- Australia

- /

- Metals and Mining

- /

- ASX:BIS

Top ASX Dividend Stocks To Consider In July 2025

Reviewed by Simply Wall St

As the Australian market navigates a slight dip following an unexpected climb into the 8,700s, investors are keeping a close eye on global influences and upcoming earnings reports to gauge future movements. In this fluctuating environment, dividend stocks can offer stability and potential income streams, making them an attractive option for those looking to balance their portfolios amidst current market dynamics.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.97% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.20% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 6.02% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.16% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.86% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.67% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.94% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.80% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.93% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.73% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bisalloy Steel Group (ASX:BIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bisalloy Steel Group Limited manufactures and sells quenched and tempered, high-tensile, and abrasion-resistant steel plates in Australia, Indonesia, Thailand, and internationally with a market cap of A$196.92 million.

Operations: Bisalloy Steel Group Limited generates revenue from the production and distribution of specialized steel plates designed for high-tensile strength and abrasion resistance across markets in Australia, Indonesia, Thailand, and other international regions.

Dividend Yield: 4.7%

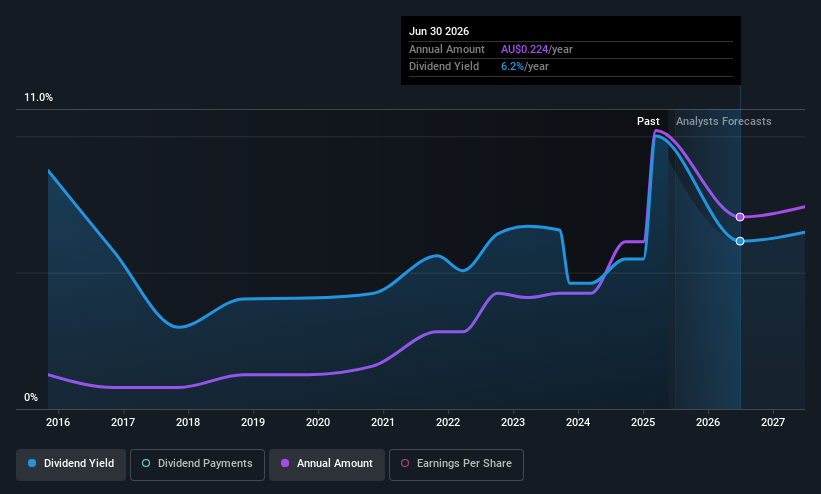

Bisalloy Steel Group maintains a dividend payout ratio of 81.2%, indicating that its dividends are covered by earnings, and with a cash payout ratio of 40%, they are well-supported by cash flows. Despite a low dividend yield of 4.7% compared to top-tier Australian stocks, BIS's dividend payments have increased over the past decade but remain volatile and unreliable. The stock trades at a significant discount to its estimated fair value, suggesting potential for capital appreciation.

- Click here and access our complete dividend analysis report to understand the dynamics of Bisalloy Steel Group.

- Our comprehensive valuation report raises the possibility that Bisalloy Steel Group is priced lower than what may be justified by its financials.

Medibank Private (ASX:MPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Medibank Private Limited operates as a provider of private health insurance and health services in Australia, with a market cap of A$13.83 billion.

Operations: Medibank Private Limited generates revenue primarily from its Health Insurance segment, amounting to A$8.06 billion, and its Medibank Health segment, which contributes A$447.10 million.

Dividend Yield: 3.3%

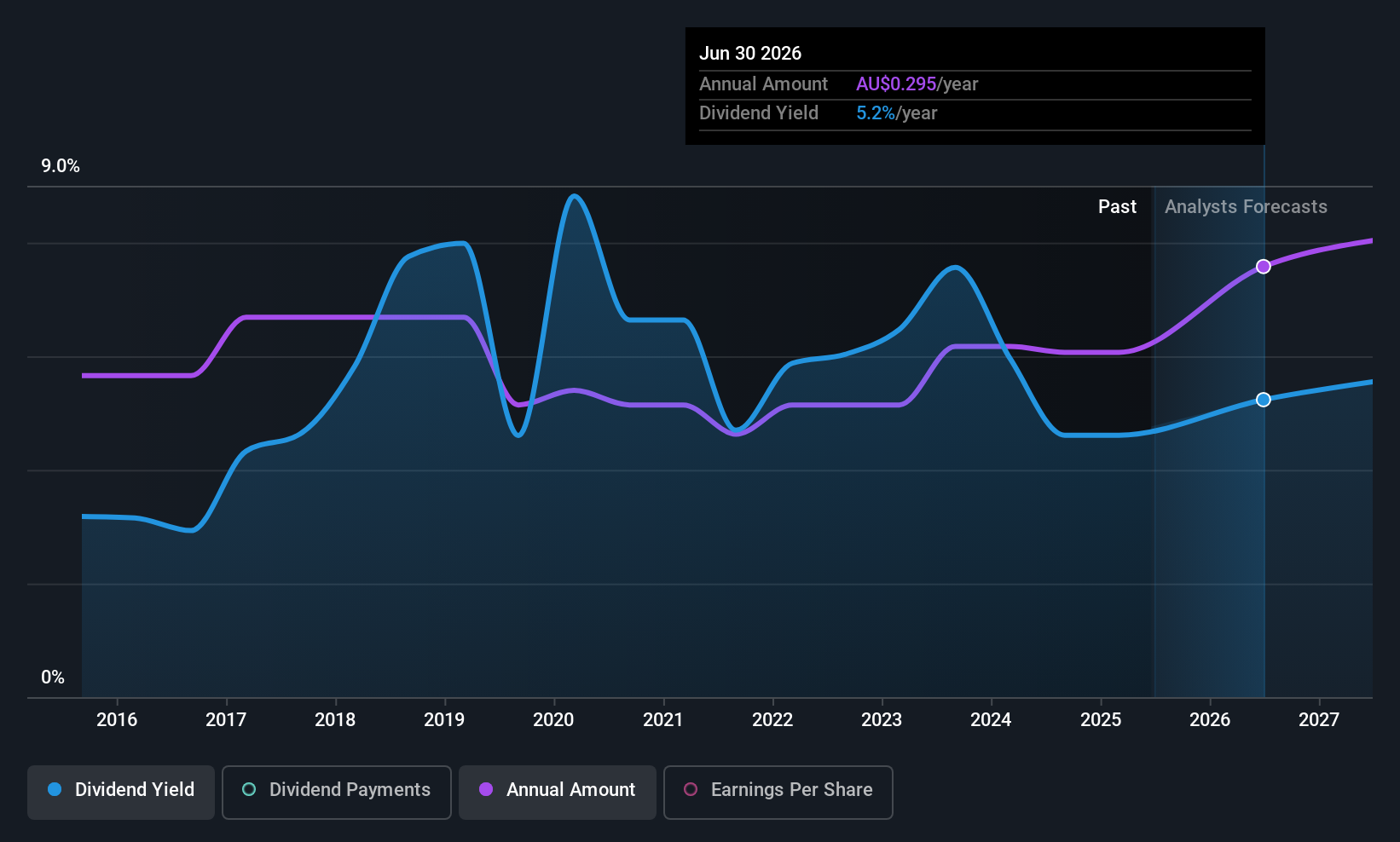

Medibank Private's dividend yield of 3.31% is low compared to the top Australian dividend payers, and its high payout ratio of 96.7% suggests dividends are not well covered by earnings. However, dividends have been stable and growing over the past decade, supported by cash flows with an 82.6% cash payout ratio. Trading at a discount to its estimated fair value indicates potential for capital gains despite concerns about dividend sustainability.

- Unlock comprehensive insights into our analysis of Medibank Private stock in this dividend report.

- Our valuation report here indicates Medibank Private may be overvalued.

Servcorp (ASX:SRV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Servcorp Limited offers executive serviced and virtual offices, coworking spaces, and IT, communications, and secretarial services with a market cap of A$570.86 million.

Operations: Servcorp Limited generates revenue primarily from its Real Estate - Rental segment, which amounts to A$326.36 million.

Dividend Yield: 4.1%

Servcorp's dividend payments are well-covered by both earnings and cash flows, with a payout ratio of 47.1% and a cash payout ratio of 13.3%. Despite this, its dividend yield of 4.1% is lower than the top Australian payers, and the track record has been volatile over the past decade. However, recent earnings growth suggests potential stability ahead. Trading at a significant discount to its fair value presents an attractive valuation for investors seeking capital appreciation alongside dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Servcorp.

- The analysis detailed in our Servcorp valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Navigate through the entire inventory of 28 Top ASX Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bisalloy Steel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BIS

Bisalloy Steel Group

Engages in the manufacture and sale of quenched and tempered, high-tensile, and abrasion resistant steel plates in Australia, Indonesia, Thailand, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives