Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Adelaide Brighton Limited (ASX:ABC) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Adelaide Brighton

What Is Adelaide Brighton's Debt?

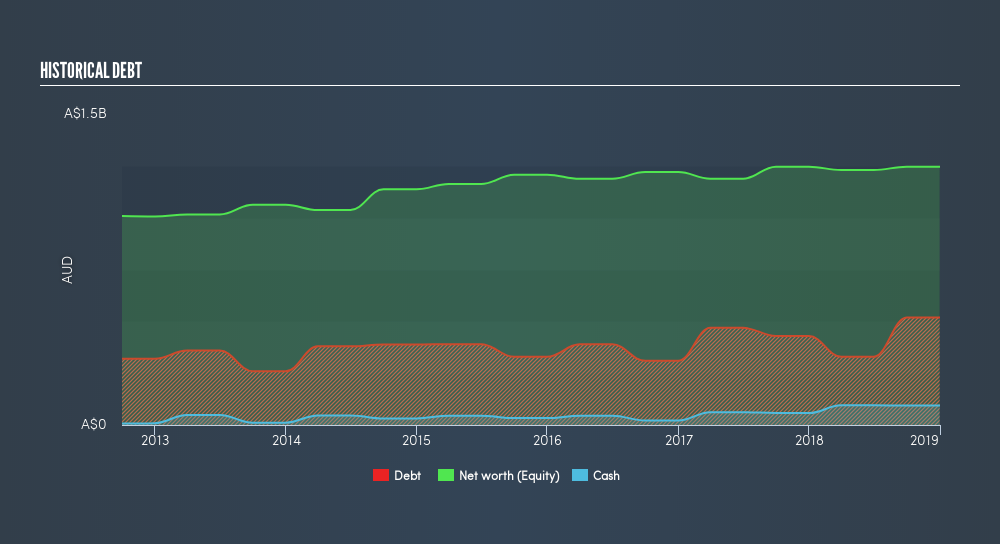

You can click the graphic below for the historical numbers, but it shows that as of December 2018 Adelaide Brighton had AU$518.7m of debt, an increase on AU$429.2m, over one year. However, because it has a cash reserve of AU$93.9m, its net debt is less, at about AU$424.8m.

How Healthy Is Adelaide Brighton's Balance Sheet?

The latest balance sheet data shows that Adelaide Brighton had liabilities of AU$179.3m due within a year, and liabilities of AU$653.2m falling due after that. Offsetting this, it had AU$93.9m in cash and AU$223.0m in receivables that were due within 12 months. So its liabilities total AU$515.6m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Adelaide Brighton is worth AU$2.20b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Adelaide Brighton's net debt is only 1.4 times its EBITDA. And its EBIT covers its interest expense a whopping 16.0 times over. So we're pretty relaxed about its super-conservative use of debt. Importantly Adelaide Brighton's EBIT was essentially flat over the last twelve months. Ideally it can diminish its debt load by kick-starting earnings growth. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Adelaide Brighton's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Adelaide Brighton produced sturdy free cash flow equating to 66% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Adelaide Brighton's impressive interest cover implies it has the upper hand on its debt. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. All these things considered, it appears that Adelaide Brighton can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. We'd be motivated to research the stock further if we found out that Adelaide Brighton insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:ABC

Mediocre balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives