- Australia

- /

- Healthcare Services

- /

- ASX:IDX

3 ASX Stocks Conceivably Trading Below Intrinsic Value By Up To 48.3%

Reviewed by Simply Wall St

The market has been flat over the last week but is up 10.0% over the past year, with earnings forecast to grow by 12% annually. In this environment, identifying stocks that are trading below their intrinsic value can provide significant opportunities for investors seeking potential gains.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hansen Technologies (ASX:HSN) | A$4.25 | A$8.21 | 48.3% |

| IPH (ASX:IPH) | A$6.23 | A$11.55 | 46.1% |

| Ansell (ASX:ANN) | A$29.62 | A$56.66 | 47.7% |

| MLG Oz (ASX:MLG) | A$0.65 | A$1.18 | 44.8% |

| Shine Justice (ASX:SHJ) | A$0.74 | A$1.34 | 44.6% |

| HMC Capital (ASX:HMC) | A$8.34 | A$15.48 | 46.1% |

| VEEM (ASX:VEE) | A$1.74 | A$3.23 | 46.1% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Clover (ASX:CLV) | A$0.395 | A$0.72 | 45.3% |

| Superloop (ASX:SLC) | A$1.705 | A$3.31 | 48.6% |

We're going to check out a few of the best picks from our screener tool.

Hansen Technologies (ASX:HSN)

Overview: Hansen Technologies Limited (ASX:HSN) develops, integrates, and supports billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$862.97 million.

Operations: The company's revenue from billing systems software amounts to A$347.61 million.

Estimated Discount To Fair Value: 48.3%

Hansen Technologies appears undervalued based on cash flows, trading at A$4.25, significantly below its estimated fair value of A$8.21. Despite a decline in net profit margins from 13.7% to 6%, earnings are forecast to grow at 20.9% per year, outpacing the Australian market's growth rate of 12.3%. Recent financials show revenue increased from A$315.22 million to A$355.43 million, though net income fell from A$42.8 million to A$21.06 million.

- The analysis detailed in our Hansen Technologies growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Hansen Technologies.

Integral Diagnostics (ASX:IDX)

Overview: Integral Diagnostics Limited (ASX:IDX) is a healthcare services company that provides diagnostic imaging services to medical professionals and patients in Australia and New Zealand, with a market cap of A$617.54 million.

Operations: The company generates revenue from diagnostic imaging services provided to general practitioners, medical specialists, and allied health professionals in Australia and New Zealand.

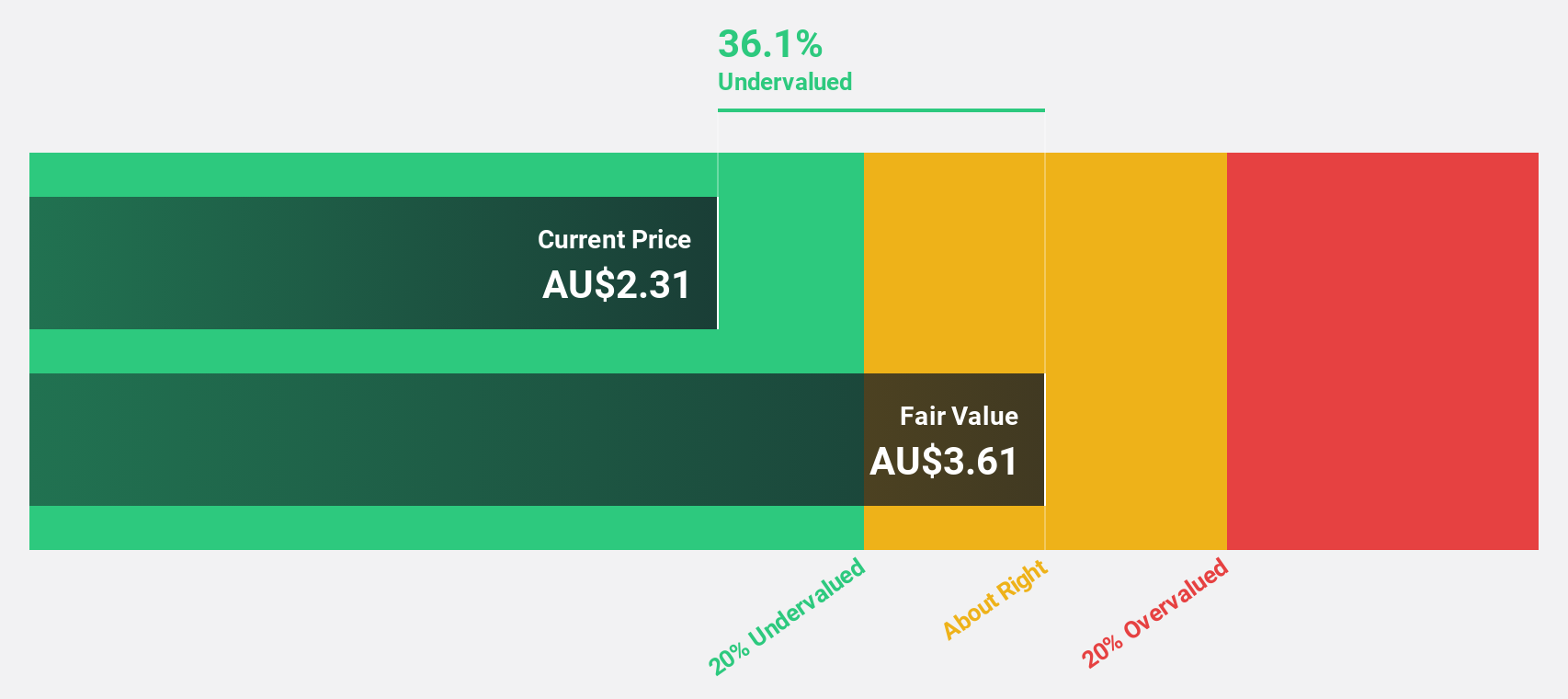

Estimated Discount To Fair Value: 12.5%

Integral Diagnostics (A$2.64) trades below its estimated fair value of A$3.02, suggesting potential undervaluation based on cash flows. The company's revenue is forecast to grow at 6.5% per year, outpacing the Australian market's 5.4%. However, recent financials show a net loss of A$60.7 million for FY2024 compared to a net income of A$25.04 million the previous year, highlighting some financial challenges despite anticipated profitability in three years and ongoing strategic mergers and acquisitions efforts.

- According our earnings growth report, there's an indication that Integral Diagnostics might be ready to expand.

- Click here to discover the nuances of Integral Diagnostics with our detailed financial health report.

Medibank Private (ASX:MPL)

Overview: Medibank Private Limited (ASX:MPL) offers private health insurance and health services in Australia, with a market cap of approximately A$10.69 billion.

Operations: Medibank's revenue segments include A$7.90 billion from Health Insurance and A$360.10 million from Medibank Health services.

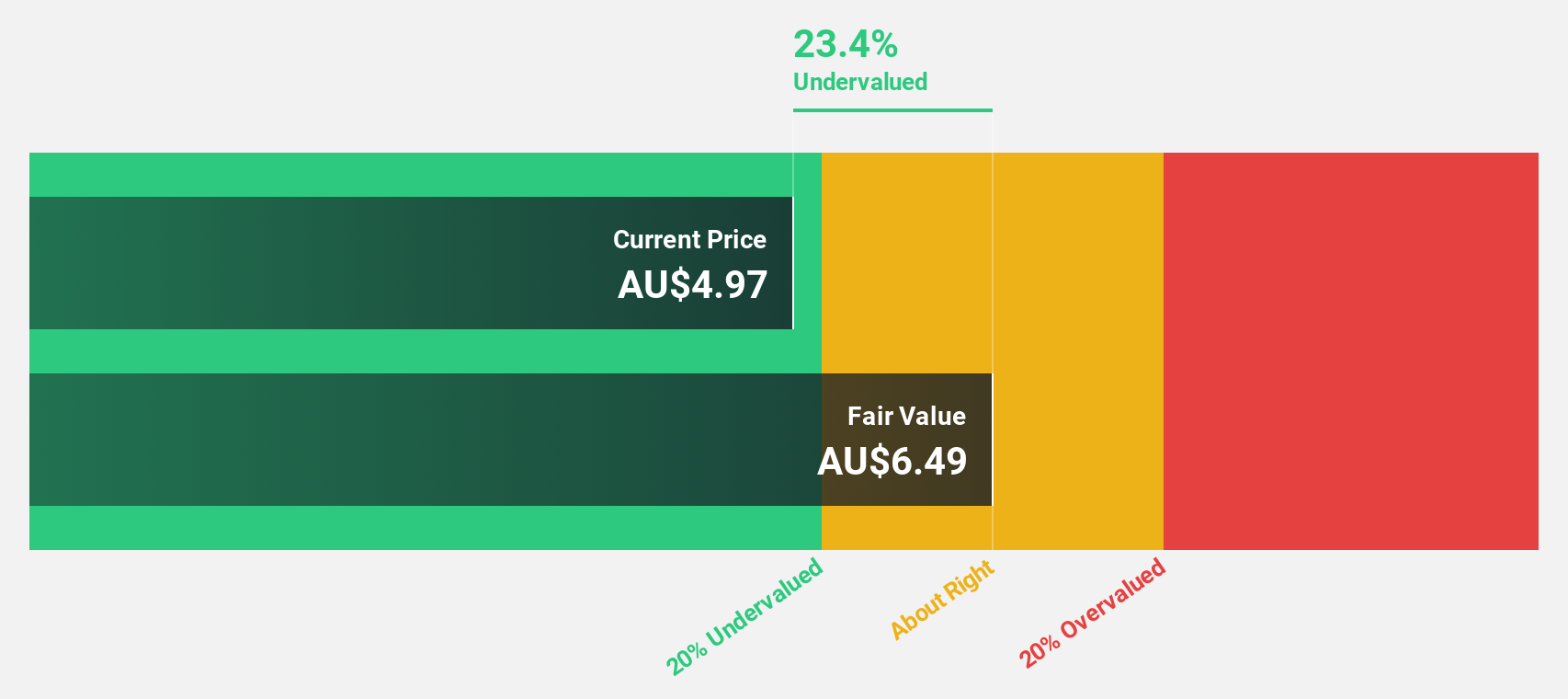

Estimated Discount To Fair Value: 40.1%

Medibank Private (A$3.88) trades at a 40.1% discount to its estimated fair value of A$6.48, indicating significant undervaluation based on cash flows. Despite slower revenue growth forecasts of 4.6% annually, earnings are expected to grow significantly at 28.2% per year, outpacing the broader Australian market's 12.3%. However, the dividend yield of 4.28% is not well covered by earnings, and recent net income was A$3.9 million for FY2024 amidst ongoing M&A activities in primary healthcare with Macquarie Group.

- Our growth report here indicates Medibank Private may be poised for an improving outlook.

- Dive into the specifics of Medibank Private here with our thorough financial health report.

Make It Happen

- Navigate through the entire inventory of 46 Undervalued ASX Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:IDX

Integral Diagnostics

A healthcare services company, engages in the provision of diagnostic imaging services to general practitioners, medical specialists, and allied health professionals and their patients in Australia and New Zealand.

Reasonable growth potential and fair value.