- Australia

- /

- Capital Markets

- /

- ASX:AEF

Exploring 3 Undiscovered Gems In The Australian Stock Market

Reviewed by Simply Wall St

As the Australian Stock Exchange reaches a new all-time high, buoyed by strong performances in the materials and real estate sectors, investors are keenly observing market dynamics that suggest potential shifts in monetary policy. In this climate of heightened activity, identifying stocks with robust fundamentals and growth potential becomes crucial for those looking to capitalize on emerging opportunities within Australia's vibrant market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

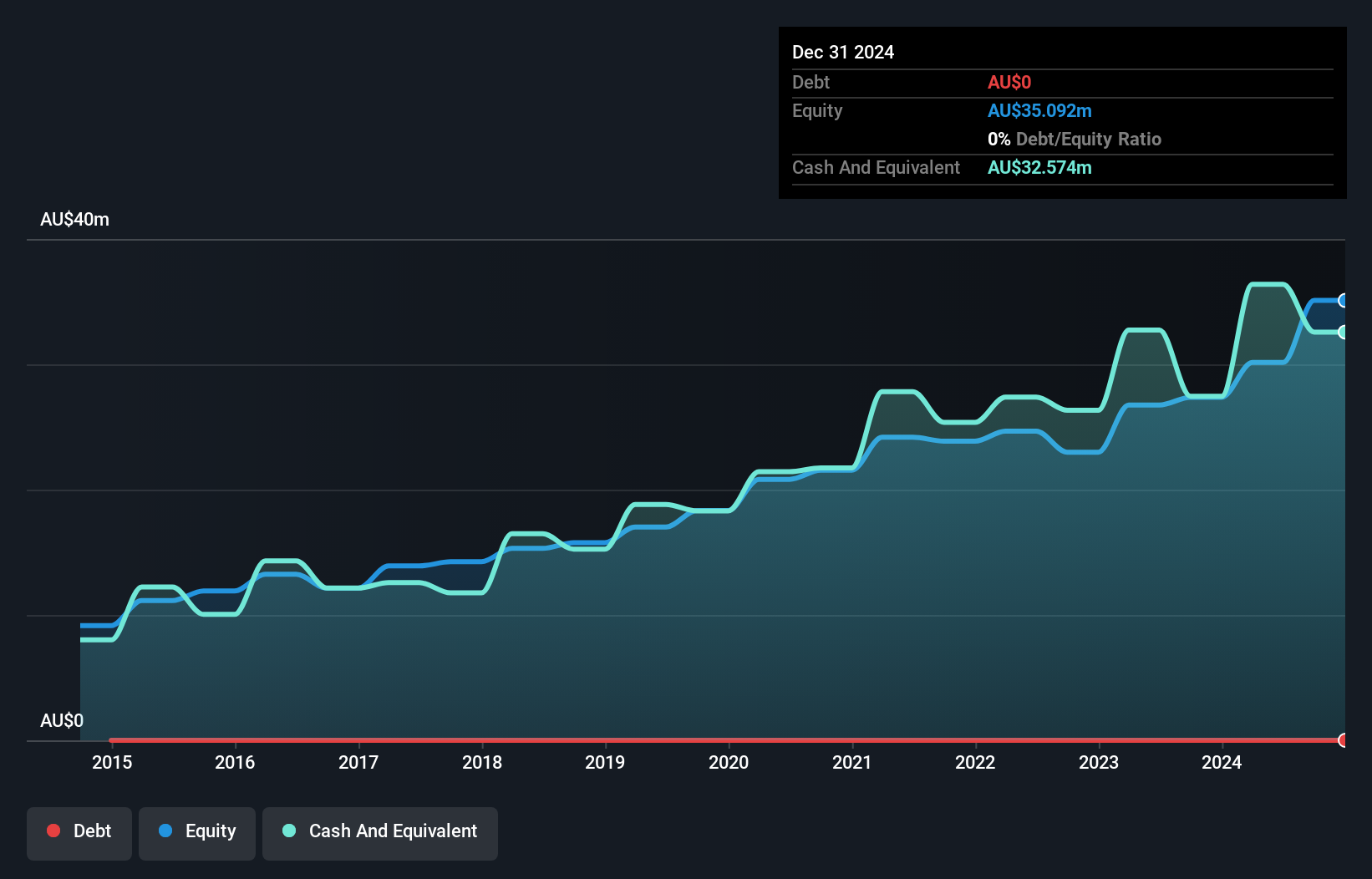

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$687.32 million, focusing on ethical and sustainable investment options.

Operations: The company's revenue primarily comes from its funds management segment, generating A$110.80 million.

Australian Ethical Investment, a nimble player in the market, has demonstrated robust growth with earnings rising 24.6% over the past year, surpassing industry benchmarks. Despite a significant A$8.4 million one-off loss impacting recent results, the company remains debt-free and continues to generate positive free cash flow. The integration of Altius Asset Management added A$1.93 billion in assets under management, likely boosting revenue potential through scale efficiencies and enhanced capabilities. With strategic transitions to GROW for super administration and State Street for custody services underway, Australian Ethical aims to streamline operations further while expanding its values-driven product offerings for sustained growth.

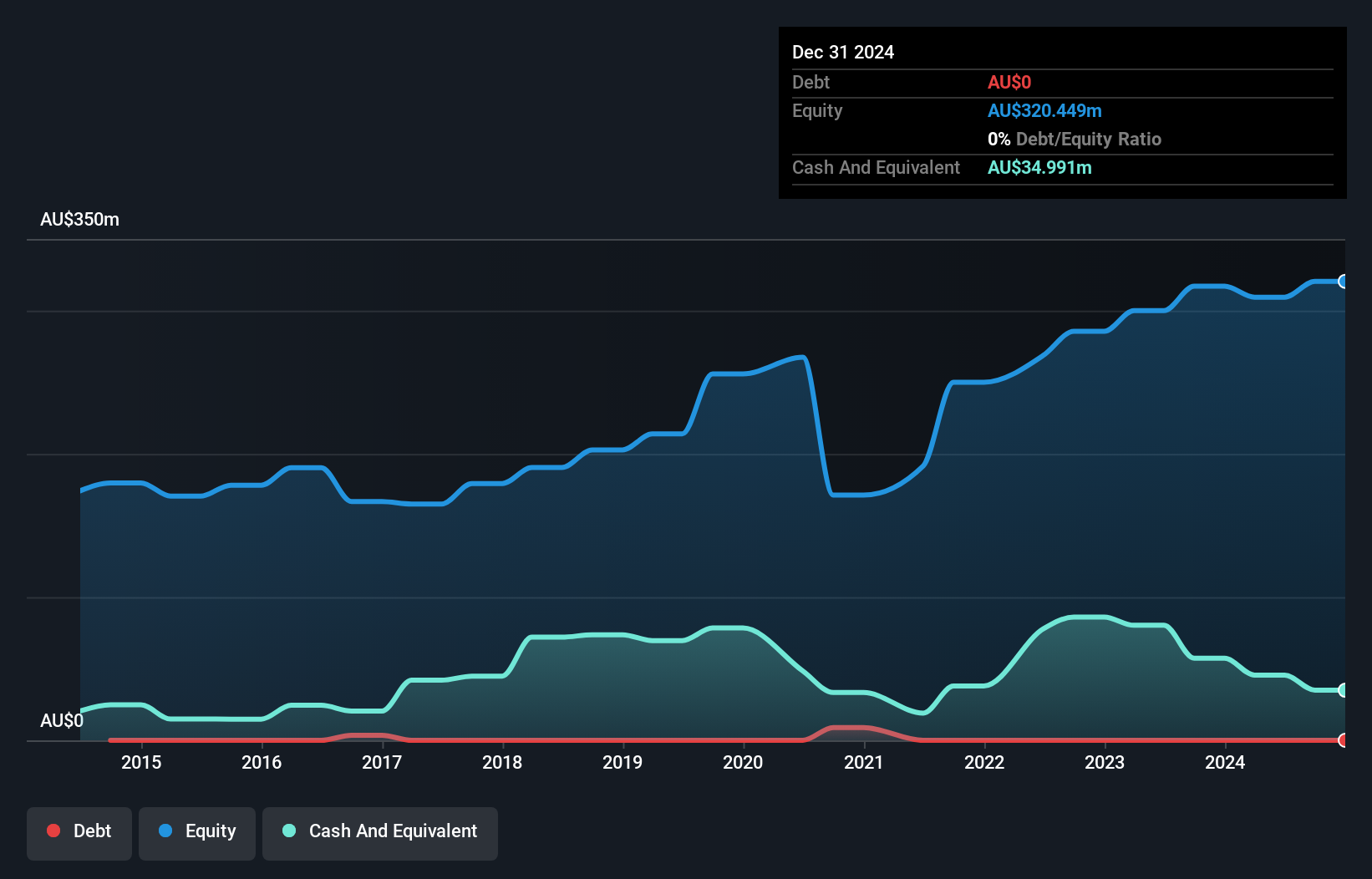

Alkane Resources (ASX:ALK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Alkane Resources Ltd is an Australian company focused on gold exploration and production, with a market capitalization of A$426.91 million.

Operations: Alkane Resources generates revenue primarily from its gold operations, amounting to A$239.14 million.

Alkane Resources, a notable player in Australia's mining sector, showcases a robust growth trajectory with earnings surging by 47% over the past year, outpacing the industry average of 14%. Despite being debt-free now compared to a debt-to-equity ratio of 1.3 five years ago, it trades at an impressive 87% below its estimated fair value. Recent financial results highlight significant progress; third-quarter sales jumped to A$63.2 million from A$30.46 million last year, while net income reached A$8.1 million versus a previous loss of A$2 million. This performance underscores Alkane's potential for continued expansion in the market.

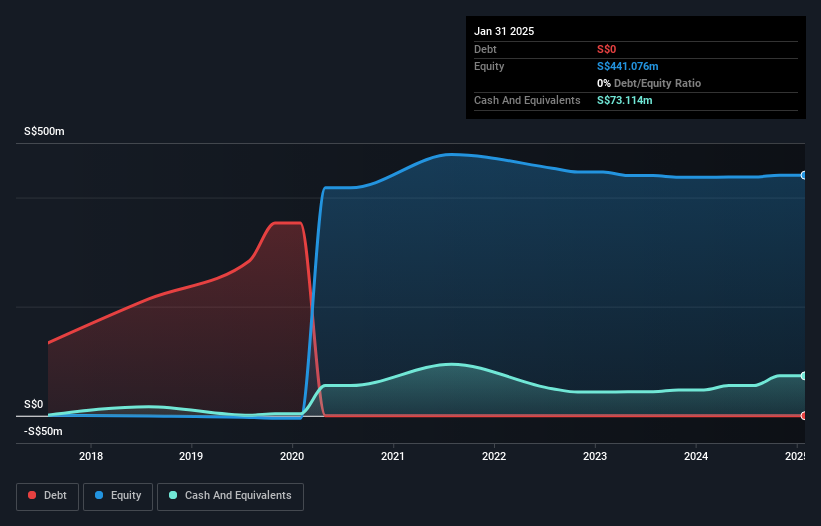

Tuas (ASX:TUA)

Simply Wall St Value Rating: ★★★★★★

Overview: Tuas Limited operates a mobile network in Singapore with a market cap of A$2.73 billion.

Operations: The company generates revenue from its mobile operations, amounting to SGD 135.51 million.

Tuas stands out in the telecom sector with its debt-free status and impressive financial turnaround, becoming profitable this year. The company is projected to see revenue growth of 16.81% annually, highlighting its robust potential against the industry average of 7.8%. Recent executive changes include the resignation of director Robert Millner AO, signaling a shift in leadership dynamics. Its free cash flow has turned positive at A$26.70 million as of July 2025, a significant improvement from previous years' deficits. With high-quality earnings and no debt concerns, Tuas seems poised for steady progress in Australia's competitive market landscape.

- Take a closer look at Tuas' potential here in our health report.

Gain insights into Tuas' past trends and performance with our Past report.

Key Takeaways

- Embark on your investment journey to our 48 ASX Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEF

Australian Ethical Investment

Australian Ethical Investment Ltd is a publicly owned investment manager.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives