Positive Sentiment Still Eludes Rubicon Water Limited (ASX:RWL) Following 29% Share Price Slump

The Rubicon Water Limited (ASX:RWL) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

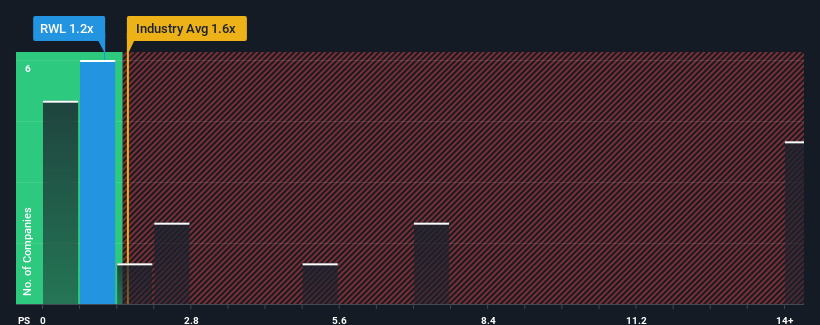

After such a large drop in price, Rubicon Water may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Electronic industry in Australia have P/S ratios greater than 1.9x and even P/S higher than 8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Rubicon Water

What Does Rubicon Water's Recent Performance Look Like?

Rubicon Water could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rubicon Water.How Is Rubicon Water's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Rubicon Water's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 5.7% gain to the company's revenues. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 28% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 17% per year over the next three years. That's shaping up to be materially higher than the 14% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Rubicon Water's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Rubicon Water's P/S

Rubicon Water's recently weak share price has pulled its P/S back below other Electronic companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Rubicon Water currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You should always think about risks. Case in point, we've spotted 2 warning signs for Rubicon Water you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:RWL

Rubicon Water

Designs, manufactures, installs, and maintains irrigation automation software and hardware in Australia, New Zealand, Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives