- Australia

- /

- Construction

- /

- ASX:DRA

3 Promising ASX Penny Stocks With Market Caps Under A$200M

Reviewed by Simply Wall St

In the last week, the Australian market has stayed flat, but it is up 15% over the past year with earnings expected to grow by 13% per annum over the next few years. Investing in penny stocks—often smaller or newer companies—can still open doors to growth opportunities when these stocks are backed by strong financial health and solid fundamentals. This article highlights three promising penny stocks that stand out as hidden gems with potential for impressive returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.615 | A$71.21M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$140.36M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.985 | A$314.24M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.55 | A$341.08M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.75 | A$228.01M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.61 | A$806.18M | ★★★★★☆ |

| Perenti (ASX:PRN) | A$1.175 | A$1.08B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$67.53M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$5.00 | A$499.25M | ★★★★☆☆ |

Click here to see the full list of 1,040 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

DRA Global (ASX:DRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DRA Global Limited is a multi-disciplinary engineering, project delivery, and operations management company serving the mining, mineral, and metal sectors globally, with a market cap of A$110.99 million.

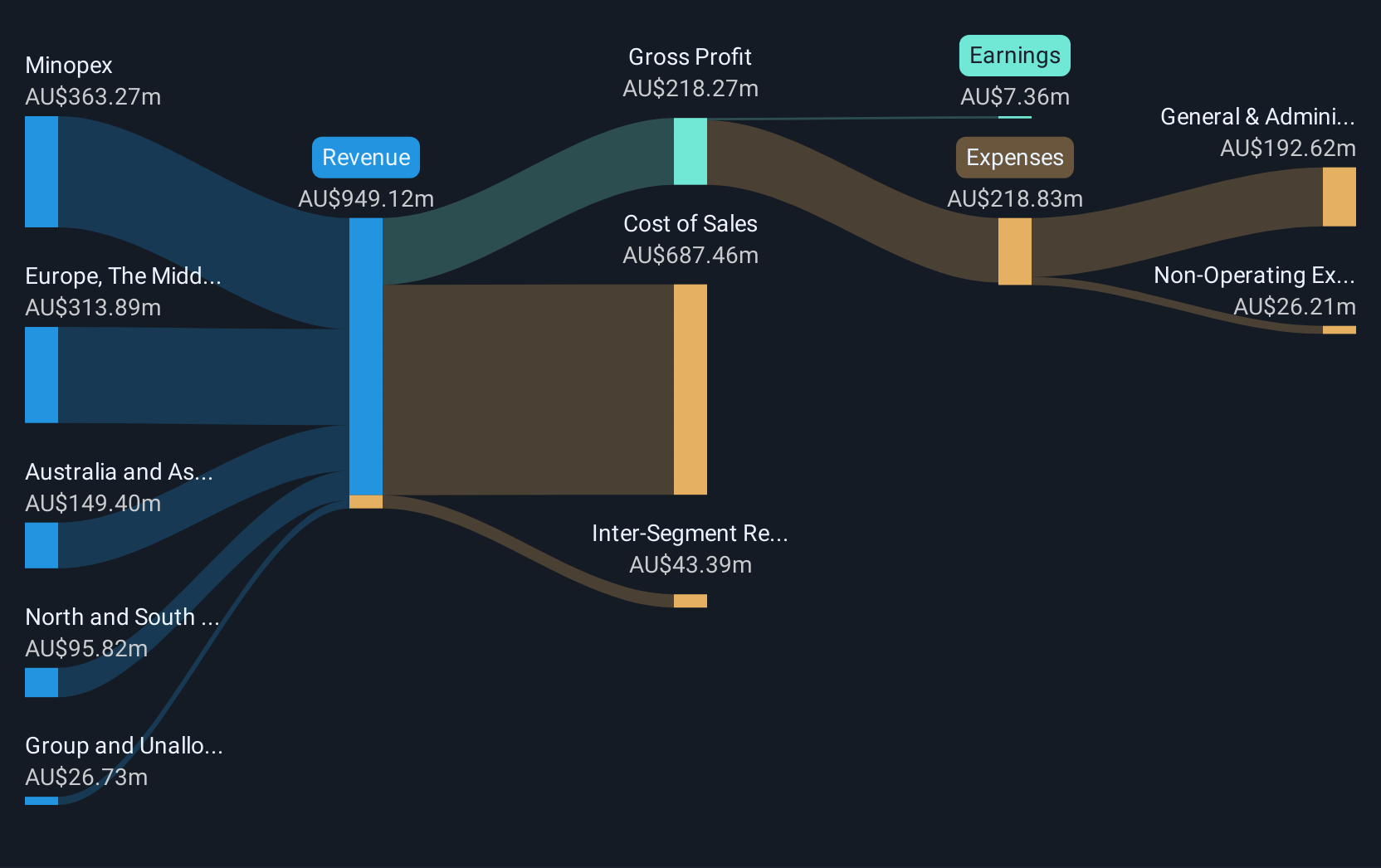

Operations: The company's revenue is primarily derived from its Minopex segment (A$363.27 million), with additional contributions from its geographical operations in Europe, The Middle East and Africa (A$313.89 million), Australia and Asia Pacific (A$149.40 million), and North and South America (A$95.82 million).

Market Cap: A$110.99M

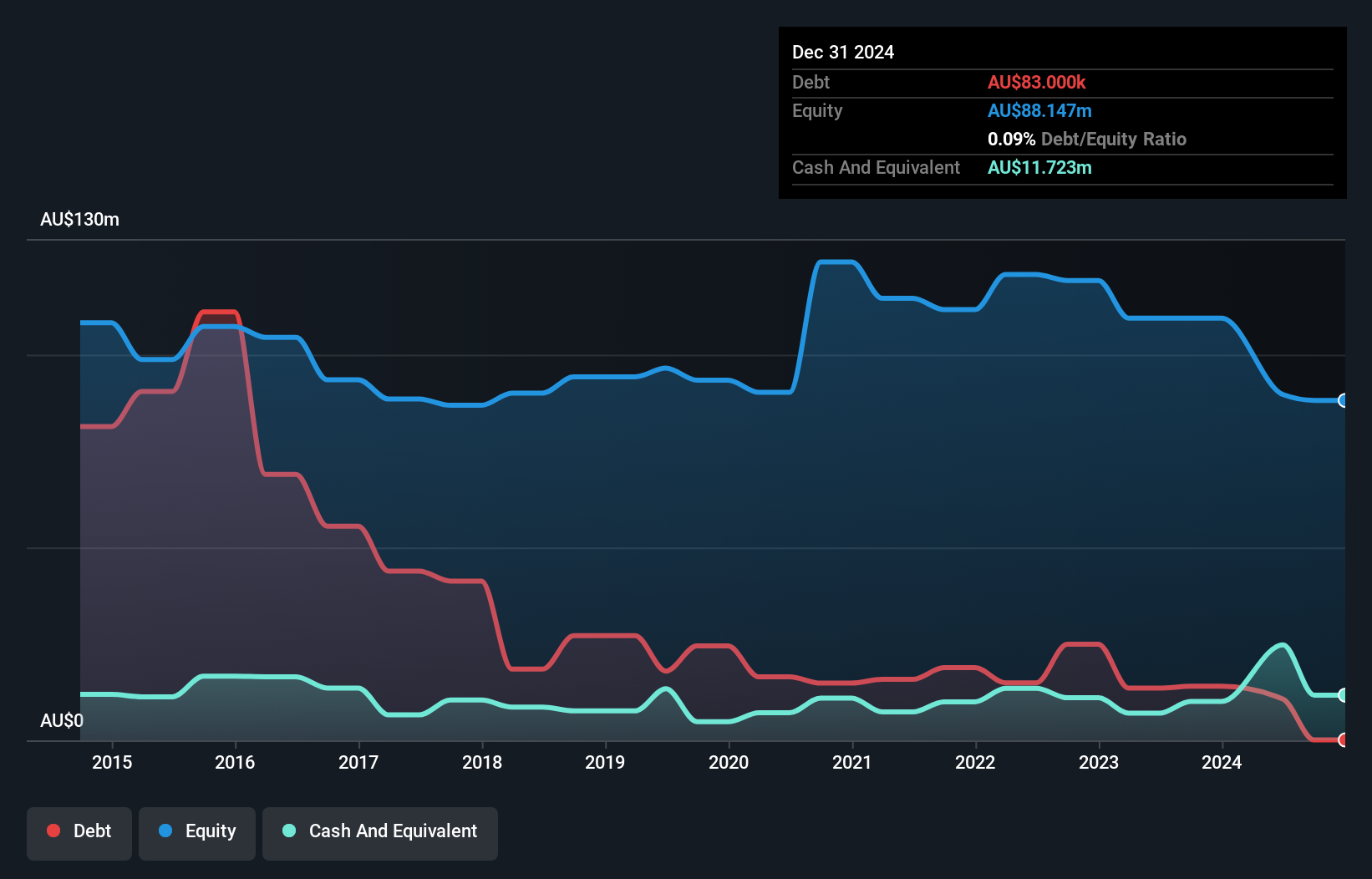

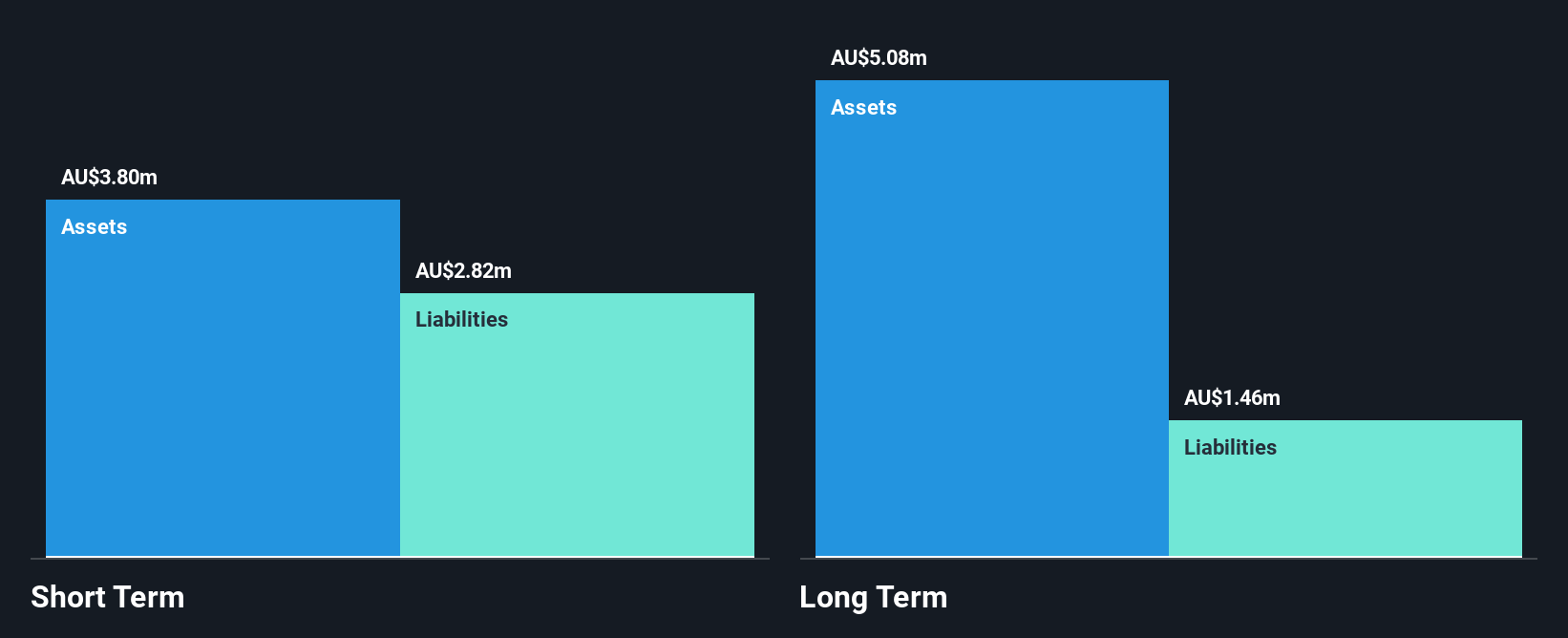

DRA Global Limited, with a market cap of A$110.99 million, is navigating significant changes as it plans to delist from the ASX and JSE due to low trading volumes and high compliance costs. The company has announced a share buyback program worth A$23.06 million, subject to shareholder approval, providing an exit strategy for investors before delisting in early 2025. Despite its challenges, DRA's financials show strong coverage of debt by operating cash flow and no meaningful shareholder dilution over the past year. However, it faces declining profit margins and negative earnings growth recently amidst management transitions.

- Take a closer look at DRA Global's potential here in our financial health report.

- Understand DRA Global's track record by examining our performance history report.

McPherson's (ASX:MCP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: McPherson's Limited operates in the health, wellness, and beauty sectors across Australia, New Zealand, Asia, and internationally with a market capitalization of A$57.58 million.

Operations: The company's revenue is primarily derived from Australia and New Zealand, contributing A$192.09 million, with an additional A$5.58 million generated from international markets.

Market Cap: A$57.58M

McPherson's Limited, with a market cap of A$57.58 million, faces challenges as it remains unprofitable with increasing losses over the past five years. The company's recent earnings report for the year ending June 30, 2024, showed a decline in sales to A$144.63 million from the previous year's A$155.17 million and a net loss widening to A$15.99 million from A$5.06 million. Despite these setbacks, McPherson's maintains a stable cash runway exceeding three years due to positive free cash flow and reduced debt levels, offering some financial resilience amidst ongoing profitability issues.

- Navigate through the intricacies of McPherson's with our comprehensive balance sheet health report here.

- Learn about McPherson's historical performance here.

Motio (ASX:MXO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Motio Limited is an Australian company specializing in audience experience and digital place-based media, with a market cap of A$6.97 million.

Operations: The company generates revenue primarily from its Media segment, amounting to A$6.99 million, and its Non-media segment, contributing A$1.38 million.

Market Cap: A$6.97M

Motio Limited, with a market cap of A$6.97 million, is navigating challenges as it remains unprofitable with increasing losses over the past five years at a rate of 18.2% annually. Despite these setbacks, the company reported sales growth to A$8.37 million for the year ending June 30, 2024. Motio's financial stability is supported by its sufficient cash runway exceeding three years and satisfactory net debt to equity ratio of 24.5%. Additionally, its short-term assets surpass both short and long-term liabilities, providing a cushion against volatility in its share price and operations.

- Get an in-depth perspective on Motio's performance by reading our balance sheet health report here.

- Examine Motio's past performance report to understand how it has performed in prior years.

Taking Advantage

- Navigate through the entire inventory of 1,040 ASX Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRA

DRA Global

Operates as a multi-disciplinary engineering, project delivery, and operations management company focused on the mining, mineral, and metal sectors worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives