- Australia

- /

- Metals and Mining

- /

- ASX:AIS

Aeris Resources (ASX:AIS): Rethinking Valuation After Macquarie Downgrade and Forecast Cuts

Reviewed by Kshitija Bhandaru

Investor interest in Aeris Resources (ASX:AIS) has picked up following Macquarie’s downgrade. This move came after Aeris shares surged and production forecasts were trimmed, raising fresh questions about the company’s valuation and outlook.

See our latest analysis for Aeris Resources.

This latest surge has put Aeris Resources in the spotlight, with a 1-day share price return of 8.2% and momentum that has seen the stock climb 240% year-to-date. These gains follow a string of strong performances across the sector. It is worth noting the one-year total shareholder return of 164.4% still lags the most recent share price rally, highlighting how fast sentiment has shifted. With the market reassessing production risks and valuation, momentum appears to be building around AIS shares in the short term.

If you’re watching how mining stocks are heating up, now is a great time to broaden your view and discover fast growing stocks with high insider ownership

With shares rallying even as analysts trim forecasts, the question now is whether Aeris Resources remains undervalued or if the market has already factored in all the good news, leaving little room for upside from here.

Most Popular Narrative: 64% Overvalued

According to the most popular narrative, Aeris Resources’ fair value sits well below its last close, painting a sharply different picture from recent market action. The narrative’s fair value is A$0.36 per share versus the last close of A$0.60.

The development of the Murrawombie Pit is expected to generate significant cash flow over the next 12 to 18 months, due to higher-grade ore and increased production levels. This will positively impact revenue and operating cash flows as the pit reaches full operational capacity.

Want to know what’s fueling this bold fair value call? The narrative banks on massive production gains, tightening profit margins and a future earnings multiple far beyond the industry standard. See which precise operational levers and financial bets underpin this controversial valuation.

Result: Fair Value of $0.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Unexpected delays at Murrawombie or pressure from higher project costs could quickly shift sentiment away from the current optimism.

Find out about the key risks to this Aeris Resources narrative.

Another View: Multiples Show a Different Story

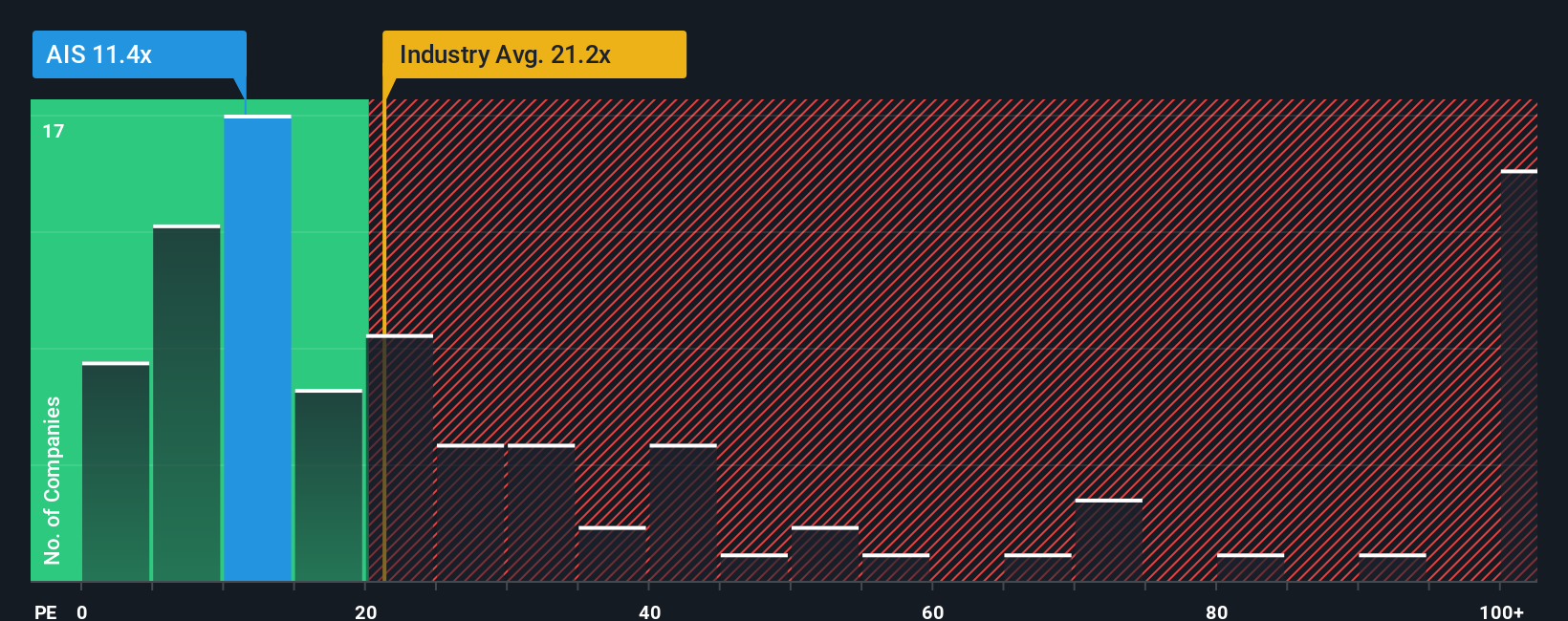

Looking at Aeris Resources using its price-to-earnings ratio tells a different tale compared to the popular fair value narrative. The current ratio is 12.8x, which is lower than both the industry average of 21.6x and the peer average of 37.2x. The fair ratio is even higher at 20.9x, suggesting shares could be trading at a discount if the market eventually moves closer to that benchmark. Does this gap point to a real value opportunity or just more risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aeris Resources Narrative

If you have your own take or want to dig even deeper than the current narratives, you can craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Aeris Resources.

Looking for more investment ideas?

Don’t let smart opportunities slip away. Expand your portfolio and get ahead of the crowd by targeting growth stories and hidden gems with these expert-curated picks:

- Tap into tomorrow’s healthcare breakthroughs and uncover top innovators by scanning these 33 healthcare AI stocks, which highlights advancements in medical AI.

- Seize the income advantage by checking out these 18 dividend stocks with yields > 3%, a source of stable yields for long-term wealth building.

- Spot undervalued stocks that could be positioned for a rebound and review these 881 undervalued stocks based on cash flows, which utilizes rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AIS

Aeris Resources

Explores, produces, and sells precious metals in Australia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)