Exploring AUB Group (ASX:AUB) Valuation: Is There More Upside After a Strong Year?

Reviewed by Simply Wall St

If you have been watching AUB Group (ASX:AUB), recent moves in its share price might have you wondering what is really driving sentiment. There hasn't been a single headline event shaking things up, but the stock's activity is grabbing attention, as investors weigh whether the latest signals point to hidden value or shifting expectations for the year ahead. It is one of those moments when looking past the surface could make all the difference.

Looking at the bigger picture, AUB Group has delivered a 17% return over the past year, outpacing many in its sector while also weathering the usual ups and downs. Share price performance has been positive this year, while short-term moves have been more mixed. Combined with steady annual revenue and net income growth, at 10% and 7% respectively, there is a sense that momentum is holding, but questions remain about how much upside is left.

So after this year’s steady rise, is the market still underestimating AUB Group’s potential, or is the current price already baking in all the future growth?

Most Popular Narrative: 9.8% Undervalued

The prevailing narrative views AUB Group as modestly undervalued, arguing that future earnings gains and margin improvement could justify a higher price. According to this perspective, analyst forecasts see meaningful operational and strategic catalysts contributing to further upside potential.

AUB's accelerating investment in digital platforms (such as BizCover's technology upgrades and new product launches) and data-driven client offerings positions the group to capture efficiency gains, enhance customer retention, and streamline underwriting and distribution. This supports sustainable margin expansion and earnings growth.

Want to know why analysts think today’s price is just the beginning? The real story lies in bold assumptions about double-digit growth and ambitious profit targets. The logic behind this price target might surprise you. See what’s powering these high expectations for AUB Group.

Result: Fair Value of $37.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intense competition in key segments and challenges with integrating new acquisitions could quickly limit AUB Group’s future growth and put pressure on margins.

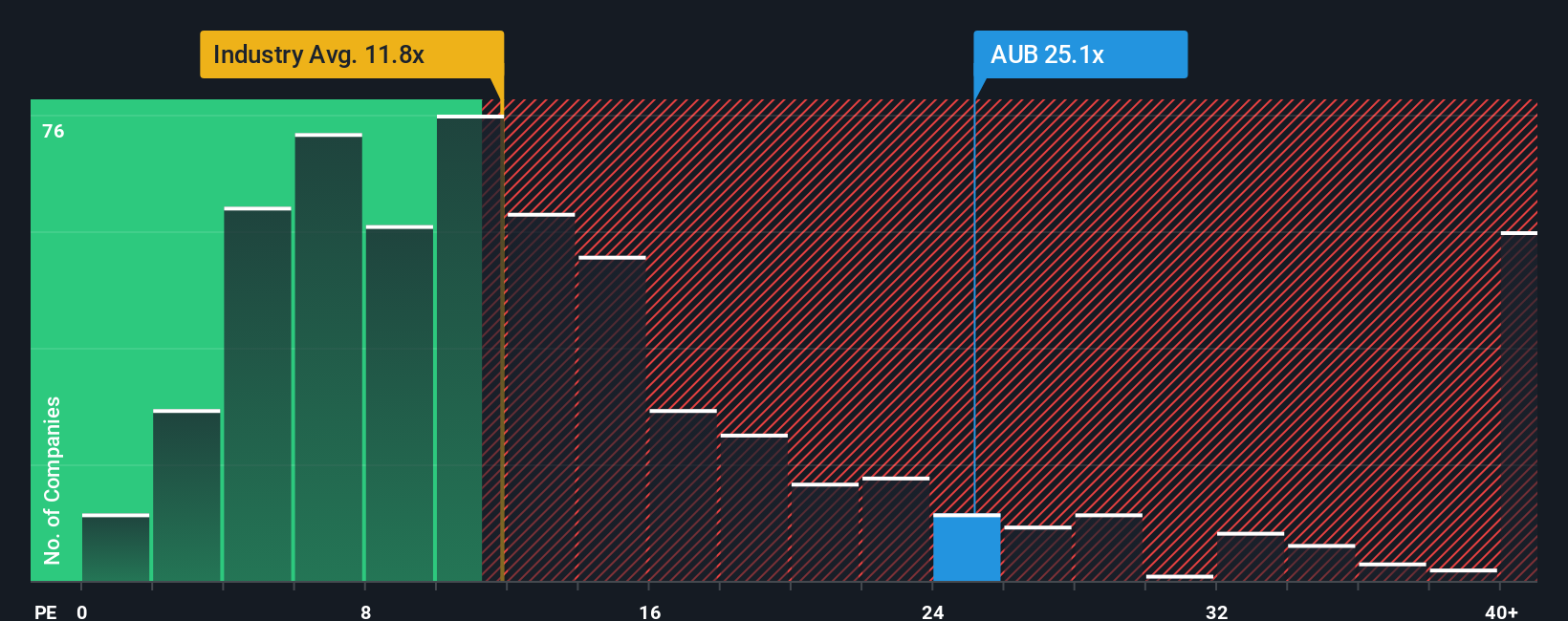

Find out about the key risks to this AUB Group narrative.Another View: What Do Earnings Ratios Say?

While DCF analysis suggests value, some investors look at how today's price compares to earnings across the global insurance sector. On this measure, AUB Group screens as more expensive than the industry average. Could this premium be justified?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding AUB Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own AUB Group Narrative

If you have a different take or prefer diving into the numbers firsthand, you can craft your own view in just a few minutes. Do it your way

A great starting point for your AUB Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit yourself to a single opportunity. Great companies are out there, and with the right tools, you can spot your next top pick before the crowd does.

- Spot the next big winners by targeting underpriced stocks with strong fundamentals using our undervalued stocks based on cash flows.

- Boost your portfolio’s income potential with a curated list of dividend stocks with yields > 3% that consistently reward investors.

- Ride the wave of digital transformation by tracking game-changers in artificial intelligence with our handpicked AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:AUB

AUB Group

Engages in the insurance broking and underwriting agency businesses in Australia, the United States, the United Kingdom, Rest of Europe, New Zealand, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives