- Australia

- /

- Energy Services

- /

- ASX:MCE

3 ASX Penny Stocks With Market Caps Over A$50M

Reviewed by Simply Wall St

The Australian market has been experiencing some turbulence, with the ASX200 down 0.4% and external factors like potential tariffs affecting currency values. Despite these challenges, sectors such as Staples and Real Estate have shown resilience, suggesting that opportunities still exist for discerning investors. Penny stocks, often smaller or newer companies, remain an intriguing area for those seeking affordability and growth potential; they can offer hidden value when built on strong financial foundations.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.965 | A$319.94M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.83 | A$234.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.525 | A$325.58M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.65 | A$117.72M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.66 | A$813.53M | ★★★★★☆ |

| GTN (ASX:GTN) | A$0.445 | A$87.21M | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.1525 | A$66.44M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.10 | A$118.22M | ★★★★★★ |

Click here to see the full list of 1,046 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Matrix Composites & Engineering (ASX:MCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Matrix Composites & Engineering Ltd specializes in designing, engineering, and manufacturing engineered polymer products for the energy, mining and resource, and defence industries with a market cap of A$61.55 million.

Operations: The company's revenue is primarily derived from its Oil Well Equipment & Services segment, which generated A$85.04 million.

Market Cap: A$61.55M

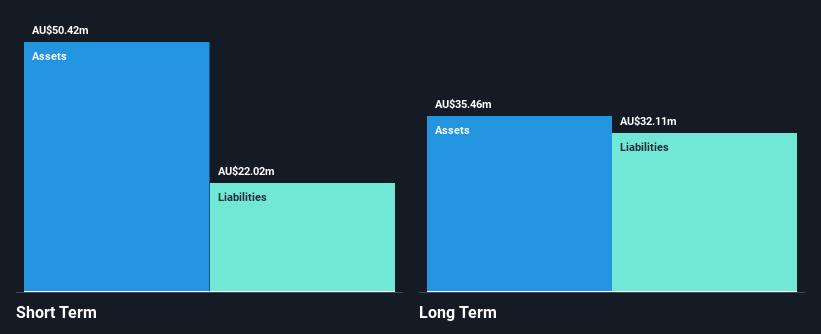

Matrix Composites & Engineering Ltd, with a market cap of A$61.55 million, has shown mixed performance as a penny stock. While the company reported revenue of A$85.04 million from its Oil Well Equipment & Services segment, net income declined to A$3.65 million from the previous year's A$8.68 million, reflecting lower profit margins and negative earnings growth over the past year. Despite this, Matrix maintains financial stability with more cash than total debt and short-term assets exceeding both short- and long-term liabilities. The board is experienced with an average tenure of 7.3 years, although management's experience remains unclear.

- Dive into the specifics of Matrix Composites & Engineering here with our thorough balance sheet health report.

- Assess Matrix Composites & Engineering's future earnings estimates with our detailed growth reports.

Metarock Group (ASX:MYE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Metarock Group Limited operates in Australia, offering mine operation, contracting, training, and related services within the mining and supporting industries, with a market cap of A$54.07 million.

Operations: The company's revenue segment includes Mastermyne, which generated A$294.39 million.

Market Cap: A$54.07M

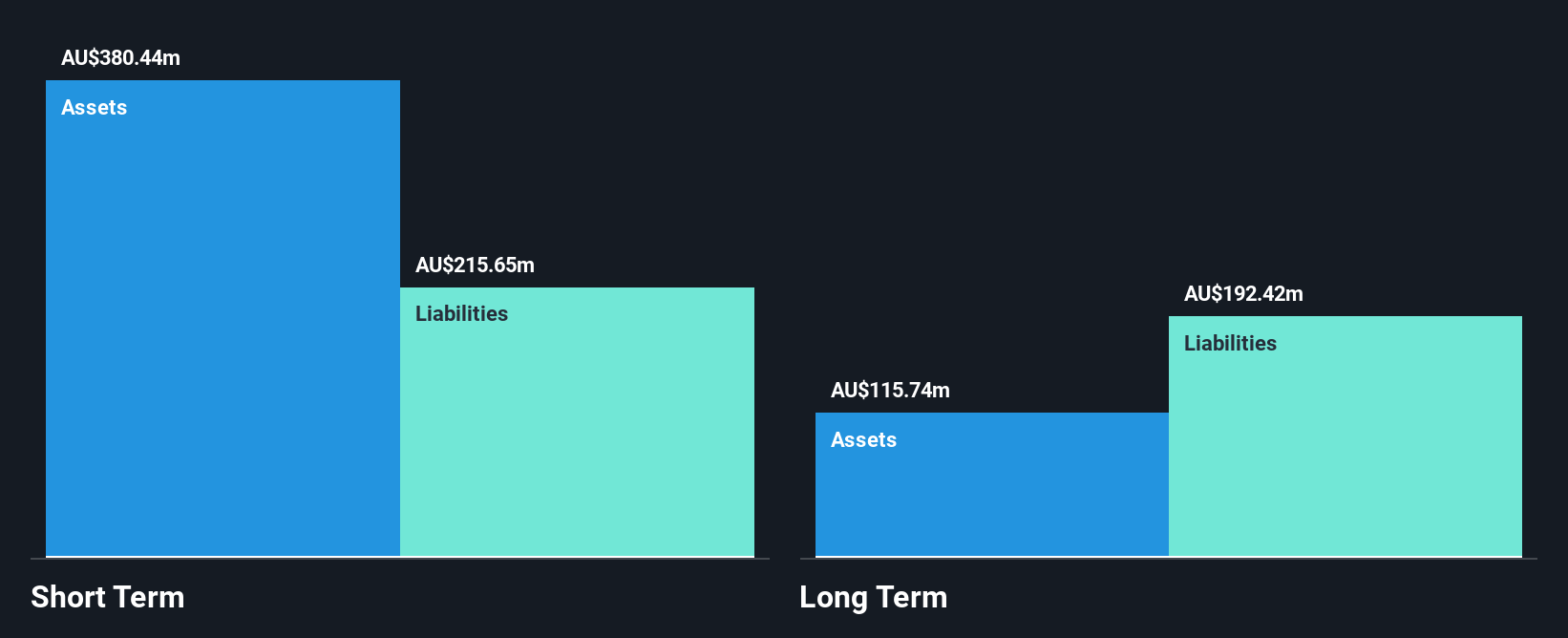

Metarock Group Limited, with a market cap of A$54.07 million, operates in the mining services sector and recently achieved profitability after years of losses. The company reported revenue of A$294.14 million for the fiscal year ending June 30, 2024, and a net income turnaround to A$39.64 million from a previous loss. Its financial health is supported by short-term assets exceeding both short- and long-term liabilities and more cash than debt, although one-off items have impacted recent earnings results. The board's average tenure is relatively low at 1.3 years, indicating potential governance changes ahead.

- Click to explore a detailed breakdown of our findings in Metarock Group's financial health report.

- Examine Metarock Group's past performance report to understand how it has performed in prior years.

NobleOak Life (ASX:NOL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NobleOak Life Limited operates in Australia, focusing on the manufacturing and distribution of life insurance products, with a market capitalization of A$144.70 million.

Operations: NobleOak Life Limited generates revenue from three main segments: Genus (A$14.98 million), Direct (A$86.65 million), and Strategic Partnerships (A$275.19 million).

Market Cap: A$144.7M

NobleOak Life Limited, with a market cap of A$144.70 million, operates in the life insurance sector and reported net income of A$9.28 million for the year ending June 30, 2024, down from A$13.51 million previously. Despite challenges like negative earnings growth over the past year and low profit margins (2.5%), NobleOak remains debt-free with strong asset coverage over liabilities. The board's seasoned tenure contrasts with a less experienced management team averaging 1.9 years in tenure, suggesting recent leadership changes may impact future strategy execution amidst forecasted earnings growth of 23.93% annually.

- Click here to discover the nuances of NobleOak Life with our detailed analytical financial health report.

- Learn about NobleOak Life's future growth trajectory here.

Make It Happen

- Get an in-depth perspective on all 1,046 ASX Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MCE

Matrix Composites & Engineering

Engages in the design, engineering, and manufacturing of engineered polymer products for the energy, mining and resource, and defence industries.

Reasonable growth potential with adequate balance sheet.