- Australia

- /

- Metals and Mining

- /

- ASX:AIS

Aeris Resources (ASX:AIS) Is Up 22.6% After Swinging to FY25 Profit—Has The Bull Case Changed?

Reviewed by Simply Wall St

- Aeris Resources Limited reported full-year results for 2025, posting A$577.06 million in sales and returning to net profitability with earnings of A$45.2 million, after reporting a net loss the previous year.

- This turnaround was supported by stronger operational performance and reserve upgrades at key projects, as well as successful refinancing and entry into the All Ords Index.

- We'll examine how the company's reversal to profitability, driven by improved project execution, reframes its investment outlook and future prospects.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

Aeris Resources Investment Narrative Recap

For investors to back Aeris Resources, they need to trust in the company’s turnaround story, anchored by its return to profitability and reserve upgrades at major projects like Constellation. While the improved full-year results highlight stronger project execution, the key short-term catalyst remains consistent ramp-up at Murrawombie, and this news bolsters that outlook. However, the risk of operational delays at Murrawombie remains the most pressing, and the latest earnings do not eliminate that concern.

Among recent milestones, the March 2025 resource upgrade at the Constellation deposit stands out for its impact on potential production growth. The 24 percent increase in contained copper and 29 percent rise in contained gold reserves directly supports near-term operating targets, providing increased confidence that the company’s production guidance is underpinned by tangible resource improvements.

In contrast, investors should be aware that despite the upbeat results, the risk of production disruptions at key sites like Murrawombie remains...

Read the full narrative on Aeris Resources (it's free!)

Aeris Resources is expected to generate A$510.9 million in revenue and A$4.0 million in earnings by 2028. This forecast reflects an annual revenue decline of 4.0% and an earnings decrease of A$41.2 million from the current earnings of A$45.2 million.

Uncover how Aeris Resources' forecasts yield a A$0.318 fair value, in line with its current price.

Exploring Other Perspectives

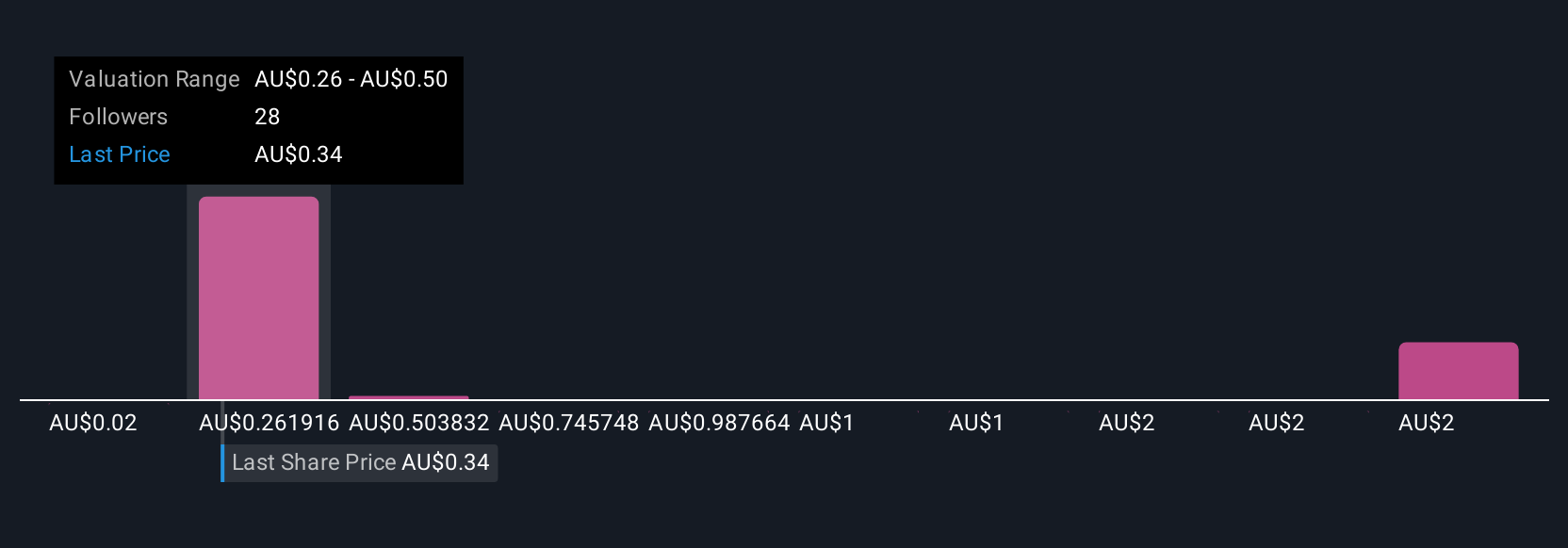

Retail fair value estimates from seven Simply Wall St Community members span from as low as A$0.02 to as high as A$2.42 per share. While many are optimistic about Aeris’s upgraded resources, you should consider ongoing operational challenges that could impact future output and returns.

Explore 7 other fair value estimates on Aeris Resources - why the stock might be worth over 7x more than the current price!

Build Your Own Aeris Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeris Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aeris Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeris Resources' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AIS

Aeris Resources

Engages in the production, exploration, and sale of precious metals in Australia.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives