Should You Reassess AUB Group After Recent Share Price Pullback?

Reviewed by Simply Wall St

Thinking of what to do with AUB Group stock? You are not alone. Investors keeping an eye on this fast-growing insurance broker have recently had a bit of a rollercoaster experience. After climbing steadily over the past year with a 16.4% gain, and an impressive 141.8% return over five years, the share price has paused for breath. It is down 4.1% over the last week but still up 2.1% for the past month and 9.3% year-to-date. These movements are catching plenty of attention, especially as broader market developments nudge sentiment in the sector, creating both pockets of optimism and caution among stakeholders.

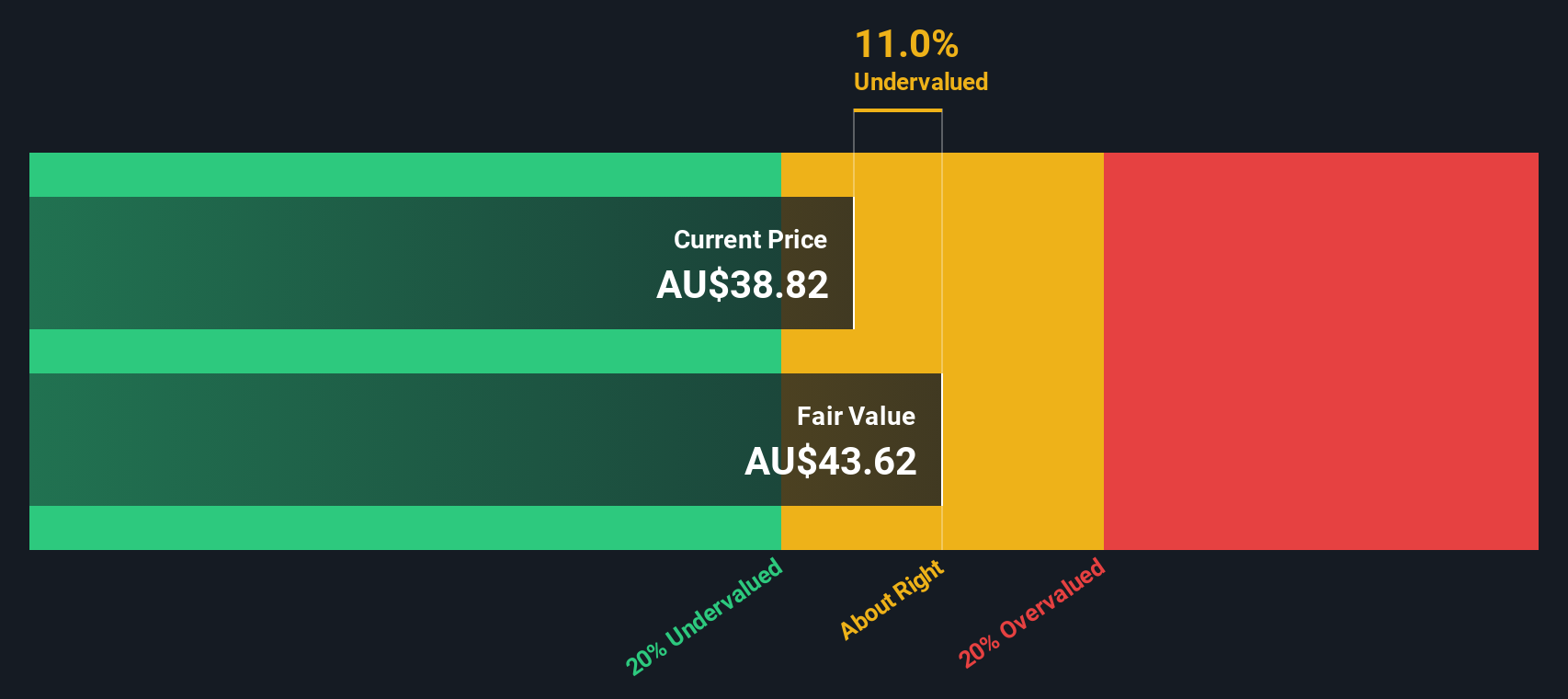

So where does that leave us when it comes to valuation? AUB Group currently picks up a value score of 3 out of 6 on our standardized checklist, meaning it is passing half of the key tests for being undervalued. While that does not make it a screaming bargain, it also suggests there is some real potential still under the surface, especially if the market is mispricing the company’s longer-term prospects.

Next, let’s break down exactly how AUB Group stacks up through different valuation lenses and see which methods are shining a light on what the numbers might be missing. Stay tuned, as we will end with an even better way to think about valuation that could change how you look at this stock altogether.

Why AUB Group is lagging behind its peersApproach 1: AUB Group Excess Returns Analysis

The Excess Returns model evaluates how efficiently a company uses its equity by measuring the returns it generates over and above its cost of capital. For AUB Group, this model focuses on return on invested capital and future growth forecasts, helping to identify value that traditional metrics might overlook.

According to the latest analysis, AUB Group’s Book Value stands at A$14.51 per share, with analysts projecting a Stable Book Value of A$15.58 per share in the future. The expected Stable Earnings Per Share (EPS) is A$1.96, based on estimates from nine analysts. Meanwhile, the Cost of Equity is A$1.01 per share, resulting in an Excess Return of A$0.95 per share. The company’s average Return on Equity over the period is estimated at 12.57%, which is a solid result for its sector.

Applying the Excess Returns methodology, this performance suggests that the intrinsic value for AUB Group shares is A$43.78. With the current share price reflecting a 22.4% discount to this fair value estimate, the model indicates the stock is undervalued at today’s levels.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for AUB Group.

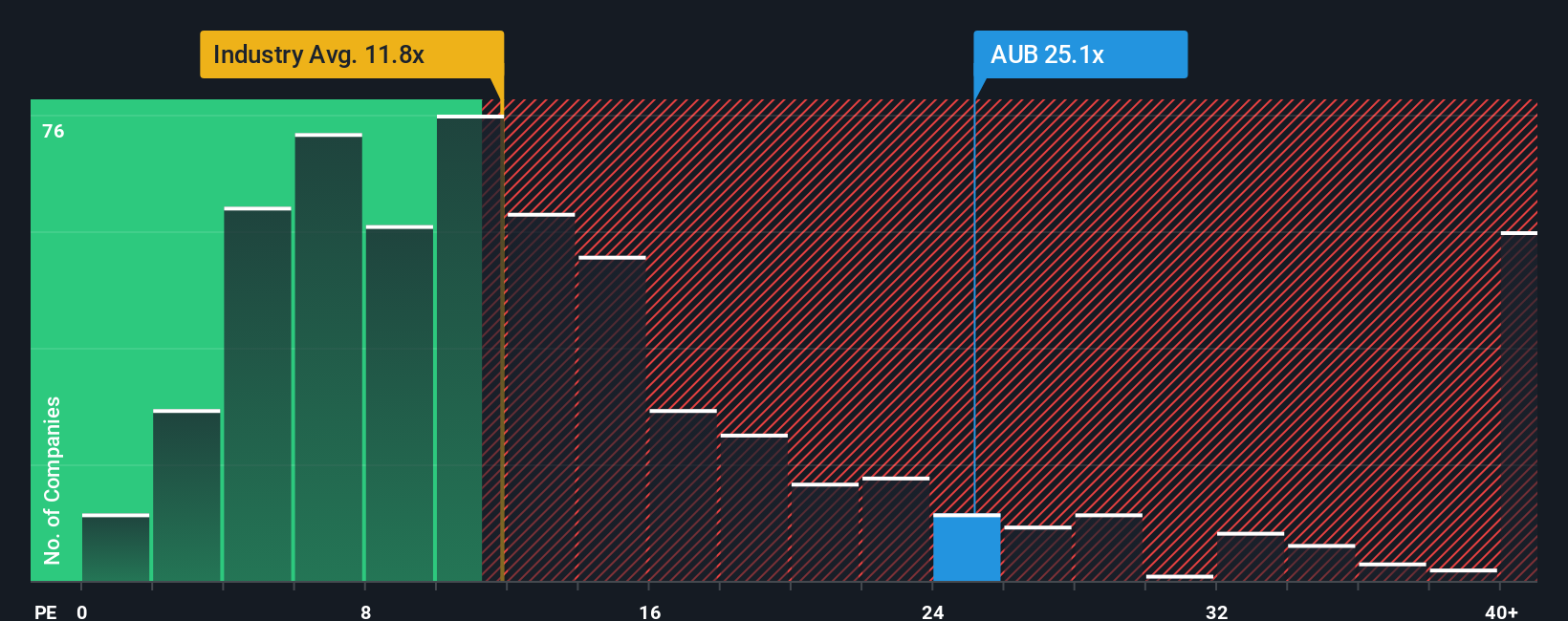

Approach 2: AUB Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like AUB Group because it gauges how much investors are paying for each dollar of earnings. It is especially relevant here as AUB has established a consistent track record of profitability, making earnings-based valuations meaningful and practical.

What counts as a “normal” or “fair” PE ratio depends on factors such as expected growth and business risk. Fast-growing, stable companies typically command higher PE ratios than slower-growing, riskier peers. For example, the insurance sector’s average PE is 12.2x, while peers of AUB Group are priced even higher at 34.1x, reflecting varying outlooks and risk appetites.

Currently, AUB Group trades on a PE ratio of 22.0x. Simply Wall St’s unique “Fair Ratio” for AUB is 20.2x, which considers more than just simple averages. The Fair Ratio weighs elements such as AUB’s earnings growth prospects, profit margins, size, industry positioning, and specific risks, offering a more holistic and tailored benchmark than generic peer or industry figures. Because AUB’s actual PE is only 1.8x above its calculated Fair Ratio, the stock appears only modestly above fair value but not to an extent that suggests a major mispricing.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your AUB Group Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful idea: it is your own story or perspective on AUB Group's future, captured as your assumptions about growth, earnings, margins, and a fair value.

Rather than relying solely on ratios or analyst targets, Narratives help you connect the underlying business story with robust financial forecasts and a fair value. This lets you see exactly how your expectations compare with reality. On Simply Wall St's platform, millions of investors use Narratives on each company's Community page, making it easy and accessible to map out your thinking and keep track as circumstances change.

Narratives dynamically update whenever new information, such as earnings or important news, comes in. This makes them a living view of the market’s evolving expectations. They give you a clear comparison between Fair Value and the current Price, so you can decide if it's finally time to buy, sell, or hold based on your personal outlook.

For AUB Group, some investors expect aggressive digital investments and acquisitions could justify a fair value in the high A$37s, while more cautious perspectives put the value below A$35. With Narratives, your interpretation really matters.

Do you think there's more to the story for AUB Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AUB

AUB Group

Engages in the insurance broking and underwriting agency businesses in Australia, the United States, the United Kingdom, Rest of Europe, New Zealand, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives