- Australia

- /

- Metals and Mining

- /

- ASX:ALK

Alkane Resources (ASX:ALK) Is Up 5.7% After Joining Key ASX Indices Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On September 19, 2025, Alkane Resources Ltd (ASX:ALK) was added to both the S&P/ASX Small Ordinaries Index and the S&P/ASX 300 Index, marking a significant milestone for the company.

- This dual index inclusion increases Alkane Resources' visibility among institutional investors and raises expectations for transparency and governance standards.

- We'll examine how increased investor attention following inclusion in key ASX indices may influence Alkane's investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Alkane Resources' Investment Narrative?

To be an Alkane Resources shareholder, you have to believe in the company's ability to deliver on its ambitious production guidance and exploration upside, while navigating the heightened expectations that come with being added to the S&P/ASX Small Ordinaries and ASX 300 indices. This milestone is likely to boost Alkane’s profile with institutional investors and improve trading liquidity, which could support ongoing capital access. However, the catalysts that matter most in the short term, successful project execution at Tomingley, strong gold and antimony output, and robust commodity pricing, remain fundamentally unchanged. The index inclusion could bring more scrutiny to Alkane’s governance, as recent board changes and low board independence have been flagged as risks. Unless investors overweight the impact of higher visibility, the biggest risks still center on operational delivery, governance, and the company’s premium valuation.

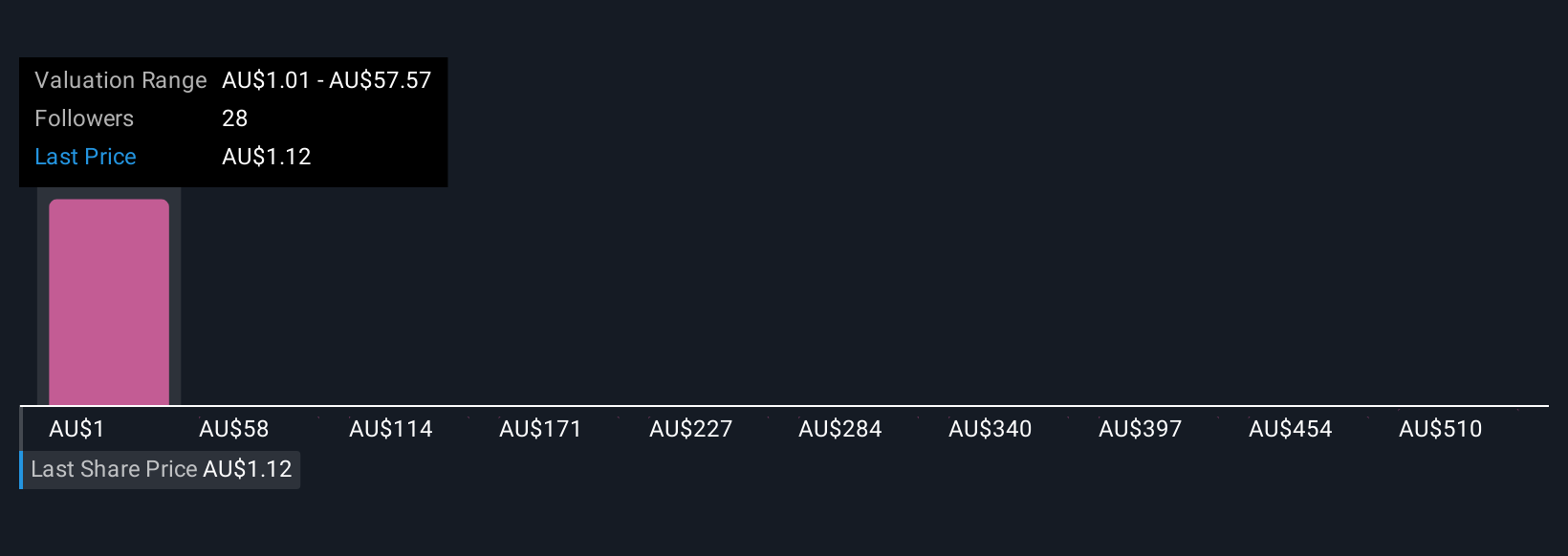

Yet, despite the excitement around Alkane’s index inclusion, concerns remain about board independence and ongoing operational risks. Alkane Resources' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on Alkane Resources - why the stock might be worth over 2x more than the current price!

Build Your Own Alkane Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alkane Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alkane Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alkane Resources' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ALK

Alkane Resources

Operates as a gold exploration and production company in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives