- Australia

- /

- Personal Products

- /

- ASX:MCP

Central Petroleum And 2 More ASX Penny Stocks To Watch

Reviewed by Simply Wall St

The Australian market experienced a mixed day, with the ASX closing just above 8,300 points amid a choppy earnings season. In such uncertain times, investors often look towards smaller or newer companies that offer potential growth opportunities at lower price points. Penny stocks may be an outdated term, but they continue to represent intriguing prospects for those seeking value and growth in overlooked corners of the market.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$145.87M | ★★★★☆☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.00 | A$93.64M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.45 | A$275.96M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$2.05 | A$335.4M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.54 | A$103.1M | ★★★★★★ |

| Bisalloy Steel Group (ASX:BIS) | A$3.21 | A$153.29M | ★★★★★★ |

| Dusk Group (ASX:DSK) | A$1.03 | A$65.69M | ★★★★★★ |

| MotorCycle Holdings (ASX:MTO) | A$1.81 | A$136.54M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.34 | A$340.76M | ★★★★☆☆ |

| Lindsay Australia (ASX:LAU) | A$0.70 | A$220.39M | ★★★★☆☆ |

Click here to see the full list of 1,036 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Central Petroleum (ASX:CTP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Central Petroleum Limited is an Australian company involved in the development, production, processing, and marketing of hydrocarbons with a market cap of A$48.44 million.

Operations: The company generates revenue of A$37.15 million from its producing assets segment.

Market Cap: A$48.44M

Central Petroleum, with a market cap of A$48.44 million, has recently turned profitable, marking a significant shift in its financial trajectory. The company generates A$37.15 million in revenue from its producing assets segment and boasts a strong Return on Equity at 38.2%. Its debt is well managed, covered by operating cash flow at 29.6%, and it holds more cash than total debt. However, short-term assets do not cover long-term liabilities (A$52.9M). Despite these challenges, Central Petroleum trades at good value compared to peers and remains undiluted over the past year.

- Dive into the specifics of Central Petroleum here with our thorough balance sheet health report.

- Explore Central Petroleum's analyst forecasts in our growth report.

Little Green Pharma (ASX:LGP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Little Green Pharma Ltd is involved in the cultivation, production, and distribution of medicinal cannabis products both in Australia and internationally, with a market cap of A$40.89 million.

Operations: The company's revenue is derived entirely from its pharmaceuticals segment, amounting to A$28.88 million.

Market Cap: A$40.89M

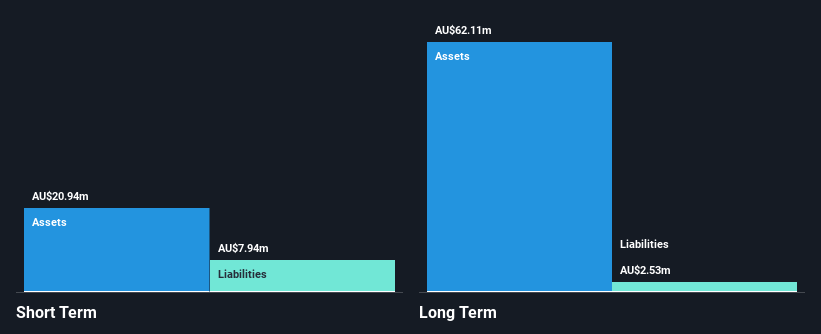

Little Green Pharma Ltd, with a market cap of A$40.89 million, is navigating the challenges of being unprofitable while maintaining positive free cash flow and a sufficient cash runway for over three years. Despite its negative Return on Equity (-12.99%) and increased net loss (A$3.46 million) for the half year ended September 2024, the company has improved its revenue to A$17.51 million from A$12.8 million year-over-year. Its short-term assets (A$20.9M) comfortably cover both short-term (A$7.9M) and long-term liabilities (A$2.5M). The board's experience contrasts with an inexperienced management team, indicating potential strategic shifts ahead.

- Jump into the full analysis health report here for a deeper understanding of Little Green Pharma.

- Explore historical data to track Little Green Pharma's performance over time in our past results report.

McPherson's (ASX:MCP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McPherson's Limited is a company that offers health, wellness, and beauty products across Australia, New Zealand, Asia, and other international markets with a market cap of A$46.78 million.

Operations: The company's revenue is primarily derived from the Australia and New Zealand segment, which accounts for A$192.09 million, with an additional A$5.58 million generated from international markets.

Market Cap: A$46.78M

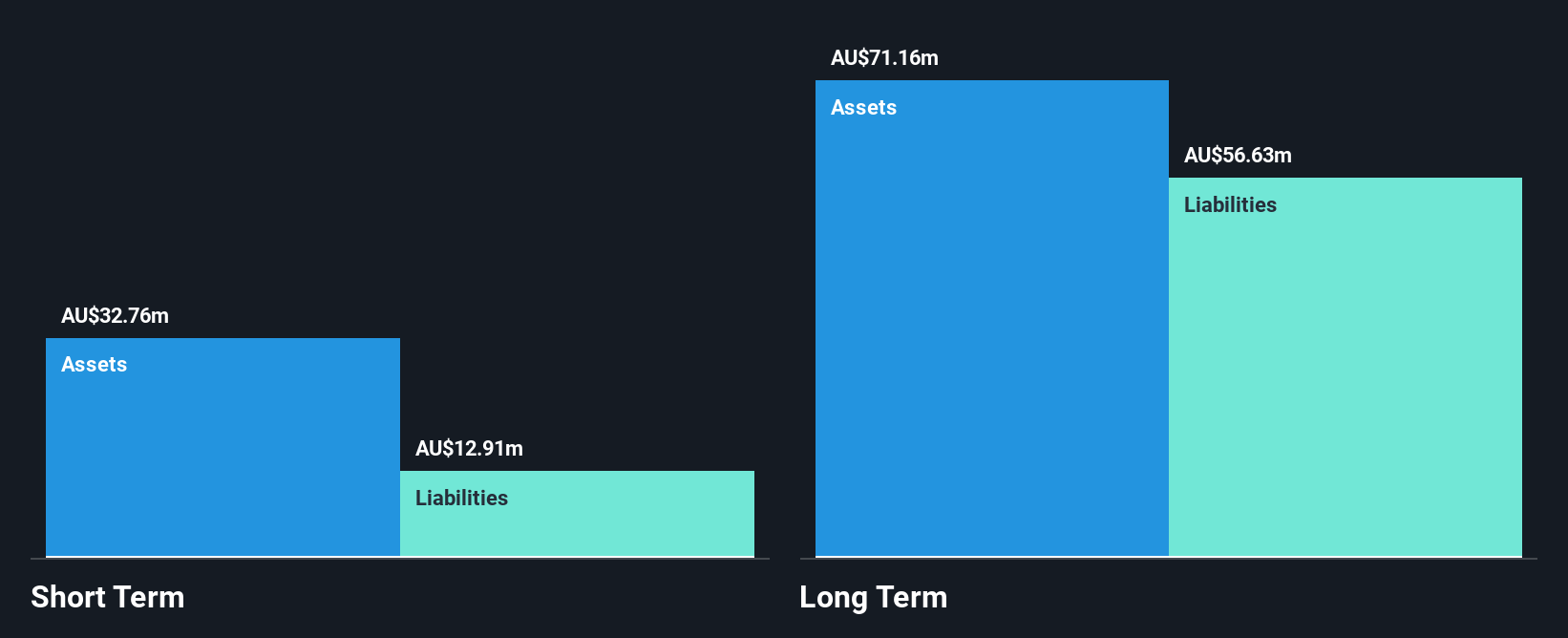

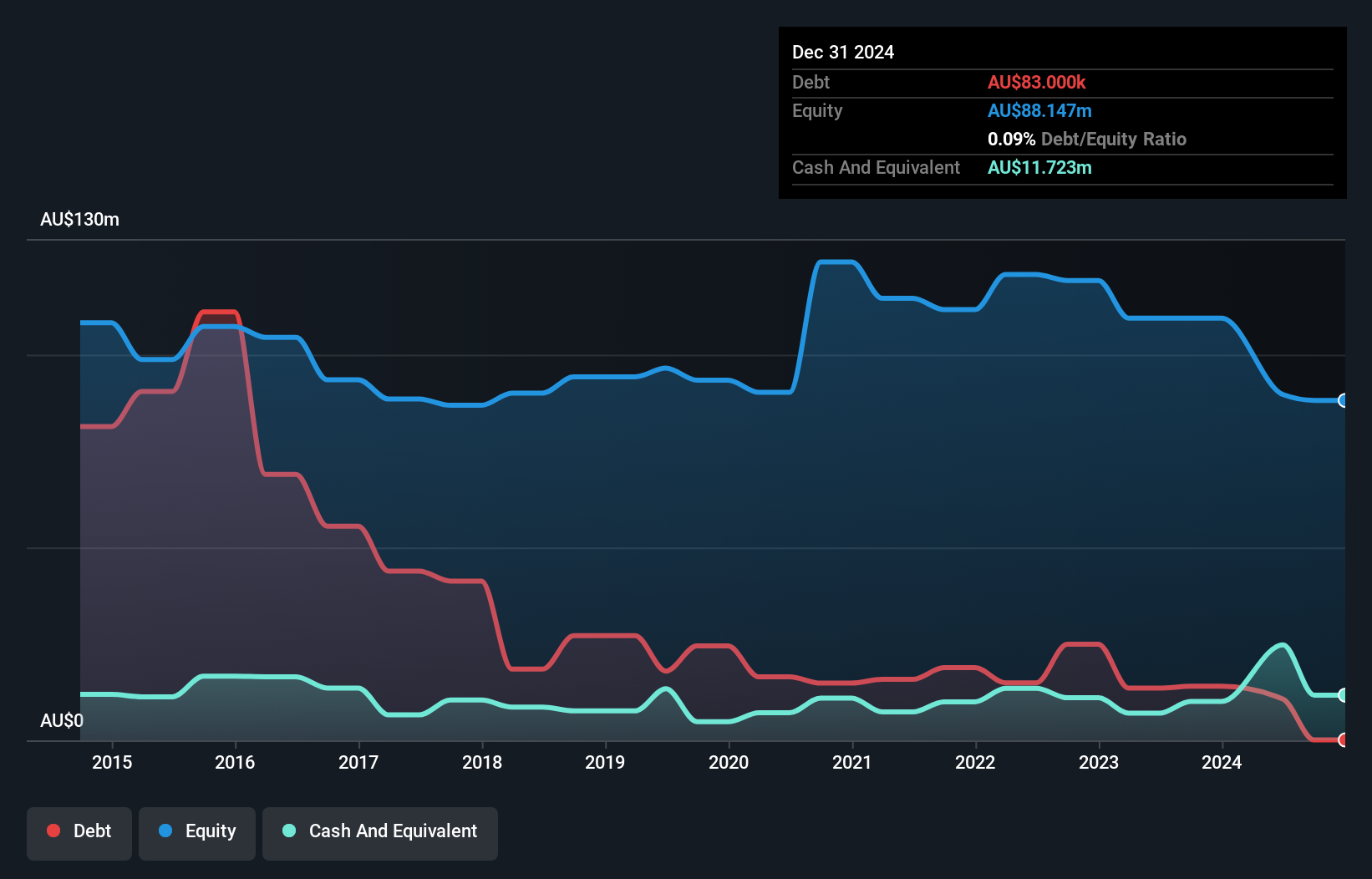

McPherson's Limited, with a market cap of A$46.78 million, faces challenges due to its unprofitability and declining earnings over the past five years. Despite this, the company maintains a strong financial position with cash exceeding total debt and short-term assets (A$75.8M) covering both short-term (A$46.7M) and long-term liabilities (A$10.5M). Trading significantly below estimated fair value, McPherson's has not diluted shareholders recently and possesses a cash runway exceeding three years thanks to positive free cash flow growth. The board is experienced; however, management's inexperience could impact strategic execution moving forward.

- Navigate through the intricacies of McPherson's with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into McPherson's track record.

Next Steps

- Reveal the 1,036 hidden gems among our ASX Penny Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MCP

McPherson's

Provides health, wellness, and beauty products in Australia, New Zealand, Asia, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives