aldoro Resources (ASX:ARN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aldoro Resources Limited is a mineral exploration and development company based in Australia with a market capitalization of A$17.50 million.

Operations: Aldoro Resources Limited has not reported any revenue segments.

Market Cap: A$17.5M

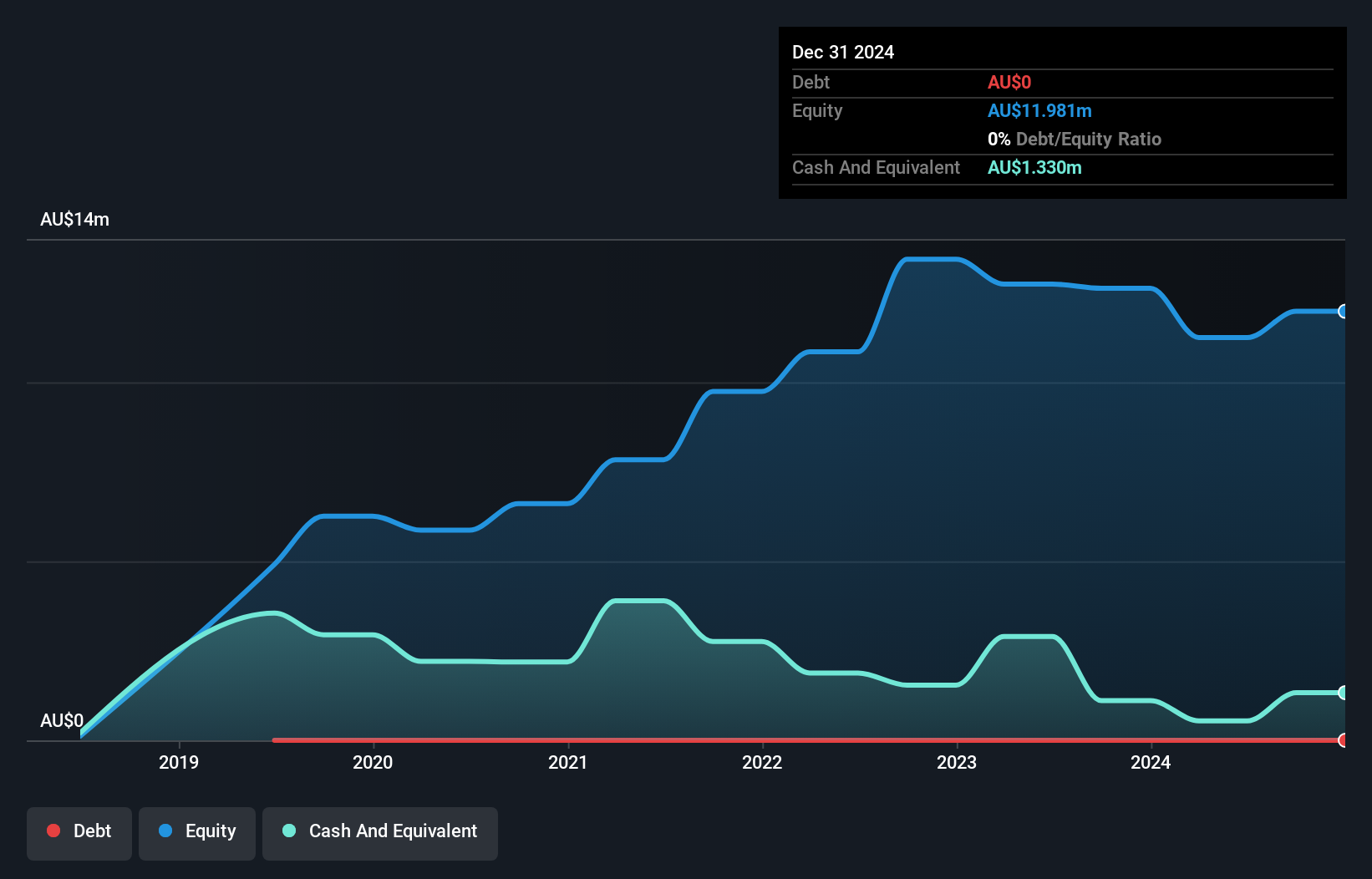

Aldoro Resources Limited, with a market capitalization of A$17.50 million, is a pre-revenue mineral exploration company facing significant financial challenges. Despite reducing its net loss to A$1.79 million for the year ending June 30, 2024, compared to A$4.56 million previously, the company has less than a year of cash runway and no long-term liabilities or debt. The company's share price remains highly volatile and its board lacks experience with an average tenure of only 0.3 years. Additionally, auditors have expressed doubts about Aldoro's ability to continue as a going concern due to financial instability.

- Navigate through the intricacies of Aldoro Resources with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Aldoro Resources' track record.

Metal Hawk (ASX:MHK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metal Hawk Limited is involved in the evaluation, exploration, and development of mineral resource projects in Australia with a market cap of A$36.74 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: A$36.74M

Metal Hawk Limited, with a market cap of A$36.74 million, is a pre-revenue company focused on mineral exploration in Australia. It faces financial hurdles with a net loss of A$4.27 million for the year ending June 30, 2024, and auditors expressing doubts about its ability to continue as a going concern. Despite having no debt and short-term assets exceeding liabilities, the company's cash runway is limited to 8 months without further capital infusion. Recent efforts to raise A$2.5 million through equity offerings aim to bolster its financial position amidst high share price volatility and negative return on equity.

- Click to explore a detailed breakdown of our findings in Metal Hawk's financial health report.

- Gain insights into Metal Hawk's historical outcomes by reviewing our past performance report.

Sequoia Financial Group (ASX:SEQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sequoia Financial Group Limited (ASX:SEQ) is an integrated financial services company offering financial products and services to retail and wholesale clients, as well as third-party professional service firms primarily in Australia, with a market cap of A$47.79 million.

Operations: The company's revenue is primarily derived from the Sequoia Licensees Services Group at A$102.79 million, followed by Sequoia Professional Services at A$9.95 million, Sequoia Equity Markets Group at A$9.09 million, and Sequoia Direct Investment Group contributing A$2.35 million.

Market Cap: A$47.79M

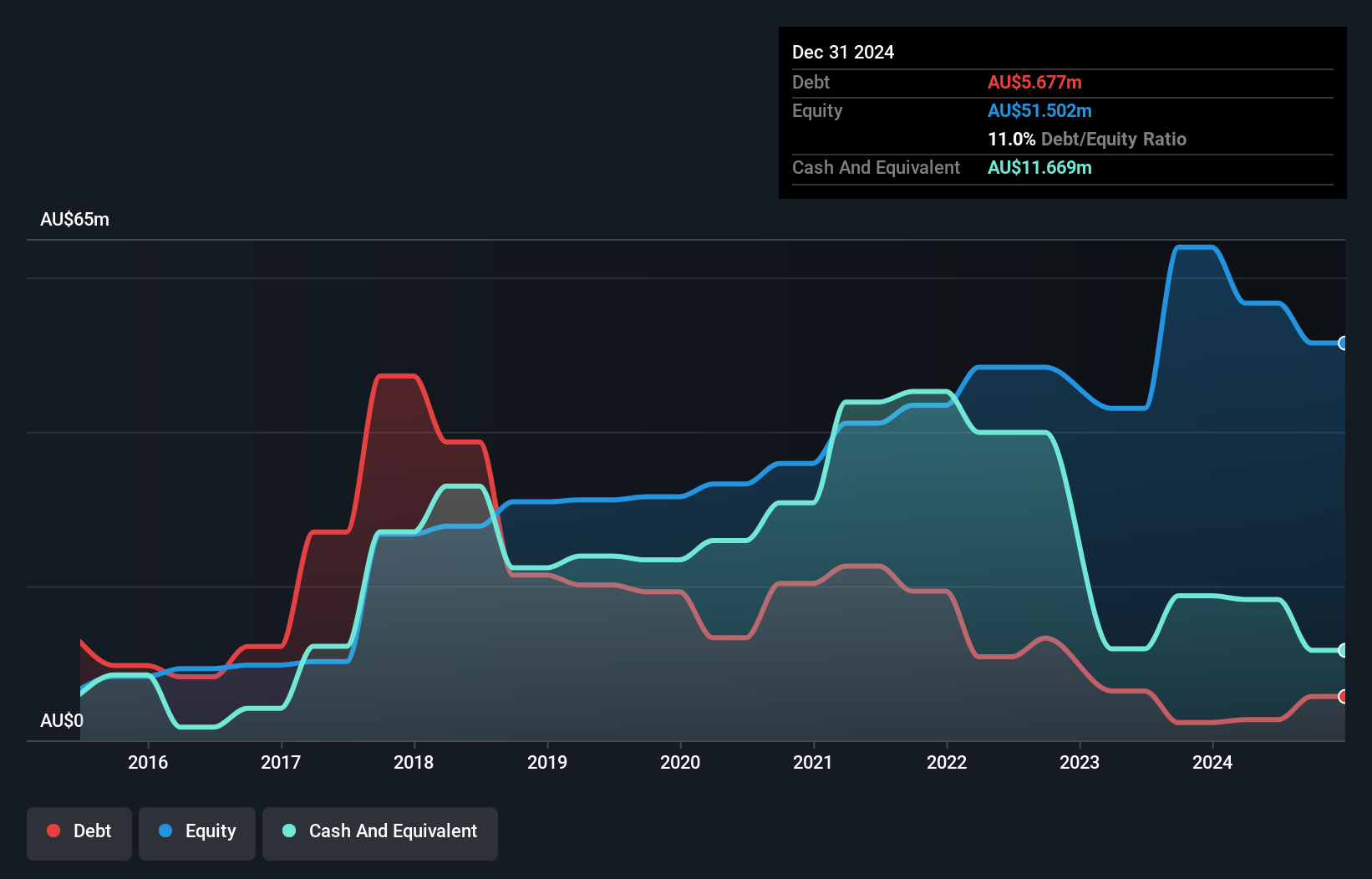

Sequoia Financial Group, with a market cap of A$47.79 million, derives significant revenue from its Sequoia Licensees Services Group at A$102.79 million. Despite being unprofitable with a negative return on equity of -5.54%, the company has more cash than debt and covers both short-term and long-term liabilities with its assets. Its cash runway extends over a year, even if free cash flow continues to decline at historical rates. The management team is relatively new, averaging 1.5 years in tenure, while the board is experienced with an average tenure of 5.8 years.

- Unlock comprehensive insights into our analysis of Sequoia Financial Group stock in this financial health report.

- Examine Sequoia Financial Group's past performance report to understand how it has performed in prior years.

Summing It All Up

- Click here to access our complete index of 1,045 ASX Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ARN

Aldoro Resources

Operates as a mineral exploration and development company in Australia.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives