- Australia

- /

- Metals and Mining

- /

- ASX:AIS

Aeris Resources (ASX:AIS) pulls back 13% this week, but still delivers shareholders incredible 66% CAGR over 3 years

Aeris Resources Limited (ASX:AIS) shareholders might be concerned after seeing the share price drop 28% in the last month. But in three years the returns have been great. In fact, the share price is up a full 148% compared to three years ago. So the recent fall in the share price should be viewed in that context. The thing to consider is whether the underlying business is doing well enough to support the current price.

Since the long term performance has been good but there's been a recent pullback of 13%, let's check if the fundamentals match the share price.

View our latest analysis for Aeris Resources

Because Aeris Resources made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Aeris Resources' revenue trended up 24% each year over three years. That's much better than most loss-making companies. Along the way, the share price gained 35% per year, a solid pop by our standards. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say Aeris Resources is still worth investigating - successful businesses can often keep growing for long periods.

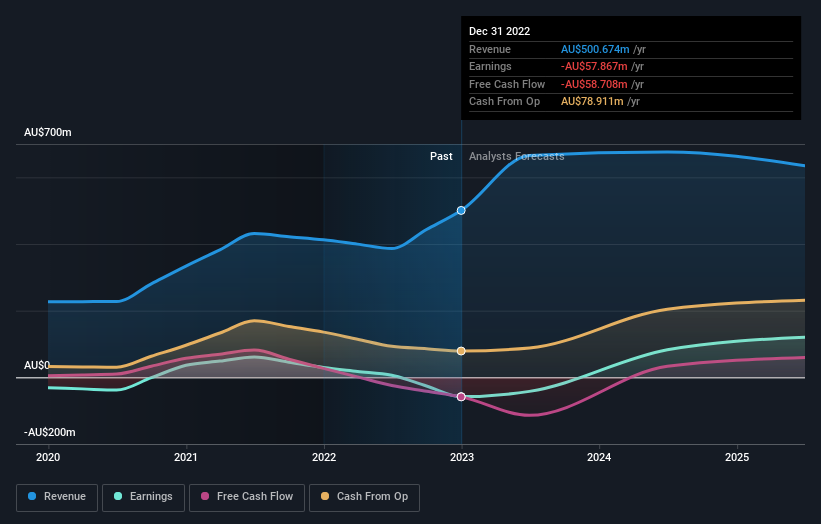

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered Aeris Resources' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Aeris Resources' TSR, at 359% is higher than its share price return of 148%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market lost about 1.4% in the twelve months, Aeris Resources shareholders did even worse, losing 44%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Aeris Resources is showing 1 warning sign in our investment analysis , you should know about...

But note: Aeris Resources may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:AIS

Aeris Resources

Engages in the production, exploration, and sale of precious metals in Australia.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives