- Australia

- /

- Metals and Mining

- /

- ASX:AGY

Shareholders May Be A Bit More Conservative With Argosy Minerals Limited's (ASX:AGY) CEO Compensation For Now

The underwhelming share price performance of Argosy Minerals Limited (ASX:AGY) in the past three years would have disappointed many shareholders. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 27 April 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Argosy Minerals

How Does Total Compensation For Jerko Zuvela Compare With Other Companies In The Industry?

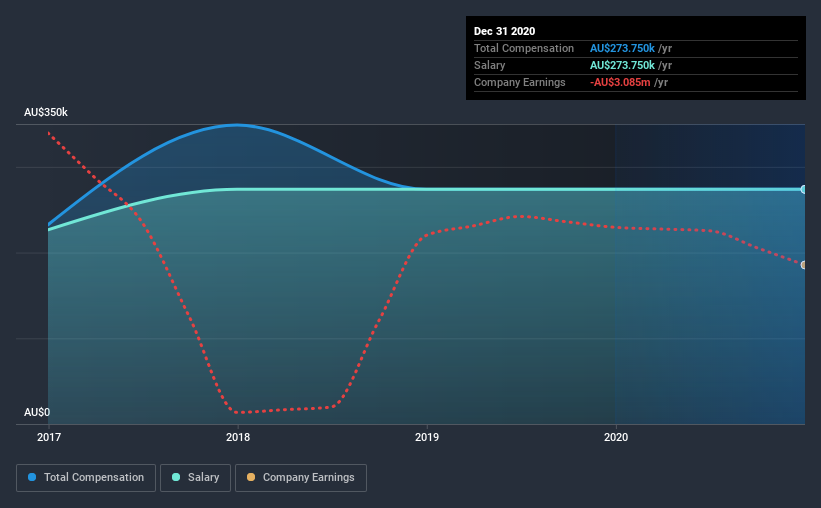

Our data indicates that Argosy Minerals Limited has a market capitalization of AU$116m, and total annual CEO compensation was reported as AU$274k for the year to December 2020. There was no change in the compensation compared to last year. It is worth noting that the CEO compensation consists entirely of the salary, worth AU$274k.

For comparison, other companies in the industry with market capitalizations below AU$258m, reported a median total CEO compensation of AU$302k. So it looks like Argosy Minerals compensates Jerko Zuvela in line with the median for the industry. Moreover, Jerko Zuvela also holds AU$6.5m worth of Argosy Minerals stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | AU$274k | AU$274k | 100% |

| Other | - | - | - |

| Total Compensation | AU$274k | AU$274k | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. On a company level, Argosy Minerals prefers to reward its CEO through a salary, opting not to pay Jerko Zuvela through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Argosy Minerals Limited's Growth

Argosy Minerals Limited's earnings per share (EPS) grew 41% per year over the last three years. It saw its revenue drop 17% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Argosy Minerals Limited Been A Good Investment?

Few Argosy Minerals Limited shareholders would feel satisfied with the return of -71% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Argosy Minerals rewards its CEO solely through a salary, ignoring non-salary benefits completely. Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 5 warning signs (and 2 which are a bit concerning) in Argosy Minerals we think you should know about.

Important note: Argosy Minerals is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Argosy Minerals, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:AGY

Argosy Minerals

Engages in the exploration and development of lithium properties in Argentina and the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion