Despite shrinking by AU$23m in the past week, Advance ZincTek (ASX:ANO) shareholders are still up 799% over 5 years

While Advance ZincTek Limited (ASX:ANO) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 23% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been spectacular. To be precise, the stock price is 797% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 34% drop, in the last year. It really delights us to see such great share price performance for investors.

Since the long term performance has been good but there's been a recent pullback of 12%, let's check if the fundamentals match the share price.

Check out our latest analysis for Advance ZincTek

While Advance ZincTek made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Advance ZincTek saw its revenue grow at 25% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 55% per year in that time. It's never too late to start following a top notch stock like Advance ZincTek, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

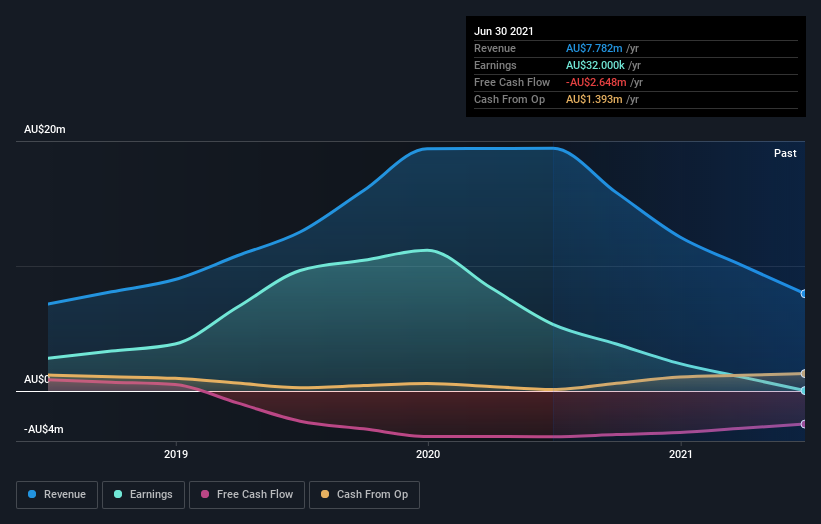

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on Advance ZincTek's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Advance ZincTek had a tough year, with a total loss of 34%, against a market gain of about 9.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 55%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Advance ZincTek that you should be aware of.

Advance ZincTek is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ANO

Advance ZincTek

Manufactures aluminum oxide powder, and zinc oxide dispersions and powder for use in the personal care sector in Australia, the United States, Canada, Europe, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)