- Australia

- /

- Metals and Mining

- /

- ASX:AMI

Major Gold Discovery at Nymagee and Board Changes Might Change The Case For Investing In Aurelia Metals (ASX:AMI)

Reviewed by Sasha Jovanovic

- In recent weeks, Aurelia Metals Limited announced the discovery of two new mineral lenses at the Nymagee Mine in New South Wales and confirmed upcoming Board changes, with Mr. Peter Botten stepping down as Chair after the November Annual General Meeting and Ms. Rachel Brown joining as a Non-Executive Director.

- The Nymagee exploration results highlight a higher gold content and resource expansion potential, supporting ongoing growth initiatives and operational developments across Aurelia’s portfolio.

- We’ll examine how the significant gold discovery at Nymagee could reshape Aurelia Metals’ long-term growth and resource outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Aurelia Metals Investment Narrative Recap

To believe in Aurelia Metals as a shareholder, you need confidence in their ability to turn new discoveries and ongoing exploration into meaningful resource and production growth, particularly as electrification drives demand for base metals. The recent high-grade gold discovery at Nymagee offers a boost to resource potential, but near-term investor focus remains fixed on whether ongoing tight labor markets in regional New South Wales can be managed to avoid adding cost pressure, making this the biggest short-term risk. The news does not materially reduce this execution risk.

The upcoming September quarter results announcement, due October 21, stands out as the most relevant recent development alongside these exploration updates. With stakeholders keen to see early evidence that discoveries and portfolio changes can translate into stronger financial or operational performance, any emerging trends in production costs or margins may serve as an early signal for how well Aurelia is addressing key catalysts and challenges.

However, while the gold discovery is encouraging, investors should be aware that rising labor costs remain a potential headwind, especially if...

Read the full narrative on Aurelia Metals (it's free!)

Aurelia Metals' outlook forecasts A$453.8 million in revenue and A$61.8 million in earnings by 2028. This is based on a projected annual revenue growth rate of 9.7% and represents a A$12.9 million increase in earnings from the current A$48.9 million.

Uncover how Aurelia Metals' forecasts yield a A$0.374 fair value, a 39% upside to its current price.

Exploring Other Perspectives

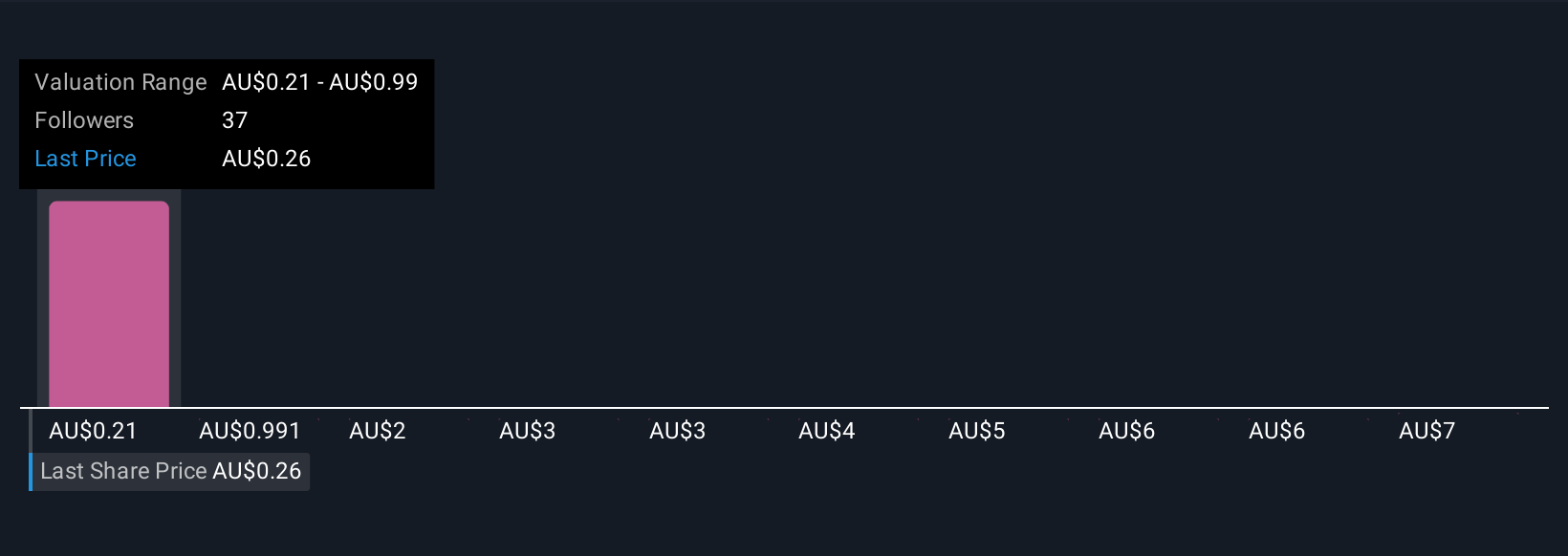

Fifteen Simply Wall St Community members placed fair value estimates for Aurelia Metals from A$0.21 to A$8.02 per share, highlighting strikingly wide opinions. While exploration success is raising hopes, ongoing cost pressures could be what truly shapes future performance, consider several viewpoints before making up your mind.

Explore 15 other fair value estimates on Aurelia Metals - why the stock might be worth 22% less than the current price!

Build Your Own Aurelia Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aurelia Metals research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Aurelia Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aurelia Metals' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AMI

Aurelia Metals

Engages in the exploration and production of mineral properties in Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success